Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

cfa-level-iii

22 Nov 2023

Accurately modeling fixed income return involves carefully considering all potential factors contributing to gains and losses when holding the security. The model can produce precise output by thoroughly examining each component and applying sound financial concepts. Though the process may entail multiple steps, each builds upon fundamental principles in finance.

The Five Components of Fixed Income Return

Income Yield: This component represents the return from holding a bond and receiving its coupon payments. The formula for income yield is as follows:

$$ \text{Income Yield} =\frac {\text{Annual coupon payment} }{ \text{Current bond portfolio price}} $$

Rolldown Return: This component represents the return from renewing bonds in the portfolio as they mature, assuming the yield curve will remain unchanged. The formula for the rolldown return is as follows:

$$ \begin{align*} & \text{Rolldown Return} \\ &= \left( \frac { \text{End of horizon period projected price} – \text{Beginning price} }{ \text{Beginning price}} \right) \end{align*} $$

Expected Price Change: This component represents the return resulting from changes in the yield curve or spread. The formula to calculate the expected price change is as follows:

$$ \text{Expected Price Change} = (-MD \times \Delta Y) + (0.5 \times C \times (\Delta Y)^2) $$

Where:

\(MD\) = Modified duration of the portfolio.

\(\Delta Y\) = Change in yield.

\(C\) = Convexity

Credit Losses: This component captures the losses incurred from defaults. Calculating credit losses is simple as it involves looking up actual losses. However, for expected credit losses, the analyst needs to estimate both the probability of default and the expected loss severity in the event of default.

Foreign Exchange Gain/Loss: This component considers the impact of fluctuating foreign currency prices on the portfolio. To calculate the foreign exchange gain/loss, the analyst should multiply the weight of the portfolio invested in each foreign currency by the corresponding gain/loss resulting from currency movements.

Constraints of the Expected Return Breakdown

The described return decomposition is an approximation, using only duration and convexity to summarize the bond's price-yield relationship.

It assumes reinvestment of all intermediate cash flows at the yield to maturity, resulting in varying coupon reinvestment rates for different bonds.

The model overlooks local richness/cheapness effects and potential financing advantages. Local richness/cheapness effects represent deviations of specific maturity segments from the fitted yield curve, often obtained through curve estimation techniques. Such techniques yield relatively smooth curves, while practical deviations from the curve can occur.

Financing advantages may exist for specific maturity segments in the repo market, offering short-term borrowing options for dealers in government securities.

Question

Which component of fixed income returns assumes that there will be no change in the yield curve or credit spreads?

- Rolldown yield.

- Expected price change.

- Foreign exchange gains/losses.

Solution

The correct answer is A.

Rolldown return or roll yield, refers to the return generated by renewing contracts in a portfolio as they mature. It assumes no change in the yield curve or credit spreads during renewal.

B is incorrect. Expected price change explicitly assumes that there will be a change in the yield curve and credit spreads, leading to an anticipated price change in the fixed-income security.

C is incorrect. Foreign exchange gains/losses are related to currency exchange rate fluctuations and do not directly involve the yield curve or credit spreads.

Reading 19: Overview of Fixed-Income Portfolio Management

Los 19 (d) Describe and interpret a model for fixed-income returns

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

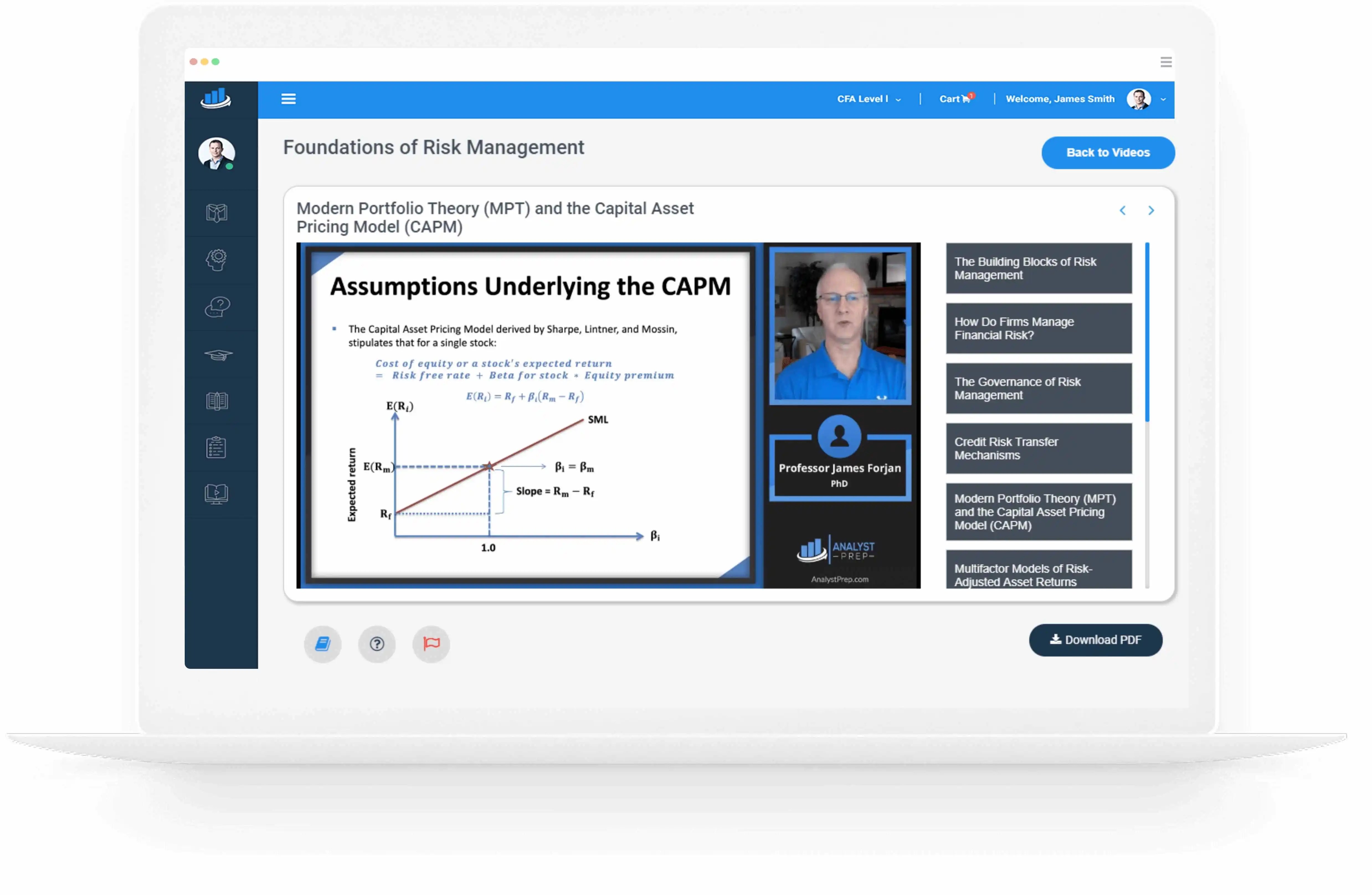

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts