By Eric Esposito

Eric Esposito

Contributor

Full Bio »

Learn about our editorial policies

Reviewed by Jessie Moore

Jessie Moore

Editor

Jessie Moore has been writing professionally for nearly two decades; for the past seven years, she's focused on writing, ghostwriting, and editing in the finance space. She is a Today Show and Publisher's Weekly-featured author who has written or ghostwritten 10+ books on a wide variety of topics, ranging from day trading to unicorns to plant care.

Full Bio »

Learn about our editorial policies

Our editorial team uses a strict editorial review process to compile all reviews, research, and evaluations of any kind. Our company, WallStreetZen Limited, is supported by our user community and may receive a small commission when purchases are made through partner links. Commissions do not affect the opinions or evaluations of our editorial team.

Pro stock traders look super sophisticated with their charts and graphs, but many are surprisingly superstitious.

In fact, countless investors subscribe to an unscientific concept called “stock market seasonality.”

Just as birds sense it’s time to fly south before it snows, stock traders “know” to buy or sell positions during different months.

Sounds crazy, right?

But interestingly, some stats suggest there may be some merit to choosing the best months for stocks.

Find out about the best and worst months for the stock market, and how to choose the right season to pick up shares.

What’s stronger than seasonal trends? Cold, hard research.

Seeking Alpha’s new service, Alpha Picks, is an alert service that endeavors to give you a market edge based on extensive market research that results in high-conviction stock picks.

Want to know more? Check out our extensive Alpha Picks review.

What are the Best and Worst Months for the Stock Market?

According to historical trends, the best months for stocks are:

- April

- November

- December

And the worst months for stocks are:

- June

- August

- September

Stocks tend to be “greenest” during early winter and the start of spring. However, major stock market indices usually struggle to eke out gains in the summer.

Remember that these patterns are based on average returns for broad stock indices over decades. Seasonal patterns can’t predict the expected return on a specific stock.

Also, although some months usually have a positive or negative reputation, these patterns aren’t identical every year. They simply give traders a general sense of how the stock market performed over the past decades.

What is Stock Market Seasonality?

“Stock market seasonality” is the theory that stock prices tend to move in predictable patterns at specific times of the year.

People who subscribe to stock seasonality believe traders usually buy or sell positions during particular months, regardless of macroeconomic conditions.

The general model of stock market seasonality goes as follows:

- Stock prices rise into the new year until April.

- Traders sell off shares in late spring and throughout the summer.

- After the steepest drop in September, traders gradually return for an end-of-year rally.

While this is an oversimplification, it highlights the major points traders keep in mind when determining the best months for the stock market.

Looking to bone up on investing basics (and beyond)?

Get up to speed on the factors that make stocks move and improve your stock market savvy with our favorite ecourses:

- Best day trading course: Investors Underground

- Best free course: TD Ameritrade

- Best investing courses for beginners: Udemy

- Best way to practice trading: eToro Demo Account

Plus, discover more great courses here.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Breaking Down Historical Returns: S&P 500 and the DJIA

Since the S&P 500 and the Dow Jones Industrial Average (DJIA) are major US stock indices, analysts focus on their average returns when evaluating the best and worst months for the stock market.

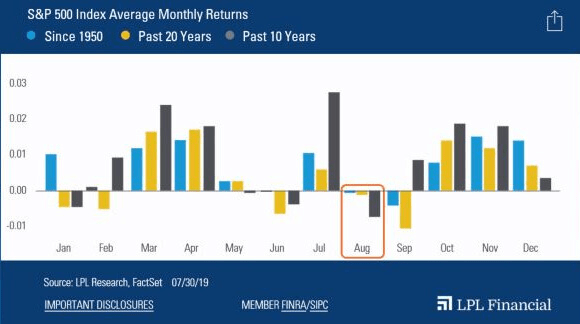

As you can see in the chart below, 1950 and 2020, the S&P 500 usually returns between 1 – 2% in April and November, but it posts negative returns in August and September.

In the chart below, you can see that the DJIA has a similar historical pattern, with April, November, and December performing well, and August and September with negative rates.

Interestingly, these patterns hold true for stock market indices worldwide. As evidenced below, markets like the German DAX, British FTSE, and Japanese NIKKEI have similar seasonal patterns.

There are dozens of theories surrounding these yearly trends, but some reports suggest the September lull correlates with low retail sales.

There are also well-known theories surrounding the “Santa Claus rally” and “January effect,” both of which suggest investors jump back into the stock market before and after New Year’s.

Typically, retail salesare at their highest before Christmas, meaning there’s a better chance companies are doing great thanks to the boost in economic activity.

As for why stocks tend to slump after spring, some speculate this may be due to the looming tax deadline. There may also be less trading activity in the summer as more people focus on their tan lines versus trendlines.

Want to improve your chart prowess? Here’s your homework:

- Up your charting game. Our top charting platform, hands down, is TradingView. With free and paid options available, this platform can meet you where you’re at right now.

- Check out our article on common stock chart patterns.

Best Months for Stocks: S&P 500

The best months for stocks in the S&P 500 are:

- April

- November

- December

Worst Months for Stocks: S&P 500

Usually, the worst months for stocks in the S&P 500 are:

- June

- August

- September

Best and Worst Months for Stocks: DJIA

Like the S&P 500, the best months for stocks in the DJIA are usually April, November, and December and the worst months are June, August, and September.

What is the Best Month (or Months) to Buy Stocks — and Why?

From a statistical and seasonal perspective, September might just be the best month to buy stocks — depending on your approach. Here’s why.

It doesn’t matter what index you look at — stock prices tend to slump during this month.

Nobody knows why September is so sour for stock investors, but data shows there’s a higher chance people will sell. If you’re looking for value, September could potentially offer you great discounts on high-quality stocks.

What is the Worst Month (or Months) to Buy Stocks — and Why?

Unless you’re a short-term trader, the worst months to buy stocks are usually November, December, and April.

Why? Because during these months, there’s a high probability stocks are at their peak valuations, so there aren’t as many bargains in the market.

While the typical rallies during these months may present great opportunities for momentum traders, they may not offer the best entry points for long-term investors.

Knowing when to buy stocks isn’t the same as knowing WHAT stocks to buy.

There are never guarantees in the stock market. But a thumbs-up from a reputable service like Alpha Pickshas the potential toimprove your conviction.

Remember: regardless of what alert service you use, you should always do your own due diligence. Ultimately, your investments are your decisions.

Check out Alpha Picks

What Affects Stock Market Seasonality?

Honestly? Nobody’s 100% sure what’s behind stock market seasonality. However, there are a few popular theories people use to explain this phenomenon:

- Tax season: The impact of capital gains taxes may make traders more prone to buy early in the year and cool off as the IRS deadline approaches.

- Vacations: People are usually more interested in sandy beaches than stock portfolios during summer.

- Retail activity: The increased retail spending at the end of the year may correlate with better performance in the stock market (aka the “Santa Claus rally”).

- Self-fulfilling prophecy: Stock seasonality may be a big mind game. In other words, since everyone expectsthis pattern to play out, it happens!

Seasonal Stock Market Trends

Within the broad stock market seasonal pattern, there are few microtrends traders pay attention to.

Earnings Season

Earnings season refers to a window after each of the four yearly quarters when companies report their financial results.

Usually, stocks aremore volatileduring earnings season as traders bet on whether companies will exceed or fall short of expectations. For this reason, investing in stocks before earnings season is riskier than at other times of the year.

Short-term traders may use the volatility of earnings season in their favor, but cautious investors wait for an earnings confirmation before deciding to buy or sell.

The January Effect

The “January effect” is a theory that stocks tend to perform well after New Year’s Day. Supposedly, everyone is so cheery after the holidays that they keep pushing stocks higher in early January.

Plus, some people theorize traders are more willing to put money to work followingtax-loss harvesting.

While that all sounds logical, there’s no evidence that January outperforms other months of the year. In fact, data suggestsJanuary has about a 50/50 chance of closing in the green.

“Sell in May and Go Away”

Because June, August, and September are usually bad for equities, some traders jump ship in May.

While there’s a historical precedent for months like September being bad for stocks, there’s never a guarantee shares will plunge in summer and early fall. In fact, July tends to be positive for many stock indices.

That being said, traders who want to avoid seasonal risks often swap shares for cash before re-entering the market around October or November.

The October Effect

October is the “spookiest” month for investors.

Some of the worst crashes in stock market history happened during October, including the disastrous falls in 1929, 1987, and 2008.

Because October is associated with double-digit stock declines, investors brace themselves for extra volatility.

However, aside from a few famous 20%-plus falls, October has usually been a positive month for global stock markets.

The Santa Claus Rally

Generally, there’s more pine green than Rudolph red in the stock market during December. While it’s not always the case, this month tends to be a great time for global stocks.

However, analysts caution against relying too heavily on a rally literally before Christmas. According to historical data, the S&P 500’s average pre-Christmas performance is only marginally positive.

What is the Best Date of the Month for Traders — and Why?

Some traders believe it’s best to buy shares around the middle of the month to take advantage of a late-month rally. Supposedly, it’s more likely that mutual fund managersbuy near the close of a month to make their returns look good.

Historical evidence also suggests buying a day before a significant holiday leads to better yearly returns. Apparently, traders are more likely to sell shares before a holiday break, which explains why “pre-holiday trading” sometimes works well for buyers.

What are the Best Days of the Week to Trade — and Why?

Everyone’s depressed on Mondays, stockbrokers included. In fact, some traders believe people hate Mondays so much that they’re more prone to sell equities.

Interestingly, historical chartssuggest Mondays have higher-than-average sell pressure. So, it’s more likely you’ll buy stocks at a discount on Monday versus other days of the week.

For more info on short-term stock trading strategies, check out this article: “Best Time Frame for Swing Traders.”

What are the Best Times of Day to Trade — and Why?

The “best” time to buy shares depends on a trader’s risk tolerance. Trading activity is most volatile early and late in the daily session, but it usually flattens out mid-day.

Therefore, if people want to make a high-risk momentum trade, they’ll buy close to the opening or closing bell. By contrast, investors who avoid volatility should focus on intraday price moves.

Interested in maximizing your potential as a day trader? Here are some of our top resources and tools for short-term traders:

- Best charting software: TradingView Pro+

- Best trading computer: Radical X13 EZ Trading Computer

Brokers

- Best for beginners: eToro*

- Best for advanced traders: Tradestation

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford the high risk of losing your money before investing with these products.

Final Word:

Stock market seasonality has some merit, but it’s far from a precise science. Also, most seasonal tests only give us data on the general trends of the broader market, not individual stocks or sectors.

While knowing a bit about seasonality can help pick a favorable environment to enter the market, it shouldn’t be a trader’s sole metric. Instead, it’s best to use seasonality alongside other technical and fundamental factors to make an informed decision.

FAQs:

What are the best and worst months for the stock market?

The best months for the stock market are April, November, and December; the worst months are June, August, and September.

What time of year do stocks do the best?

Typically, early winter and early spring are the best for stocks.

What is typically the worst month for stocks?

Usually, September is the worst month for stocks.

Is January typically a good month for stocks?

January is usually good for stocks, but April tends to be the best.

What is the 10 am rule in stocks?

Traders who follow the "10 am rule" wait 30 minutes after the stock market's opening bell before placing a trade. The first 30 minutes of trading are usually volatile, so some traders feel more comfortable opening a position after this flurry of activity.

What is sell in May and go away?

"Sell in May and go away" means selling stock positions in early spring to avoid the historically bad performance of June, August, and September.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our December report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.

- Share

- Share

- Tweet

About the author

Eric Esposito

Contributor

As a seasoned financial expert and enthusiast deeply entrenched in the world of stock trading, I bring a wealth of firsthand knowledge and a profound understanding of the intricacies of market dynamics. My expertise is not just theoretical but is grounded in practical experience, enabling me to navigate the complexities of stock markets with precision.

Now, let's delve into the concepts discussed in the provided article:

-

Stock Market Seasonality:

- Definition: Stock market seasonality is a theory suggesting that stock prices exhibit predictable patterns at specific times of the year.

- Overview: Traders tend to buy or sell positions during particular months, irrespective of macroeconomic conditions. The general seasonal trend involves rising prices into the new year until April, selling off shares in late spring and summer, and a year-end rally.

-

Best and Worst Months for Stocks:

- Best Months: April, November, December.

- Worst Months: June, August, September.

- Pattern: Stocks generally perform well in early winter and early spring, while struggling to gain in the summer. These patterns are based on average returns for broad stock indices over decades.

-

Historical Returns - S&P 500 and DJIA:

- Focus Indices: S&P 500 and Dow Jones Industrial Average (DJIA).

- Observation: Both indices show similar historical patterns, with positive returns in April, November, and December, and negative returns in August and September. This pattern is not unique to U.S. markets but extends to global indices like the German DAX, British FTSE, and Japanese NIKKEI.

-

Factors Affecting Stock Market Seasonality:

- Theories:

- Tax Season: Capital gains taxes may influence traders to buy early in the year and reduce activity as the tax deadline approaches.

- Vacations: Summer months may see reduced trading activity as people focus on leisure rather than investments.

- Retail Activity: Increased retail spending at the end of the year may correlate with better stock market performance (Santa Claus rally).

- Self-Fulfilling Prophecy: Stock seasonality could be influenced by psychological factors, where expectations shape market behavior.

- Theories:

-

Seasonal Stock Market Trends:

- Earnings Season: Periods when companies report financial results, leading to increased stock volatility.

- January Effect: Theory suggesting stocks perform well after New Year's Day, potentially driven by positive sentiment and tax-loss harvesting.

- "Sell in May and Go Away": Some traders exit the market in May to avoid historically poor performance in June, August, and September.

- October Effect: October historically has seen significant market crashes, though it's not always negative.

- Santa Claus Rally: Generally positive stock market performance in December, although caution is advised against relying solely on this trend.

-

Best Date and Days for Trading:

- Best Date: Some traders believe mid-month is optimal for buying to take advantage of a late-month rally.

- Best Days: Mondays are considered to have higher sell pressure, potentially offering buying opportunities at a discount.

-

Best Times of Day for Trading:

- Volatility: Trading activity is most volatile at the opening and closing bell, with mid-day showing lower volatility.

- Risk Tolerance: High-risk momentum trades may be suitable near the market open or close, while conservative investors focus on intraday price moves.

-

Conclusion on Stock Market Seasonality:

- Merits: Stock market seasonality has some merit but is not an exact science. It provides general trends for the broader market, and caution is advised in using it as the sole metric for decision-making.

In essence, understanding stock market seasonality involves a combination of historical data, psychological factors, and awareness of broader economic trends, offering traders valuable insights for informed decision-making.