What is a non depository bank?

A non-depository institution is an entity that does not accept deposits. For example, an established FDIC-insured bank may have a branch or office that only handles commercial lending transactions, and does not accept deposits or disburse funds.

The non-depository institutions include insurance companies, pension funds, finance companies and mutual funds. Insurance companies are the contractual saving institutions which collect periodic premium from an insured party and in return agree to compensate against the risk of loss of life and properties.

Definition. Non Depository Institution. Any financial institution that acts as the middleman between two parties in a financial transaction, and that does not provide traditional depository services, such as brokerage firms, insurance companies, investment companies, etc.

Nondepository institutions include insurance companies, pension funds, securities firms, government-sponsored enterprises, and finance companies. There are also smaller nondepository institutions, such as pawnshops and venture capital firms, but they are much smaller sources of funds for the economy.

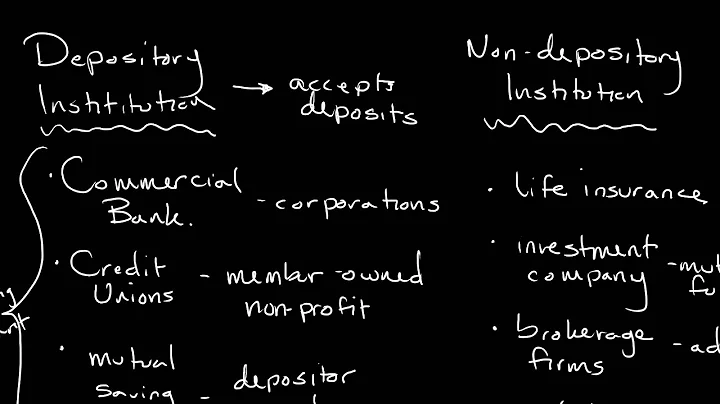

There are three major types of depository institutions in the United States. They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions.

NBFCs are often called shadow banks as they function a lot like banks but with fewer regulatory controls. Barring a few, they cannot accept deposits from people and so raise money from bonds or borrow from banks.

A bank, organization, or any institution holding and assisting in security trading is referred to as a depository. Depository accounts hold securities in the same way that bank accounts hold funds. A depository can also be a place where something is held for safekeeping or storage.

Depository institutions focus on collecting demand deposits from their customers. Common types include credit unions, retail banks, and thrift banks. On the other hand, non-depository institutions do not accept demand deposits.

The role of NBFIs is generally to allocate surplus resources to individuals and companies with financial deficits, allowing them to supplement banks. By unbundling financial services, targeting them and specialising in the needs of the individual, NBFIs work to enhance competition in the financial sector.

The role of nondepository financial institutions in the financial system is that they offer financial services like transferring savings from savers to investors to be available for investments. Therefore, they encourage investment and refresh economy.

What is the difference between bank and non bank financial institution?

An NBFC is a company that provides banking services to people without holding a bank license. Bank is a government authorized financial intermediary that aims at providing banking services to the general public.

The most common types of financial institutions include commercial banks, trust companies investment banks, brokerage firms or investment dealers, insurance companies, and asset management funds.

Non-Deposit Trust Company: a corporation which is engaged as a trustee, fiduciary, or agent for individuals or businesses in the administration of trust funds, estates, custodial arrangements, stock transfer and registration, and other related services.

A Depository Bank refers to a facility like an office, building, or even warehouse that acts as a depository for safeguarding and storage purposes. This might be a bank, a vault, an organization, or even a financial institution which inventories and helps with the act of trading securities.

Depository Account includes any commercial, checking, savings, time, or thrift account, or an account that is evidenced by a certificate of deposit, thrift certificate, investment certificate, certificate of indebtedness, or other similar instrument maintained by a Financial Institution in the ordinary course of a ...

• Depository Name = Your Bank Name. • Branch. = Your Bank Branch Location.

- Branch Banking.

- Unit Banking.

- Mixed Banking.

- Chain Banking.

- Retail Banking.

- Wholesale Banking.

- Relationship Banking.

- Correspondent Banking.

Commercial banks are profit making institutes. They accept deposits from the public and pay interest on it and advance these deposits as loan to seekers at an interest rate higher than that what was offered on deposits.

They make money from what they call the spread, or the difference between the interest rate they pay for deposits and the interest rate they receive on the loans they make. They earn interest on the securities they hold.

There are two depositories which are functional in India – National Securities Depository Ltd (NSDL) and Central Securities Depository Ltd (CDSL).

Why are banks different from other depository institutions?

Depository institutions (aka banks), which includes commercial banks, savings and loans, and credit unions, receive money from depositors to lend out to borrowers. Nondepository institutions, such as finance companies, rely on other sources of funding, such as the commercial paper market.

As will be detailed further below, a depositary's clients are investment funds only, while custodians can have a wider array of clients. Compared with depositaries, custodians focus on the operational side of the safekeeping and settlement of securities while depositaries focus on the accurate monitoring of the assets.

Non-deposit financial institutions earn their money by selling securities (bonds, notes, stock or shares) as well as insurance policies. Life insurance companies, investment companies, and consumer finance companies are three common non-deposit financial institutions.

Many people use investment products to help buy a home, send children to college, or build a retirement nest egg. But unlike traditional checking or savings accounts, non-deposit investment products are not insured by the FDIC, even if they were purchased from an FDIC-insured bank.

In comparison to the banks, the loan process with NBFCs is seamless. While a loan disbursal in the banks can take a few days to weeks, NBFCs can process an application within 24 hours of its approval. NBFCs are more flexible when it comes to loan approval as opposed to banks.

D.

NBFC does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property.

The major categories of financial institutions include central banks, retail and commercial banks, internet banks, credit unions, savings, and loans associations, investment banks, investment companies, brokerage firms, insurance companies, and mortgage companies.

The non-banking financial institution which comes under the category of financial institutions cannot accept deposits into savings and demand deposit accounts. A bank is a financial institution which can accept deposits into various savings and demand deposit accounts, and give out loans.

Under the umbrella of banking and finance, the industry has commercial banks—which are consumer facing like Bank of America—as well as central banks—the government entities that regulate the industry and manage monetary policy.

The key point to remember when you contemplate purchasing mutual funds, stocks, bonds or other investment products, whether at a bank or elsewhere, is: Funds so invested are NOT deposits, and therefore are NOT insured by the FDIC - or any other agency of the federal government.

Why are some banks not member banks?

One reason that state-chartered banks may decide to refrain from membership is that regulation can be less onerous, some believe, under the Federal Deposit Insurance Corporation (FDIC), which oversees non-member banks rather than the Federal Reserve Banks (member banks report to regional Federal Reserve banks).

State-chartered credit unions fall under the regulatory authority of their respective state's division of financial services. Federally chartered credit unions all include the word "federal" in their name and fall under the regulatory authority of the National Credit Union Administration (NCUA).

Non-Deposit Trust Company: a corporation which is engaged as a trustee, fiduciary, or agent for individuals or businesses in the administration of trust funds, estates, custodial arrangements, stock transfer and registration, and other related services.

An example of a non-depository institution might be a mortgage bank.

Role of non-depository financial institutions: Generate funds other than deposits: For financing companies, non-depository financial institutions generate funds by issuing securities and then lend this fund to sole proprietors and small companies.

Life insurance companies, investment companies, and consumer finance companies are three common non-deposit financial institutions.

The most common types of financial institutions include commercial banks, trust companies investment banks, brokerage firms or investment dealers, insurance companies, and asset management funds.

The key point to remember when you contemplate purchasing mutual funds, stocks, bonds or other investment products, whether at a bank or elsewhere, is: Funds so invested are NOT deposits, and therefore are NOT insured by the FDIC - or any other agency of the federal government.

One reason that state-chartered banks may decide to refrain from membership is that regulation can be less onerous, some believe, under the Federal Deposit Insurance Corporation (FDIC), which oversees non-member banks rather than the Federal Reserve Banks (member banks report to regional Federal Reserve banks).

Depository institutions focus on collecting demand deposits from their customers. Common types include credit unions, retail banks, and thrift banks. On the other hand, non-depository institutions do not accept demand deposits.

What is the difference between bank and non bank financial institution?

An NBFC is a company that provides banking services to people without holding a bank license. Bank is a government authorized financial intermediary that aims at providing banking services to the general public.

Many people use investment products to help buy a home, send children to college, or build a retirement nest egg. But unlike traditional checking or savings accounts, non-deposit investment products are not insured by the FDIC, even if they were purchased from an FDIC-insured bank.

Terms in this set (17) Non-Depository Institutions. do not accept deposits, although many make loans. Non-depository institutions accept money from their customers to invest in business deals. This spreads the risk and provides a way for the customers to invest.

How do depository institutions differ from nondepository institutions? Depository institutions take in people's money into savings or checking accounts and make loans. Nondepository institutions do not accept deposits.

Commercial banks are owned by shareholders and are run for a profit, which is largely obtained by lending at rates higher than they pay their depositors.