ECONOMICS COMMENTARY Mar 10, 2023

Rajiv Biswas

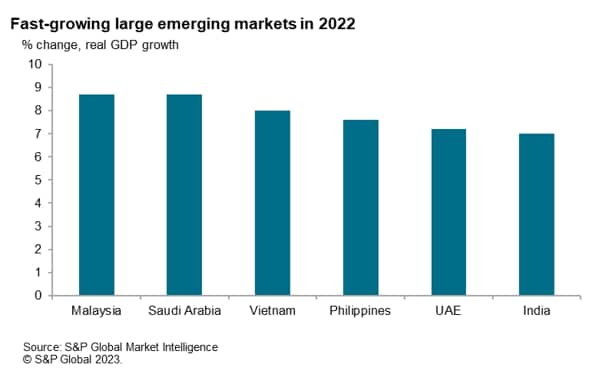

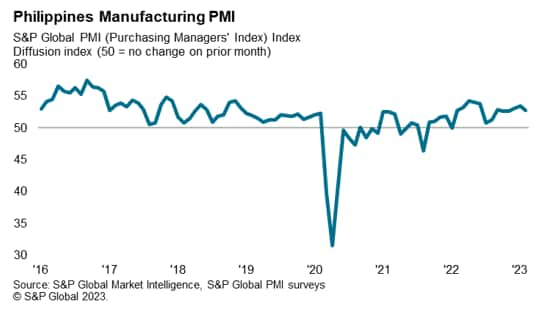

The Philippines economy grew at a pace of 7.6% in 2022, thefastest rate of economic growth recorded by the Philippines since1976. The rapid pace of economic expansion was driven by stronggrowth in household consumption as well as gross capitalformation. The outlook for 2023 is for continued firm economic expansion.The latest S&P Global Philippines Manufacturing PMI surveyresults for February 2023 continue to signal expansionaryconditions for manufacturing output and new orders. Sustainedremittance inflows from workers abroad, fast-growing IT-BPO sectorexports and the recovery of the tourism sector are also expected tosupport economic growth momentum during 2023.

Philippines: One of world's fastest growing emergingmarkets

The strong rebound from the COVID-19 pandemic during 2022 helpedto drive the pace of growth of the Philippines economy to thefastest rate since 1976. The Philippines GDP growth rate of 7.6%was comparable to some of the world's fastest growing largeemerging markets in 2022, including the Gulf Co-operation Counciloil exporting nations of Saudi Arabia and United Arab Emirates, aswell as other rapidly growing Asian emerging economies such asMalaysia, Vietnam and India.

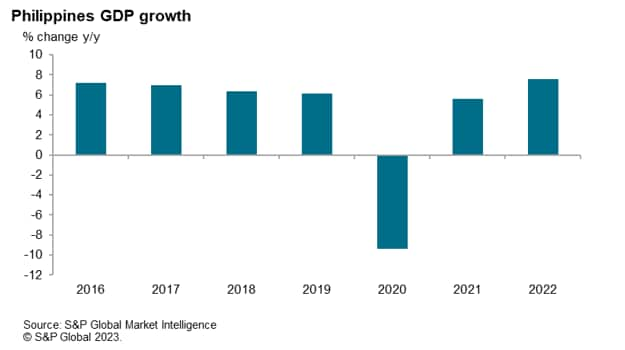

The Philippines has also shown a much-improved economic growthperformance over the past decade, apart from during the peak periodof the COVID-19 pandemic during 2020-21 when there was widespreadglobal disruption to economic activity. During the period from 2012to 2019, real GDP growth in the Philippines each year rangedbetween 6% to 7%. The economic rebound in 2022 pushed real economicgrowth to the highest pace recorded since 1976, with householdfinal consumption expenditure growing by 8.3% y/y while grosscapital formation grew by 16.8% y/y.

The S&P Global Philippines Manufacturing PMI survey readingof 52.7 in February continued to show expansionary conditions inthe manufacturing sector, albeit somewhat lower than January'sseven-month high of 53.5. Overall growth in the manufacturingsector was supported by continued strong expansions in output andnew orders.

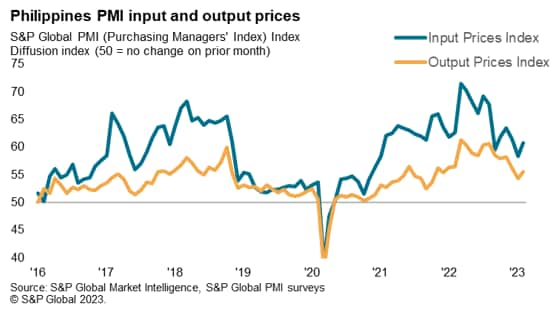

However, supplier performance worsened further, as materialscarcity, port congestion and difficult transportation conditionsresulted in a further lengthening of average lead times. Moreover,higher prices at suppliers directly fed into cost burdens, causinginput price inflation to rise at a rapid and accelerated pace.

Broader inflation pressures have remained a key concern for thenear-term economic outlook, with the headline CPI inflation rate at8.6% y/y in February 2023. While the rate edged down from 8.7% y/yin January, it is still far above the inflation rate a year ago inFebruary 2022, when CPI inflation was at 3.0% y/y.

With CPI inflation having moved significantly above the BangkoSentral ng Pilipinas (BSP) inflation target range of 2% to 4%, theBSP tightened monetary policy by a total of 350bps during 2022.

Reflecting continued high inflation pressures, the MonetaryBoard of the BSP decided to further raise the interest rate on theBSP's overnight reverse repurchase facility by 50 basis points to6.0 percent on 16 February 2023. According to the BSP's latestassessment, average CPI inflation is projected to be above theupper end of the 2-4 percent target range at 6.1 percent in 2023,before returning to within target at 3.1 percent in 2024.

Deteriorating current account deficit

Merchandise exports have continued to record moderate expansionin 2022, rising by 5.6% y/y. The Philippines export sector showedresilience to the impact of the slowdown in mainland China, whichis a key export market. Although exports to mainland China fell by5.1% y/y in 2022, exports to a number of other key markets rose.Exports to the US were up by 4.2% y/y while exports to Singaporerose by 17% y/y and exports to South Korea rose by 21.5% y/y.

However, exports of electronics products, which comprises thelargest share of the total merchandise exports of the Philippinesat around 56% of the total, have weakened during the second half of2022 as electronics demand in key export markets has slowed. InDecember 2022, exports of electronics products fell by 13.9% y/y,with semiconductors exports declining by 12.8% y/y.

However, imports have shown even more rapid growth, rising by17.3% y/y in 2022, reflecting sharply higher imports of energyproducts due to higher world prices for oil and gas. Consequently,the trade deficit for 2022 rose to USD 58.3 billion, compared withUSD 37.1 billion in the same period of 2021.

The transmission effects from weaker growth in the US andWestern Europe are a vulnerability for the Philippines exportsector in 2023, but the rebound in economic growth in mainlandChina is expected to help to mitigate these effects.

In 2020, the current account surplus reached a record high ofUSD 11.6 billion or 3.2% of GDP, boosted by the sharp slump inimports due to the severe contraction in domestic demand. However,the current account shifted back to a deficit of USD 6.0 billion in2021, or 1.5% of GDP, as growth recovery triggered higher domesticdemand and rising imports.

Imports soared during 2022, with surging prices for world oiland gas being important factor contributing to a further sharpdeterioration in the current account balance for calendar 2022. InDecember 2022, the Philippines central bank, Bangko Sentral ngPilipinas (BSP), revised down its current account projection for2022 to a deficit of USD 20.5 billion or 5.1% of GDP due to awidening trade deficit, as the economic recovery and rising oilprices pushed up imports. This was a significant downward revisionfrom its March 2022 projection of a current account deficit of USD16.3 billion, or 3.8% of GDP.

External debt as a share of GDP remains moderate, at anestimated 26.8% of GDP in September 2022, according to BSPdata.

An important stabilizing factor for the Philippines economy hasbeen overseas worker remittances by Filipinos working abroad, whichremained quite stable during 2020 despite the COVID-19 pandemic,down only 0.8% y/y, and equivalent to around 10% of GDP.Remittances sent home by workers are an important factor supportingdomestic consumer spending in the Philippines. Despite concernsabout job losses for workers abroad due to the impact of thepandemic on many industries such as tourism and aviation,remittances data continues to show resilient remittance inflows for2021. Remittances by workers abroad rose by 5.1% y/y in 2021, to arecord high of USD 34.9 billion. In 2022, remittances by workersabroad rose by 3.6% y/y, to USD 36.1 billion.

Rapid growth in exports from the IT-BPO sector have also becomean important boost for the Philippines economy and for totalexports. IT-BPO exports have risen from USD 9.5 billion in 2010 toUSD 25.1 billion by 2021, according to BSP estimates.

Philippines economic outlook

Despite the impact of the COVID-19 Delta wave in the second halfof 2021, GDP growth for calendar 2021 rebounded to 5.6% y/y. Stronggrowth momentum has continued in 2022, at a pace of over 7.6% y/y.Easing of pandemic-related travel restrictions during 2022 has alsoallowed a gradual reopening of domestic and international tourismtravel. If sustained during 2023, this would provide an importantboost to the economy. Prior to the pandemic, in 2019, gross directtourism value added as a share of GDP was estimated at 12.7% ofGDP, including both international and domestic tourism spending.International tourism spending was estimated at Peso 549 billion,while domestic tourism spending was estimated at Peso 3.1 trillion.Due to the importance of domestic tourism in the overallcontribution of tourism to GDP, the recovery of domestic tourismcould be a significant growth driver in 2023.

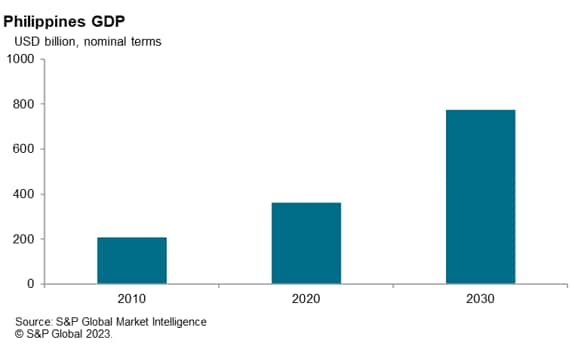

Continued rapid GDP growth of around 5.8% y/y is expected in2023, helped by sustained strong private consumption spending, anupturn in government infrastructure spending and improvingremittance inflows. Over the next decade the Philippines economy isforecast to continue to grow rapidly, with total GDP increasingfrom USD 400 billion in 2021 to USD 830 billion in 2031. A keygrowth driver will be rapid growth in private consumption spending,buoyed by strong growth in urban household incomes.

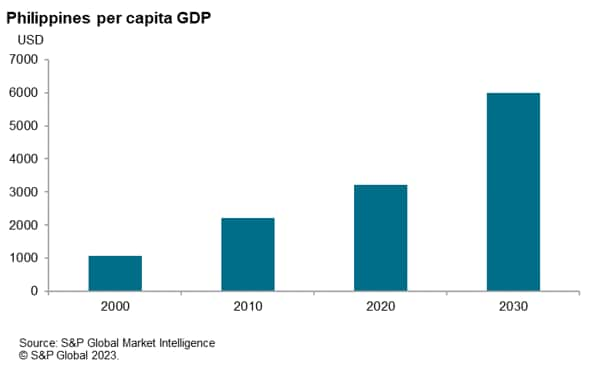

By 2034, the Philippines is forecast to become on theAsia-Pacific region's one trillion-dollar economies, joiningmainland China, Japan, India, South Korea, Australia, Taiwan andIndonesia in this grouping of the largest economies in APAC. Thisstrong growth in the size of the Philippines economy is alsoexpected to drive rapidly rising per capita GDP, from USD 3,500 in2021 to USD 6,400 by 2031. This will help to underpin the growth ofthe Philippines domestic consumer market, catalysing foreign anddomestic investment into many sectors of the Philippineseconomy.

The Philippines will also benefit from its membership of therecently implemented RCEP trade deal, particularly due to its veryfavourable rules of origin treatment, which provide cumulativebenefits that will help to build manufacturing supply chains withinthe RCEP region across different countries. This will help toattract foreign direct investment flows for a wide range ofmanufacturing and infrastructure projects into the RCEP membernations, particularly into low-cost manufacturing hubs such as thePhilippines.

Consequently, the outlook for the Philippines economy over thenext decade is very favourable, with significant progress ineconomic development expected. In 2021, the Family Income andExpenditure Survey of the Philippines government indicated that 20million people, or around 18.1% of the total population, still livebelow the poverty threshold. Rapidly rising per capita GDP andstandards of living will help to underpin a broad improvement inhuman development indicators and should deliver a significantreduction in the share of the population living in extreme povertyover the decade ahead.

Access the full press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&PGlobal Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction inwhole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [ {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-amongst-worlds-fastest-growing-emerging-markets-Mar23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-amongst-worlds-fastest-growing-emerging-markets-Mar23.html&text=Philippines+amongst+world%27s+fastest+growing+emerging+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-amongst-worlds-fastest-growing-emerging-markets-Mar23.html","enabled":true},{"name":"email","url":"?subject=Philippines amongst world's fastest growing emerging markets | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-amongst-worlds-fastest-growing-emerging-markets-Mar23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Philippines+amongst+world%27s+fastest+growing+emerging+markets+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-amongst-worlds-fastest-growing-emerging-markets-Mar23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"} ]}