How can I lower my tax bill 2023?

Whether your income went north or south—or even stayed the same—the rate at which your income is taxed could have changed when income ranges for the 7 federal tax brackets were adjusted for tax year 2023. Across the board, the brackets increased by about 7% from 2022 because of inflation.

- Ways To Pay Less Tax Before Dec. ...

- Accelerate Deductions To Pay Less Tax. ...

- Optimize Your Giving To Charities. ...

- Sell Your Stock Losers To Offset Gains. ...

- Max Out Your Retirement Plans To Pay Less Tax. ...

- Score The Saver's Credit.

Whether your income went north or south—or even stayed the same—the rate at which your income is taxed could have changed when income ranges for the 7 federal tax brackets were adjusted for tax year 2023. Across the board, the brackets increased by about 7% from 2022 because of inflation.

- Plan throughout the year for taxes.

- Contribute to your retirement accounts.

- Contribute to your HSA.

- If you're older than 70.5 years, consider a QCD.

- If you're itemizing, maximize deductions.

- Look for opportunities to leverage available tax credits.

- Consider tax-loss harvesting.

The additional standard deduction for age or blindness also increased for the 2023 tax year. It's equal to $1,500 for joint filers, married taxpayers filing separately, and surviving spouses (up from $1,400 for 2022); and $1,850 for single taxpayers and head-of-household filers (up from $1,750 for 2022).

IRAs are another way to save for retirement while reducing your taxable income. Depending on your income, you may be able to deduct any IRA contributions on your tax return. Like a 401(k) or 403(b), monies in IRAs will grow tax deferred—and you won't pay income tax until you take it out.

Having enough tax withheld or making quarterly estimated tax payments during the year can help you avoid problems at tax time. Taxes are pay-as-you-go. This means that you need to pay most of your tax during the year, as you receive income, rather than paying at the end of the year.

The most common reason why taxpayers end up owing money to the IRS is because they did not have enough money taken out of their paychecks throughout the year, according to tax experts. When employees first start a job, they fill out a W-4 form, which determines how much money is withheld from their paychecks for taxes.

Claiming 0 allowances means that too much money will be withheld by the IRS. The allowances you can claim vary from situation to situation. If you are married with a kid, you can claim up to three allowances. If you want a higher tax return, you can claim 0 allowances.

As the 2024 tax deadline approaches, you may be in the position of expecting to owe money to the IRS. This may be the case if you made over $20,000 from a side hustle in 2023, you earn self-employment income (such as through a freelance gig), or you entered a new tax bracket.

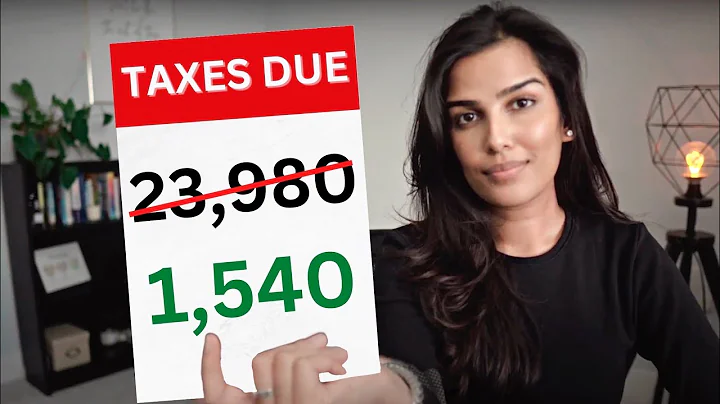

What lowers your taxes the most?

Less taxable income means less tax, and 401(k)s are a popular way to reduce tax bills. The IRS doesn't tax what you divert directly from your paycheck into a 401(k). In 2024, you can funnel up to $23,000 per year into an account.

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

There are a few methods recommended by experts that you can use to reduce your taxable income. These include contributing to an employee contribution plan such as a 401(k), contributing to a health savings account (HSA) or a flexible spending account (FSA), and contributing to a traditional IRA.

If you usually get a tax refund, there are several reasons you might find that you owe taxes instead. These include receiving unemployment benefits, changing jobs, sold stock, or made money from a side hustle. Is it better to owe tax or get a refund at the end of the year?

For 2023, the standard deduction increased to $27,700 for married couples filing jointly, up from $25,900 in 2022. Single filers may claim $13,850 for 2023, an increase from $12,950. Enacted via the Tax Cuts and Jobs Act of 2017, the higher standard deduction is slated to sunset in 2026, along with lower tax rates.

- Self-employment taxes. ...

- Home office expenses. ...

- Self-employed health insurance premiums. ...

- Self-employed retirement plan contributions. ...

- Vehicle expenses. ...

- Cell phone expenses.

$6,500 if you are under the age of 50. $7,500 if you are age 50 or older by the end of the tax year.

Consider a Roth IRA

In general, if you think you'll be in a higher tax bracket when you retire, a Roth IRA may be the better choice. You'll pay taxes now, at a lower rate, and withdraw funds tax-free in retirement when you're in a higher tax bracket.

Note: For other retirement plans contribution limits, see Retirement Topics – Contribution Limits. For 2023, the total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than: $6,500 ($7,500 if you're age 50 or older), or. If less, your taxable compensation for the year.

Many everyday expenses can be itemized as deductions on your income tax return. Categorize your expenses into IRS-approved deduction categories such as medical and dental expenses, deductible taxes, home mortgage points, etc. Bunch your expenses into one tax year to maximize the value of your deductions.

What happens if you owe the IRS money and don't pay?

Levies and liens

Within a few months, you can expect to receive letters from the IRS indicating how much you owe. These may be followed by collection notices or phone calls. Eventually, you may receive a Notice of Intent to Levy, a letter indicating the IRS is prepared to seize your assets to cover the amount due.

You cannot claim yourself as a dependent on taxes. Dependency exemptions are applicable to your qualifying dependent children and qualifying dependent relatives only. You can, however, claim a personal exemption for yourself on your return. Personal exemptions are for you and your spouse.

However, as a general rule of thumb, you can expect to pay around 15% of your income in taxes. So, for a $700 paycheck, you would likely pay around $105 in taxes.

You can increase the amount of your tax refund by decreasing your taxable income and taking advantage of tax credits. Working with a financial advisor and tax professional can help you make the most of deductions and credits you're eligible for.

Why do I owe federal taxes but get a state refund? Because taxes are different at a state and federal level, sometimes nonresidents find they can owe taxes at a federal level, but may be due a refund at their state level.