How much money do I need perpetuity?

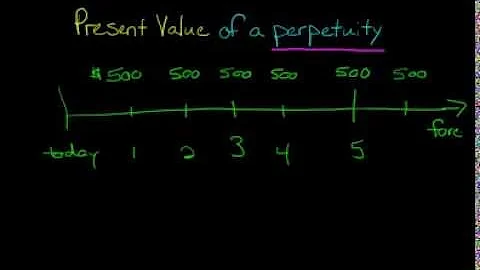

Written out, the formula for the present value of a perpetuity looks like this: PV = P/i. "PV" is the present value, "P" is the dollar amount you want each payment to be, and "i" is the periodic rate -- the annual rate divided by the number of payments per year.

It typically divides cash flow by a discount rate, which is the interest rate banks pay to borrow money from the Federal Reserve. So, if you were to receive $10,000 every year forever, and the discount rate was 5%, the present value of your perpetuity would be 10,000 / 0.05 = $200,000.

...

- First of all, we know that the coupon payment every year is $100 for an infinite amount of time.

- And the discount rate is 8%.

- Using the formula, we get PV of Perpetuity = D / r = $100 / 0.08 = $1250.

A perpetuity is a security that pays for an infinite amount of time. In finance, perpetuity is a constant stream of identical cash flows with no end.

A perpetuity is like an annuity except for one important difference. With an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. With a perpetuity, the payments continue on the same schedule infinitely.

A practical example of perpetuity is Consols, a type of bond issued by the British government. This type of security guarantees holders continuous annual payments. In this case, through the perpetuity concept, the present value of an infinite series of cash flow can be determined.

For a perpetuity, perpetual annuity, the number of periods t goes to infinity therefore n goes to infinity and, logically, the future value in equation (5) goes to infinity so no equations are provided. The future value of any perpetuity goes to infinity.

Present Value (Growing Perpetuity) = D / (R - G)

If G is less than R or equal to R, the formula does not hold true. This is because, the stream of payments will cease to be an infinitely decreasing series of numbers that have a finite sum.

Calculating Perpetual Bond Value

The price of a perpetual bond is, therefore, the fixed interest payment, or coupon amount, divided by the discount rate, with the discount rate representing the speed at which money loses value over time.

15. What is the present value or price of a $150 annual perpetuity if the returns on similar contracts are now 7%? a. $10.50.

Does perpetuity mean forever?

Definition of in perpetuity

formal. : for all time : forever The land will be passed on from generation to generation in perpetuity.

An annuity is a set payment received for a set period of time. Perpetuities are set payments received forever—or into perpetuity. Valuing an annuity requires compounding the stated interest rate. Perpetuities are valued using the actual interest rate.

Know what perpetuity means: FOREVER … yup, and not just for your lifetime or your investor's lifetime but into eternity. One thing I never want to do with my business is to close the door on an opportunity before it has a chance to present itself … it's why I entered the Tank with an open mind about all of the Sharks.

🤔 Understanding perpetuity

The bond comes with a term, for example, 10 years. Once the 10-year term ends, you get the face value (usually the amount you paid to buy it) of the bond back and stop receiving interest payments.

Annuity payments can last for as long as you live – or even longer – because the payments are based on your life expectancy.

Perpetuity is widely used by companies to properly place a value on various investments, such as stocks, bonds, real estate and especially annuities. With perpetuity, payments from these investments theoretically never stop, making perpetuity a stream of cash flow that has no end limit.

Pension is a type of retirement account where you keep saving throughout your entire life. On the other hand, perpetuity is an annuity that not only makes regular payments throughout the year but the payments never end as well.

Answer and Explanation: The future value of a $1000 investment today at 8 percent annual interest compounded semiannually for 5 years is $1,480.24. See full answer below.

Perpetuities are securities or cash flows that pay out for an infinite amount of time. A growing perpetuity is a cash flow that is not only expected to be received ad infinitum, but also grow at the same rate of growth forever.

The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result.

What is the future value of a growing annuity?

The future value of a growing annuity is the amount of money you end up with after a series of increasing payments, where each payment is increasing at a specified growth rate (i.e. each payment is 5% larger than the last payment).

Perpetual care funds are monies placed in trust by cemeteries to generate income to cover cemetery maintenance in perpetuity. The funds are derived from sales of grave sites, above-ground crypts, and niches in mausoleums and columbariums.

A perpetual bond is a debt with no maturity date. Investors may collect interest from these bonds indefinitely much as they would expect from a dividend-paying stock or preferred stock. Such a bond is also referred to as a 'consol' or 'perp.

Summary: The future value of $500 one year from today if the interest rate is 6 percent is $530.

A perpetuity series which is growing in terms of periodic payment and is considered to be indefinite which is growing at a proportionate rate. Therefore the formula can be summed up as follows: PV = D/ (1+r) + D (1+g) / (1+r) ^2 + D (1+g) ^2 …. The perpetuity series is considered to continue for an infinite period.

Investors prefer to receive money today rather than the same amount of money in the future because a sum of money, once invested, grows over time. For example, money deposited into a savings account earns interest. Over time, the interest is added to the principal, earning more interest.

Present Value of a Perpetuity - YouTube

That all changed after shark Mark Cuban learned about the clause contestants had to sign to be featured on the show. “FYI, there is no additional equity or percentage of anything taken any longer.

SCRUB DADDY

Aaron Krause invented it in 2012, and in October appeared on the show. Lori Greiner invested $20,000 for a 20% equity, a bid that soon paid off. Since then, Scrub Daddy has made over $100 million in sales, making it by and large the most successful pitch in the show's history.

Mark Cuban (born July 31, 1958) is an American billionaire entrepreneur, television personality, and media proprietor whose net worth is an estimated $4.3 billion, according to Forbes, and ranked No. 177 on the 2020 Forbes 400 list.

How do you calculate NPV perpetuity?

NPV(perpetuity)= FV/i

Where; FV- is the future value. i – is the interest rate for the perpetuity.

To find the FV of a perpetuity would require setting a number of periods which would mean that the perpetuity up to that point can be treated as an ordinary annuity. There is, however, a PV formula for perpetuities. The PV is simply the payment size (A) divided by the interest rate (r).

The calculation for the present value of growing perpetuity formula is the cash flow of the first period divided by the difference between the discount and growth rates.

🤔 Understanding perpetuity

The bond comes with a term, for example, 10 years. Once the 10-year term ends, you get the face value (usually the amount you paid to buy it) of the bond back and stop receiving interest payments.

15. What is the present value or price of a $150 annual perpetuity if the returns on similar contracts are now 7%? a. $10.50.

Perpetuity Formula in Excel (With Excel Template)

You can easily calculate the Perpetuity using Formula in the template provided.

An annuity is a set payment received for a set period of time. Perpetuities are set payments received forever—or into perpetuity. Valuing an annuity requires compounding the stated interest rate. Perpetuities are valued using the actual interest rate.

Answer and Explanation: The future value of a $1000 investment today at 8 percent annual interest compounded semiannually for 5 years is $1,480.24. See full answer below.

Answer: If the Interest Rate is 10 Percent, then the Future Value in Two Years of $100 Today is $120.

which one of these correctly defines the future value of $1,000 investment? future value is the value of the investment at any date after the initial investment date.

Does perpetuity mean forever?

Definition of in perpetuity

formal. : for all time : forever The land will be passed on from generation to generation in perpetuity.

Perpetuity Growth Method

The perpetuity growth rate is typically between the historical inflation rate of 2-3% and the historical GDP growth rate of 4-5%. If you assume a perpetuity growth rate in excess of 5%, you are basically saying that you expect the company's growth to outpace the economy's growth forever.