What is the relationship between saving and investing?

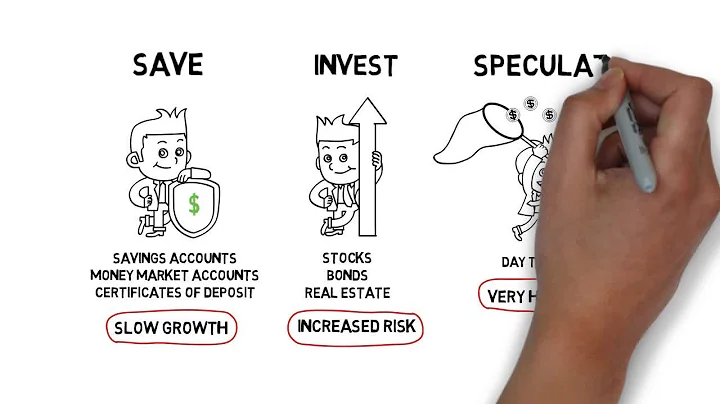

The biggest difference between saving and investing is the level of risk taken. Saving typically results in you earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

A fundamental macroeconomic accounting identity is that saving equals investment. By definition, saving is income minus spending. Investment refers to physical investment, not financial investment. That saving equals investment follows from the national income equals national product identity.

The difference between saving and investing

Saving can also mean putting your money into products such as a bank time account (CD). Investing — using some of your money with the aim of helping to make it grow by buying assets that might increase in value, such as stocks, property or shares in a mutual fund.

Like investing, savings lets you “put your money to work,” but because it's typically protected from most risk, the earnings might not be as high. As a result, it may take you longer to reach your goals with this more cautious approach.

Saving differs from savings. The former refers to the act of not consuming one's assets, whereas the latter refers to either multiple opportunities to reduce costs; or one's assets in the form of cash.

The result shows an affirmative association between savings, investment and economic growth. The inflation rate, among the determinants of savings considered in the study, has a negative impact on saving, while interest rate influences saving positively.

In any economy, individuals have two ways to use income—they can spend it or save it. Much of what is spent is used to purchase goods; much of what is saved is used to invest in the companies that produce the goods. If too much is spent and too little saved, the economy's capacity to produce will be diminished.

Saving and investing are both important to consider in your future planning. Through saving money, your money is kept safe, and easy to access should you need it. By investing early over time, your money grows in value, benefiting from the magic of compounding.

What is the difference between saving and investing? Saving you are putting money away to keep and use later. Investing you are putting money in, hoping that it will increase. Define liquidity, interest, compound interest, opportunity cost, and trade-off.

A savings account is for money you will use within the next 5 years. If you're willing to leave that money alone for more than 5 years, then you can invest it.

How is saving vs investing similar and different?

Key takeaways

There's a difference between saving and investing: Saving means putting away money for later use in a secure place, such as a bank account. Investing means taking some risk and buying assets that will ideally increase in value and provide you with more money than you put in, over the long term.

when planned saving is highter than planned investment it indicates experienditure on buying goods in the economy is less than what the producers had expected this would result in unplanned addition in the inventories of unsold stock consequently AD fail short of AS producers will cut down employment and produce less ...

For example, you might save money for emergencies and short-term goals, while investing for long-term goals like retirement. By having both savings and investments, you can ensure that you have money available for immediate needs and also have your money growing for the future.

But saving does not actually equal investment. Then what is saving? Saving includes income left from consumption and investment; value of part of consumption but not yet consumed in that period (waiting for the next period of consumption), and value of part of investment that is left for the next period of production.

Invest early

Starting early is one of the best ways to build wealth. Investing for a longer period of time is widely considered more effective than waiting until you have a large amount of savings or cash flow to invest. This is due to the power of compounding.

When planned savings is less than the planned investment , then the planned inventory rises above the desired level which denotes that the consumption is the economy was less then the expected level which indicates at less aggregate demand in comparison to aggregate supply.

Most people know they should be saving a portion of their income, but they might not grasp all of the benefits of doing so. Saving is an important habit to get into for a number of reasons — it helps you cover future expenses, manage financial stress and plan for vacations, just to name a few.

The review of the literature shows that there is a positive relationship between savings and economic growth. This positive relationship can be explained by one of the following hypotheses. First, that growth in savings can stimulate economic growth through investment.

Relation Between Savings and Investment In Classical System

If savings exceeds investment, the excess supply of funds brings down the rate of interest. This, in turn, reduces savings and increases investment for maintaining equilibrium.

Why is investing important? Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in value.

What is the difference between saving and investing brainly?

In summary, saving focuses on preserving and storing money, while investment entails deploying funds with the intention of earning a higher return by taking calculated risks.

The key difference is this: When you save money, you're putting your money somewhere safe to use for the future, often for short-term goals. Alternatively, when you invest money, you accept a greater potential risk in return for a greater potential reward. Investing often makes more sense for long-term goals.

First and foremost, though, savings enable you to prevent financial disaster when something unexpected—like losing a job, your car breaking down, or having a sick child or pet—happens. Similarly, savings support positive changes and enable you to plan for financing a home, retirement, and vacations.

Investing is the purchase of assets with the goal of increasing future income. Savings is the portion of current income not spent on consumption. The chance that the value of an investment will decrease.

Moving your money to other financial institutions and having up to $250,000 in each account will ensure that your money is insured by the FDIC, McBride said. Despite the recent uncertainty, experts don't recommend withdrawing cash from your account.