ECONOMICS COMMENTARY Apr 13, 2023

Rajiv Biswas

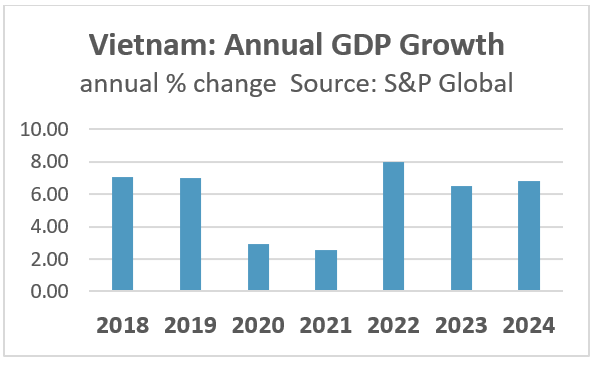

Vietnam's GDP growth rate moderated to a pace of 3.3% y/y in thefirst quarter of 2023, after rapid GDP growth of 8.0% y/y in 2022.Vietnam's manufacturing export sector has faced increasingheadwinds due to slowing growth in the US and EU, which are two keyexport markets accounting for over 40% of Vietnam's goods exports.Vietnam's goods exports fell by 11.9% year-on-year in the firstquarter of 2023. Vietnam is expected to resume rapid economic growth over themedium-term economic outlook, as a key beneficiary of the shift inglobal manufacturing supply chains towards competitive SoutheastAsian manufacturing hubs. Vietnam's real GDP grew by 8.0% in 2022, as the economyrebounded strongly from the economic disruption caused by theCOVID-19 pandemic during second half of 2021. However economicgrowth momentum has moderated to 3.3% y/y in the first quarter of2023, reflecting the impact of weakening growth in industrialproduction and exports. Vietnam's goods exports rose by 10.6% in 2022. However, theeconomic slowdown in the US and EU, which together account for 42%of Vietnam's total goods exports, has resulted in a significantweakening in exports during the first quarter of 2023, with goodsexports declining by 11.9% y/y. The US remains Vietnam's largest export market, accounting for29.4% of total merchandise exports. Vietnam's exports to the USrose by 13.6% in 2022, with the bilateral trade surplus with USincreasing to USD 95 billion.Vietnam's GDP Growth Softens as ExportsWeaken

Vietnam's industrial production rose by 7.8% y/y in 2022, withmanufacturing output up by 8.0% y/y. However, the manufacturingsector has slowed in early 2023, with industrial productiondeclining by 6.3% y/y for the first two months of 2023.

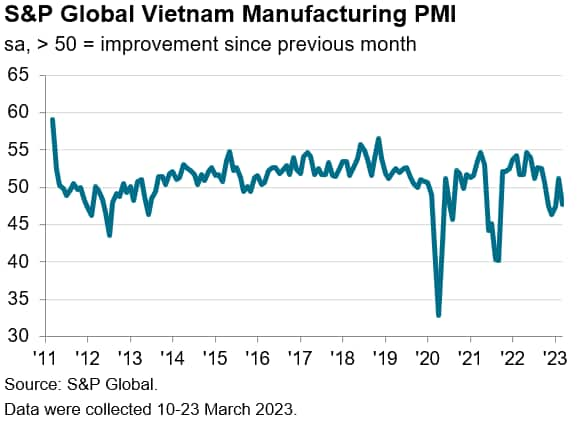

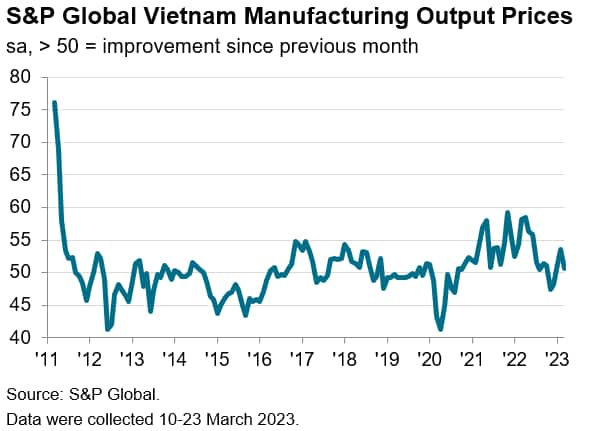

The S&P Global Vietnam Manufacturing Purchasing Managers'Index™ (PMI®) fell to 47.7 in March 2023, down from 51.2 inFebruary and below the 50.0 neutral mark for the fourth time in thepast five months. The March reading signaled contractionarybusiness conditions.

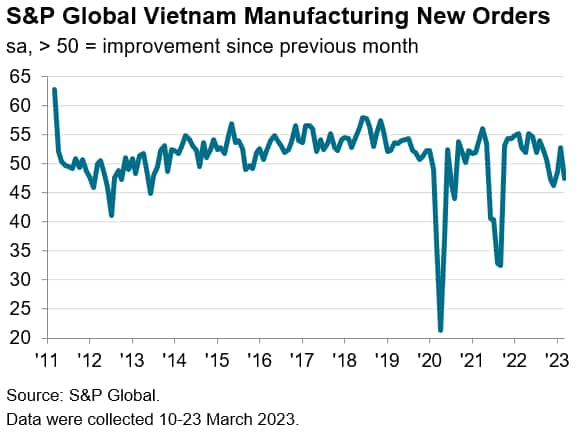

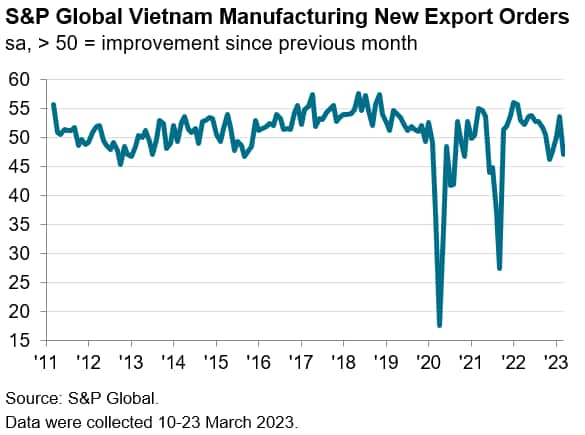

The March survey indicated a decline in both total new ordersand new export orders. The decline in overall new orders was thefourth in the past five months, while new business from abroaddipped for the first time in three months. In turn, backlogs ofwork decreased at the fastest pace since last November. Matchingthe weakening picture for new orders, manufacturing production alsodropped in March following a rise in February. The reduction wasonly modest, however. Investment goods production increased, butfalls were seen in the consumer and intermediate goodscategories.

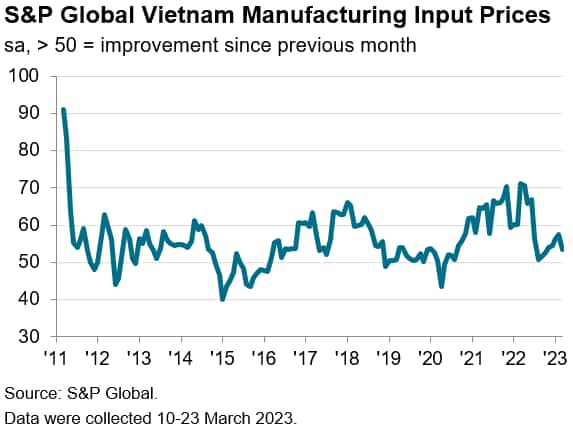

The March PMI survey also indicated that inflationary pressureseased at the end of the first quarter of 2023. Although increasedsupplier charges meant that input costs continued to rise, the rateof inflation was the softest since last October, ending a spell ofaccelerating cost inflation. With input prices rising at a slowerpace and firms keen to price competitively in order to stimulatedemand, output prices increased marginally in March.

The CPI inflation rate moderated to 3.4% y/y in March 2023,compared with a rate of 4.3% y/y in February.

In response to rising inflation and the strengthening USD versusthe dong, Vietnam's central bank, the State Bank of Vietnam (SBV),raised its policy rate by 200bps in two 100bp steps duringSeptember and October 2022. However, with Vietnam's economy slowingsignificantly in early 2023, the SBV has started easing monetarypolicy. The SBV cut its policy rates by 100bps on March 15th andagain by 50bps on April 3rd as concerns have increased about theimpact of rising interest rates on the property sector, which hasfaced rising liquidity pressures.

Medium term growth drivers

Over the medium-term outlook for the next five years, a numberof key drivers are expected to continue to make Vietnam one of thefastest growing emerging markets in the Asian region.

Firstly, Vietnam will continue to benefit from its relativelylower manufacturing wage costs relative to coastal Chineseprovinces, where manufacturing wages have been rising rapidly overthe past decade.

Secondly, Vietnam has a relatively large, well-educated laborforce compared to many other regional competitors in SoutheastAsia, making it an attractive hub for manufacturing production bymultinationals.

Third, rapid growth in capital expenditure is expected,reflecting continued strong foreign direct investment by foreignmultinationals as well as domestic infrastructure spending. Forexample, the Vietnamese government has estimated that USD 133billion of new power infrastructure spending is required by 2030,including USD 96 billion for power plants and USD 37 billion toexpand the power grid.

Fourth, Vietnam is benefiting from the fallout of the US-Chinatrade war, as higher US tariffs on a wide range of Chinese exportshave driven manufacturers to switch production of manufacturingexports away from China towards alternative manufacturing hubs inAsia.

Fifth, many multinationals have been diversifying theirmanufacturing supply chains during the past decade to reducevulnerability to supply disruptions and geopolitical events. Thistrend has been further reinforced by the COVID-19 pandemic, asprotracted disruptions created turmoil in global supply chains formany industries, including autos and electronics. Supply chaindiversification has been further driven by renewed manufacturingsupply chain delays in China during 2022, due to COVID-19 relateddisruptions to production and logistics in some Chinese cities.

For example, the Japanese government has introduced a subsidyprogram in 2020 for Japanese companies to help reduce supply chainvulnerability by relocating production out of China either back toJapan or to certain other designated nations. Vietnam has been oneof the preferred destinations for Japanese firms choosing to shifttheir production to the ASEAN region in the first round of subsidyallocations announced by the Japanese government.

Free trade agreements

Vietnam is also set to benefit from its growing network of freetrade agreements. As a member of the ASEAN grouping of nations,Vietnam already has benefited considerably from the ASEAN FreeTrade Agreement (AFTA), which has substantially removed tariffs ontrade between ASEAN member countries since 2010. ASEAN also has anetwork of free trade agreements with other major Asia-Pacificeconomies, most notably the China-ASEAN Free Trade Area whichentered into force in 2010. This network of free trade agreementshas helped to strengthen Vietnam's competitiveness as a low-costmanufacturing export hub.

Vietnam is also a member of the Comprehensive and ProgressiveAgreement for Trans-Pacific Partnership (CPTPP) among 11 Pacificnations, including the G-20 economies of Canada, Mexico, Japan andAustralia. In March 2023, the UK Government substantially concludednegotiations on the UK's accession to the CPTPP. As the UK is theworld's fifth largest economy, its accession would significantlyincrease the overall economic size of the CPTPP grouping, providingVietnam with substantial competitive advantages for exporting tothe UK market as well as attracting UK foreign directinvestment.

A very important trade deal that took effect in 2020 is theEU-Vietnam Free Trade Agreement (EVFTA). The EVFTA is an importantboost to Vietnam's export sector, with 99% of bilateral tariffsscheduled to be eliminated over the next seven years, as well assignificant reduction of non-tariff trade barriers. For Vietnam,71% of duties were removed when the EVFTA took effect on 1st August2020. The scope of the EVFTA is wide-ranging, including trade inservices, government procurement and investment flows. AnEU-Vietnam Investment Protection Agreement has also been signedwhich will help to strengthen EU foreign direct investment intoVietnam when it is implemented. In 2022, Vietnam's exports to theEU reached USD 56 billion, up 10.2% y/y.

Vietnam will also benefit from the Regional ComprehensiveEconomic Partnership (RCEP) free trade agreement that wasimplemented from 1st January 2022. The fifteen RCEP countries arethe ASEAN ten nations, plus China, Japan, South Korea, Australiaand New Zealand. Vietnam has already ratified the RCEP agreementand will therefore benefit immediately from the date of RCEPimplementation. The RCEP agreement covers a wide range of areas,including trade in goods and services, investment, e-commerce,intellectual property and government procurement.

US bilateral trade frictions

The US deficit for trade in goods with Vietnam reached USD 55.8billion in 2019, with the deficit widening by 41.2% compared to2018. This was slightly mitigated by the USD 1.2 billion surplus infavor of the US for trade in services, but still left the overallbilateral trade deficit at USD 54.5 billion in 2019.

In 2020, the US trade deficit with Vietnam for trade in goodsfurther widened, reaching USD 69.7 billion, with the overallbilateral trade deficit for goods and services at USD 68 billion.In 2021, the bilateral deficit for trade in goods widenedconsiderably further, reaching USD 91 billion, boosted by Vietnam'sgrowing exports of electronics and machinery to the US. Vietnam hadthe third largest goods trade surplus with the US in 2021. By 2022,the bilateral trade deficit for trade in goods had increased to USD116 billion.

Reflecting the persistent large bilateral trade surplus thatVietnam has with the US, the Office of the US Trade Representative(USTR) announced on 2nd October 2020 that the US government haslaunched an official investigation into acts, policies, andpractices by Vietnam that may contribute to the undervaluation ofits currency and the resultant harm caused to US commerce, undersection 301 of the 1974 Trade Act.

As part of its investigation on currency undervaluation, USTRconsults with the US Department of the Treasury as to issues ofcurrency valuation and exchange rate policy. The US Treasury hasinformed the US Department of Commerce that Vietnam's currency wasundervalued by 4.7% in 2019, partly due to intervention by theVietnamese government. In December 2020, the US Treasury namedVietnam as a "currency manipulator".

USTR also launched an investigation into Vietnam's acts,policies, and practices related to the import and use of timberthat is assessed to be illegally harvested or traded.

However, in its April 2021 semiannual Report on Macroeconomicand Foreign Exchange Policies of Major Trading Partners of theUnited States, the US Treasury determined that with reference tothe Omnibus Trade and Competitiveness Act of 1988, there wasinsufficient evidence to make a finding that Vietnam manipulatesits exchange rate for either of the purposes referenced in the 1988Act, and dropped its labelling of Vietnam as a "currencymanipulator".

Nevertheless, consistent with the 1988 Act, the US Treasuryconsiders that its continued enhanced engagements with Vietnam, aswell as a more thorough assessment of developments in the globaleconomy as a result of the COVID-19 pandemic, will enable the USTreasury to better determine whether Vietnam intervened in currencymarkets to prevent effective balance of payments adjustment or gainan unfair competitive advantage in trade.

US government concerns about currency manipulation have beenfurther addressed following a bilateral agreement in July 2021between the US and Vietnam whereby Vietnam has committed to refrainfrom competitive devaluation of the dong. The agreement wasannounced in a joint statement by US Treasury Secretary JanetYellen and State Bank of Vietnam Governor Nguyen Thi Hong. In itsDecember 2021 and June 2022 semiannual reports, the US Treasurystated that it continues to engage closely with the State Bank ofVietnam to monitor Vietnam's progress in addressing the USTreasury's concerns and is thus far satisfied with progress made byVietnam.

Economic Outlook

Due to the severe economic impact of lockdowns triggered by theCOVID-19 Delta wave in mid-2021, the pace of Vietnam's economicgrowth moderated to 2.6% in 2021, compared with the 2.9% growthrate recorded in 2020. There was a strong rebound in GDP growthmomentum in 2022, at a pace of 8.0 % y/y, as domestic demand andmanufacturing export production returned to more normal levels.

The economic outlook from 2023 to 2026 is for rapid economicexpansion, with GDP growth forecast to grow at a pace of around6.5% in 2023, with sustained strong growth at a pace of around 6.7%per year over 2024-2026. However, Vietnam's economy faces near-termrisks from the slowdown in key export markets, notably the US andthe EU.

Over the medium-term economic outlook, a large number ofpositive growth drivers are creating favorable tailwinds and willcontinue to underpin the rapid growth of Vietnam's economy. This isexpected to drive strong growth in Vietnam's total GDP as well asper capita GDP.

With strong economic expansion projected over the next decade,Vietnam's total GDP is forecast to increase from USD 327 billion in2022 to USD 470 billion by 2025, rising to USD 760 billion by 2030.This translates to very rapid growth in Vietnam's per capita GDP,from USD 3,330 per year in 2022 to USD 4,700 per year by 2025 andUSD 7,400 by 2030, resulting in substantial expansion in the sizeof Vietnam's domestic consumer market.

Vietnam's role as a low-cost manufacturing hub is also expectedto continue to grow strongly, helped by the further expansion ofexisting major industry sectors, notably textiles and electronics,as well as the development of new industry sectors such as autosand petrochemicals. Vietnam already has a domestic automaker ofelectric vehicles, Vinfast, which launched its first EV in Vietnamin 2021. In March 2022, Vinfast announced a USD 2 billioninvestment to build an auto manufacturing plant in North Carolina,for manufacturing EV buses and SUVs, as well as EV batterymanufacturing, with construction expected to commence in 2023.

For many multinationals worldwide, significant supply chainvulnerabilities have been exposed by the protracted disruption ofindustrial production in China as well as some other major globalmanufacturing hubs during the COVID-19 lockdowns. This will drivethe further reshaping of manufacturing supply chains over themedium term, as firms try to reduce their vulnerability to suchextreme supply chain disruptions. With US-China trade andtechnology tensions still remaining high, this is likely to be afurther driver for reconfiguring of supply chains. A keybeneficiary of the shift in global manufacturing supply chains willbe the ASEAN region, with Vietnam expected to be one of the mainwinners.

Rajiv Biswas, Asia Pacific Chief Economist, S&PGlobal Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction inwhole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [ {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-moderates-in-early-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-moderates-in-early-2023.html&text=Vietnam+Economy+Moderates+in+Early+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-moderates-in-early-2023.html","enabled":true},{"name":"email","url":"?subject=Vietnam Economy Moderates in Early 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-moderates-in-early-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnam+Economy+Moderates+in+Early+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-moderates-in-early-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"} ]}