When applying the equity method How is the excess of cost over book value calculated and accounted for?

When applying the equity method, how is the excess of cost over book value accounted for? The excess is allocated to the difference between fair value and book value multiplied by the percent ownership of net assets.

Goodwill is calculated by taking the purchase price of a company and subtracting the difference between the fair market value of the assets and liabilities.

With the equity method of accounting, the investor company reports the revenue earned by the other company on its income statement, in an amount proportional to the percentage of its equity investment in the other company.

In general, the cost method is used when the investment doesn't result in a significant amount of control or influence in the company that's being invested in, while the equity method is used in larger, more-influential investments. Here's an overview of the two methods, and an example of when each could be applied.

Key Takeaways. Equity accounting is an accounting method for recording investments in associated companies or entities. The equity method is applied when a company's ownership interest in another company is valued at 20–50% of the stock in the investee.

Excess Value means the difference (positive or negative) between the book value of the Adjusted Assets as included in the latest Financial Reports and their Market Value at the end of the relevant interim period, to be calculated as follows: Sample 1Sample 2.

How do you calculate book value? The book value of a company is equal to its total assets minus its total liabilities. The total assets and total liabilities are on the company's balance sheet in annual and quarterly reports.

Fair market value is defined as an asset's sale price if a transaction occurred between a willing buyer and seller. The equity method considers the asset's original purchase price and the investor's stake in the asset.

The purpose of equity accounting is to ensure that the investor's accounts accurately reflect the investee's profit and loss. A recognized profit increases the investment's worth, while a recognized loss decreases its value accordingly.

It is calculated by deducting all liabilities from the total value of an asset (Equity = Assets – Liabilities).

What does equity method mean in accounting?

The equity method of accounting, sometimes referred to as “equity accounting,” is the accounting treatment for one entity's partial ownership in another entity when the entity making the investment is able to influence the operating or financial decisions of the investee.

Equity Example

Equity can be calculated by subtracting liabilities from assets and can be applied to a single asset, such as real estate property, or to a business. For example, if someone owns a house worth $400,000 and owes $300,000 on the mortgage, the difference of $100,000 is equity.

Which of the following procedures are followed in applying the fair-value method of accounting for an investment in another firm's equity securities? - the investor continues to apply the equity method if the investor continues to have the ability to exercise significant influence over the investee.

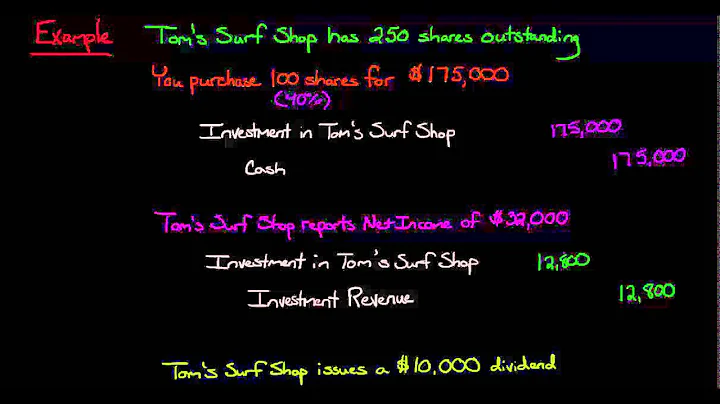

When the equity method of accounting for investments is used by the investor, the investment account is increased when: The investee reports a net income for the year.

Which of the following investments should be accounted for by using the fair value method? The fair value method is used for both temporary and long-term investments in stock where the investor does not have significant influence over the investee (less than 20% ownership).

What factors indicate if the equity method should be used for an investment in another firm's equity securities? Technological dependency between the investor and investee. Investor representation on the investee's board of directors. Investor participation in the policy-making process of the investee.

The equity method is only used when the investor can influence the operating or financial decisions of the investee. If there is no significant influence over the investee, the investor instead uses the cost method to account for its investment.

Under the equity method, after the initial investment is recorded, the investment account increases as the investee earns and reports net income. an objective is to reflect the close relationship between the investor and investee. the investor recognizes investment income using the accrual method.

- Common stock. ...

- Preferred stock. ...

- Retained earnings. ...

- Contributed surplus. ...

- Additional paid-in capital. ...

- Treasury stock. ...

- Dividends. ...

- Other comprehensive income (OCI)

The equity method of accounting is used to assess the profits earned by their investments in other companies. The firm reports the income earned on the investment of its income statement. Under the equity method, the reported value is based on the size of the equity investment.