What is 4 3 2 1 investment strategy?

Real Estate Investing with 3.5% Down

The "4" Represents your first purchase of a four unit building, then the "3" represents the pruchase of a three unit building, the "2" represents the purchase of a two unit building, and the "1" represents the final transaction of purchasing a single famliy onwer occuped unit.

Real Estate Investing with 3.5% Down

The "4" Represents your first purchase of a four unit building, then the "3" represents the pruchase of a three unit building, the "2" represents the purchase of a two unit building, and the "1" represents the final transaction of purchasing a single famliy onwer occuped unit.

4-3-2-1 Rule - Rule that states that the first 25% of depth represents 40% of the value; the second 25%, 30% of the values; the third 25%, 20% of the value; and the final 25%, 10% of the value.

4-3-2-1 rule

The front quarter of the standard site receives 40% of the total value. The second quarter receives 30% of the total value. The third quarter receives 20% of the total value; and the rear quarter receives just 10% of the total value.

What Is the 2% Rule? The 2% rule is an investing strategy where an investor risks no more than 2% of their available capital on any single trade. To implement the 2% rule, the investor first must calculate what 2% of their available trading capital is: this is referred to as the capital at risk (CaR).

We recommend a buy-and-hold strategy when it comes to investing. The stock market is like a roller coaster. There are going to be ups and there are going to be downs—the only people who get hurt are the ones who try to jump off before the ride is over.

How the Rule of 72 Works. For example, the Rule of 72 states that $1 invested at an annual fixed interest rate of 10% would take 7.2 years ((72/10) = 7.2) to grow to $2. In reality, a 10% investment will take 7.3 years to double (1.107.3 = 2).

10-3-1 is a strict formula. It means, starting with 10 qualified prospects (People you know have a need, appreciate it and can buy) can lead to 3 booked appointments. Those booked appointments will result in the acquisition of one “pocketbook” (or wallet), but over time, not immediately.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

The 4% rule is a popular retirement withdrawal strategy that suggests retirees can safely withdraw the amount equal to 4% of their savings during the year they retire and then adjust for inflation each subsequent year for 30 years.

What is the 50% rule in real estate investing?

The 50% rule or 50 rule in real estate says that half of the gross income generated by a rental property should be allocated to operating expenses when determining profitability. The rule is designed to help investors avoid the mistake of underestimating expenses and overestimating profits.

In November, Corcoran appeared on the BiggerPockets Real Estate Podcast with her son Tom Higgins to describe two methods she says make up her “golden rule” of real estate investing: putting down 20% on an investment property and having tenants of that property paying for the mortgage.

The 70% rule helps home flippers determine the maximum price they should pay for an investment property. Basically, they should spend no more than 70% of the home's after-repair value minus the costs of renovating the property.

The fundamental principle of value investing is to base investment decisions entirely on the true value of a company and buy that company's stock when it is undervalued. This strategy has been around for more than 80 years, and is still incredibly effective.

This determines the number of years it will take for your investment to double. For example, if you invest $1,000 and the growth rate is 8 percent, all you have to do is divide 72 by eight, which is nine. That's to say, it will take approximately nine years for your $1,000 investment to become $2,000.

For example, if an investment scheme promises an 8% annual compounded rate of return, it will take approximately nine years (72 / 8 = 9) to double the invested money.

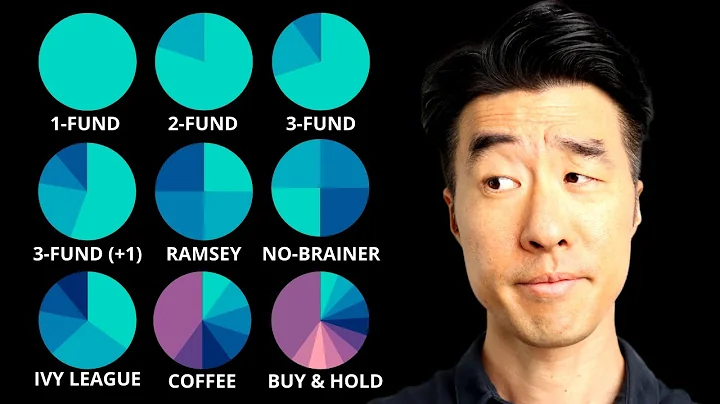

Your investment portfolio should have a good mix of stocks and bonds and include low-cost index mutual funds or ETFs, Orman wrote in a blog post. Once you have the right mix, there's nothing you should do aside from contributing regularly and reviewing your portfolio annually.

What is Warren Buffett's Investing Style? Warren Buffett is a famous proponent of value investing. Warren Buffett's investment style is to “buy ably-managed businesses, in whole or in part, that possess favorable economic characteristics.” We also look at his investment history and portfolio.

I put my personal 401(k) and a lot of my mutual fund investing in four types of mutual funds: growth, growth and income, aggressive growth, and international.

- Get a 401(k) match. Talk about the easiest money you've ever made! ...

- Invest in an S&P 500 index fund. An index fund based on the Standard & Poor's 500 index is one of the more attractive ways to double your money. ...

- Buy a home. ...

- Trade cryptocurrency. ...

- Trade options.

Where can I get 10% interest on my money?

- Stocks.

- Real Estate.

- Private Credit.

- Junk Bonds.

- Index Funds.

- Buying a Business.

- High-End Art or Other Collectables.

Some examples include: Business Loans: Debt taken to expand a business by purchasing equipment, real estate, hiring more staff, etc. The expanded operations generate additional income that can cover the loan payments. Mortgages: Borrowed money used to purchase real estate that will generate rental income.

Over the years, Mikitani noticed that “everything breaks” at predictable intervals, specifically when companies triple in size. In other words, they break when you grow from one to three employees. They break again when you get to 10, again at 30, again at 100, again at 300, and so on.

One of the best pieces of advice I ever received came from Hiroshi Mikitani, the CEO of Rakuten, the Japanese retailer. He said that everything changes at roughly every third and tenth steps. When you go from one person to three people it's different.

You usually must pay self-employment tax if you had net earnings from self-employment of $400 or more. Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment.