Is insurance capitalized during construction?

Any insurance expense properly allocable to the production activity must be capitalized and included in the basis of the asset when production is complete.

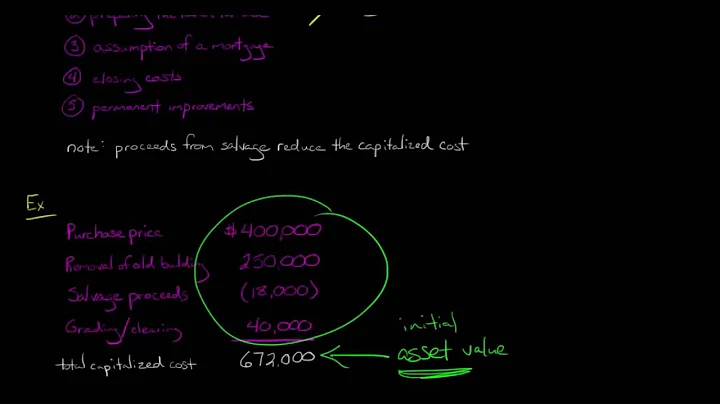

Buildings acquired by construction should be capitalized at their original cost. The following major expenditures are capitalized as part of the cost of buildings: Cost of constructing new buildings, including material, labor, and overhead.

Expenses that must be taken in the current period (they cannot be capitalized) include Items like utilities, insurance, office supplies, and any item under a certain capitalization threshold. These are considered expenses because they are directly related to a particular accounting period.

Taking in to account, insurance expense cannot be capitalized.

Non-Capitalizable Costs

Projects should expense and not capitalize any costs which do not improve or enhance the functionality of an asset or extend the useful life of an asset. Examples of these costs include, but are not limited to: Opening/completion parties. Student or employee morale (trips, gifts, or parties)

A construction-in-progress asset account records any costs associated with the project, including tools, transportation, labor-related to getting an asset ready for use, and materials. This expense information will help the accountant analyze if the project is being completed on budget and on plan.

What Costs Can Be Capitalized? Capitalized costs can include intangible asset expenses can be capitalized, like patents, software creation, and trademarks. In addition, capitalized costs include transportation, labor, sales taxes, and materials.

A capitalization requirement is the amount of liquidity a financial institution must have in its reserves to cover its business operating expenses. The amount usually is determined by taking a fixed percentage of the institution's risk-weighted assets.

Fixed assets are capitalized. That's because the benefit of the asset extends beyond the year of purchase, unlike other costs, which are period costs benefitting only the period incurred. Fixed assets should be recorded at cost of acquisition.

In general, you should capitalize the first word, all nouns, all verbs (even short ones, like is), all adjectives, and all proper nouns. That means you should lowercase articles, conjunctions, and prepositions—however, some style guides say to capitalize conjunctions and prepositions that are longer than five letters.

Is insurance included in fixed asset cost?

Most common components of a fixed asset's cost include the invoice amount of the asset, transportation cost to the site of installation, insurance during transit, installation and commissioning cost, cost of consultants and engineers which carry out the installation and cost to be incurred on dismantling the asset upon ...

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current asset account, Prepaid Insurance. The prepaid amount will be reported on the balance sheet after inventory and could part of an item described as prepaid expenses.

Insurance becomes an asset when you experience a risk covered in your insurance plan, which activates your coverage, allowing you to make a claim and receive a successful payout.

Warranty costs and service agreement costs are not capitalized if the warranty costs or service agreement costs are listed as separate line items on the purchase orders or invoices. Otherwise, warranty costs and service agreement costs are capitalized with the value of the asset.

GAAP allows companies to capitalize costs if they're increasing the value or extending the useful life of the asset. For example, a company can capitalize the cost of a new transmission that will add five years to a company delivery truck, but it can't capitalize the cost of a routine oil change.

Taxpayers are required to capitalize certain costs incurred to produce self-constructed assets, such as material costs, labor costs and other incidental costs. This practice unit discusses costs capitalized under the final IRC 263A Treasury Regulations (Treas.

Construction in Progress (CIP)

For construction in progress assets, no depreciation is recorded until the asset is placed in service. When construction is completed, the asset should be reclassified as building, building improvement, or land improvement and should be capitalized and depreciated.

Hard costs include expenses directly related to the physical construction a building. Soft costs include expenses indirectly related to construction of a building. Construction costs impact the return of an investment, and its budget should be analyzed thoroughly before investing.

- Determine which expenses are CIP. You need to determine which costs relate to the project in progress. ...

- Identify the expenses. ...

- Log expenses. ...

- Transfer the enter construction-in-progress amount when the project is finished.

Taxpayers are required to capitalize certain costs incurred to produce self-constructed assets, such as material costs, labor costs and other incidental costs. This practice unit discusses costs capitalized under the final IRC 263A Treasury Regulations (Treas.

Do you capitalize renovation costs?

What is Capitalizing Building Projects and Renovations? An item is capitalized when it is recorded as an asset, rather than an expense, on a balance sheet. In order to acquire, build, renovate and maintain most University-owned buildings, the capitalization and depreciation of costs are necessary.

Accounting for a Project Under Construction

Construction Work-in-Progress is often reported as the last line within the balance sheet classification Property, Plant and Equipment. There is no depreciation of the accumulated costs until the project is completed and the asset is placed into service.

Projects such as building construction included in the fixed asset value of the building, the cost of professional fees (architect and engineering), permits and other expenditures necessary to place the asset in its intended location and condition for use should be capitalized.

GAAP allows companies to capitalize costs if they're increasing the value or extending the useful life of the asset. For example, a company can capitalize the cost of a new transmission that will add five years to a company delivery truck, but it can't capitalize the cost of a routine oil change.

When companies make a revenue expenditure, the expense provides immediate benefits, rather than long term ones. Examples of revenue expenditure are wages or salaries paid to factory workers, machine Oil to lubricate. Hence option B is not the capital expenditure.

A taxpayer that produces property must capitalize all costs incurred before, during and after the construction or development of the property.