Right now, I am investing most of my capital into real estate investment trusts ("REITs"), which are real estate investment vehicles that are publicly listed on the stock market.

I am investing heavily in them because I think that they are offering a historic opportunity.

In 2022, their prices collapsed because of fears of rising interest rates. On average, REITs dropped by 30% (VNQ), and the number of individual REITs dropped by closer to 50% (SLG; BRMK; DEI; OPI):

That would imply that REITs are facing great difficulties, but that simply isn't the case.

On the contrary, REITs are actually doing really well right now.

They are not heavily impacted by the surge in interest rates because their balance sheets are the strongest they have ever been, with just a 35% LTV and long debt maturities at nearly 10 years.

But they greatly benefited from the recent surge in inflation, as it led to higher rents, and it pushed the cash flows of REITs to new all-time highs:

So here you have the opportunity to buy high-quality REITs at steeply discounted valuations. Their share prices dropped even as their cash flows grew significantly, and as a result, REITs are now priced at:

- Low FFO Multiples

- Large discounts to their NAV

- And high dividend yields.

But there are over 200 REITs in the U.S. and a lot more abroad.

Which are the best REITs to buy for 2023?

Below, I highlight 3 of my favorites to buy right now:

REIT #1: NewLake Capital Partners, Inc. (OTCQX:NLCP)

NLCP is one of a few REITs that specializes in Cannabis cultivation facilities and retail dispensaries. It is a less-competitive sector of the commercial real estate market and, as a result, cap rates are a lot higher at ~12% and lease terms are more favorable to the landlord with long 15-year leases, 2% annual escalations, and no landlord responsibilities (all property expenses, including the maintenance, are carried by the tenant):

This property sector is obviously somewhat riskier than most others because your tenants are more speculative and lease defaults are more frequent.

But in the case of NLCP, these risks are particularly well managed. It invests mainly in limited license states, which have a limited supply of such properties, and its tenants enjoy strong rent coverage ratios of around 5x.

As a result, NLCP has never experienced a lease default since going public whereas its largest peer, Innovative Industrial Properties (IIPR), has had a few.

NLCP's largest tenant, Curaleaf Holdings, Inc. (OTCPK:CURLF), recently reported 18% YoY growth in EBITDA in its Q3 earnings. NLCP's other tenants (OTCQX:CRLBF; CCHWF;...) are also doing well, which leaves us optimistic about the future:

And here is why NLCP is so opportunistic right now

Since going public in 2021, NewLake Capital Partners, Inc. has grown its AFFO by 75%, its portfolio has nearly doubled in size, and it has hiked its dividend in every quarter, but despite that its share price has collapsed by 45%:

This recently prompted NLCP to initiate a $10 million share buyback program to take advantage of its depressed share price. President & CEO Anthony Coniglio commented that, though their investment pipeline remains strong, "we can no longer ignore the compelling investment opportunity with our stock trading at such a discount."

Since NLCP yields ~9.3% right now, we think this is a solid use of capital, and $10 million represents less than 25% of the $45 million NLCP holds in cash.

At the same time, NLCP doesn't need to worry much about rising interest rates because the cannabis REIT has virtually zero debt and plenty of cash (~12% of market cap) to keep pursuing opportunistic acquisitions.

Moreover, with marijuana legalization gaining popularity with the U.S. population, we think it's only a matter of time before the regulatory environment opens up. This could serve as a great catalyst for the company as it would allow it to up-list to a better exchange, which would then increase the demand for its shares. It would also increase the profitability of its tenants and lower the risk of its leases.

At a price to AFFO of 8.3x, we think NLCP has at least 50% upside to fair value in a future up-listing scenario.

The nice thing here is that until then, NLCP can keep buying back shares to create value for shareholders, and with a 9.3% dividend yield, not much growth is needed to reach double digit total returns. Also, since the REIT has no debt, and it earns rental income from 15-year-long leases, it is resilient to rising rates and recession, which makes its risk-to-reward particularly compelling in today's market.

REIT #2: AvalonBay Communities, Inc. (AVB)

AVB is what you would typically describe as a blue-chip REIT:

- It has one of the best track records in the entire REIT sector.

- It has grown its dividend for nearly 30 years in a row.

- It has an A-rated balance sheet.

- It has attractive long-term growth prospects.

- And it owns a vast portfolio of Class A apartment communities in supply-constrained markets:

Despite that, AVB is priced as if it was going through some severe pain.

Its share price dropped by 36% in 2022:

But in reality, the company is doing just fine.

Its FFO (funds from operations) per share surged 20% in the first nine months of last year (Q4 has not been reported yet). A little over half of this growth came organically, as same-store NOI growth spiked 13.9%, and the rest came from its new development projects and capital recycling.

AVB has a huge development pipeline that represents ~$130 million in incremental future NOI growth and it is expected to earn a large spread over its cost of capital. With modest debt and ample liquidity of around $2.7 billion (11% of market cap), AVB is not in any danger whatsoever, despite the stock's 36% selloff.

Admittedly, the growth will slow down in 2023, but this shouldn't lead to such a sharp selloff. We estimate that the company is today priced at a 30% discount to its net asset value, which essentially means that you get to buy its assets at 70 cents on the dollar. Its FFO multiple is also just 16.5x, which is very reasonable for a blue-chip apartment REIT.

We expect at least 30% upside to fair value in addition to an attractive ~4% dividend yield.

REIT #3: EPR Properties (EPR)

EPR Properties is a net lease REIT that invests in experiential properties such as golf complexes, movie theaters, waterparks, and even hot springs:

Most of its properties are doing very well and enjoy strong characteristics, with near 3x rent coverage (ex-movie theaters), 10+ year-long leases, 2% annual rent increases, and master lease protection.

But despite that, EPR is avoided by most investors because it owns a lot of movie theaters.

About one-third of its net asset value is made of movie theaters, and a lot of people appear to believe that AMC Entertainment (AMC) could be facing bankruptcy. It is heavily indebted and still losing money:

Box office sales haven't yet recovered from the pandemic, and this recently caused Cineworld Group plc (OTCPK:CNNWQ), the parent company of Regal, to file for bankruptcy.

It also pushed AMC to freeze executive pay, raise more equity, and swap some debt for equity.

EPR was already undervalued, but it dropped even more following these announcements:

We are buying the dip because we think that the market is overlooking some key factors:

- EPR is not the operator of these theaters. It is just their landlord.

- Its theaters are already profitable at the property level with a 1.3x rent coverage even with a depressed box office.

- The box office is expected to keep recovering with a strong movie slate in 2023. Disney (DIS) just announced that Avatar had crossed the $1 billion milestone at the global box office in its first 14 days. That's the sixth movie ever to achieve that.

- EPR owns the some of the most productive theaters in its markets and they are absolutely essential to the businesses of its tenants.

- In some cases, these properties are more valuable empty because they could be redeveloped into other more profitable uses.

EPR renegotiated its lease with AMC in 2020 in a way that gave AMC a rent cut but should protect EPR in case of a future bankruptcy.

So far, Cineworld appears to only have rejected 3 small leases out of ~50 theaters.

Finally, EPR has an exceptionally strong track record and even survived the pandemic, which was the worst possible crisis for the company. Today, it has an investment-grade-rated balance sheet with a net debt to EBITDA of 5.2x, no maturities until 2024, no secured debt, and $1 billion available on its revolver.

The market has priced EPR as if it was facing huge losses, but this does not make sense to us.

We remain optimistic about the long-term outlook of movie theaters (you can read why by clicking here). While the near term is uncertain, we think that this is more than priced in already.

Even in a worse-case scenario, we would expect most of its theaters to remain occupied and the rent cuts wouldn't be large enough to justify today's low valuation.

The box office is now rapidly recovering from the pandemic with new movies like Avatar breaking records. Netflix (NFLX) didn't kill theaters as many predicted because they are mostly about shows, not movies. Disney, Paramount (PARA) and other producers have now realized that movie theaters remain essential to monetizing new blockbusters. Even Amazon (AMZN) recently noted that it would invest over $1 billion each year to produce movies that will be exclusively for theaters. If it was really a dying sector, they wouldn't care to do that.

At an FFO multiple of 8x and a 30% discount to its net asset value, EPR is simply dirt cheap and priced for significant and long-lasting pain. But the reality is that EPR is a high-quality REIT and eventually, as we put all this uncertainty behind us, it will deserve to trade at closer to 15x. While you wait for the upside, you earn an 8.2% dividend yield.

Bottom Line

The market worries about rising interest rates, but it seems to forget that most REITs aren't materially impacted and it also fails to acknowledge that rents grew significantly in 2021 and 2022.

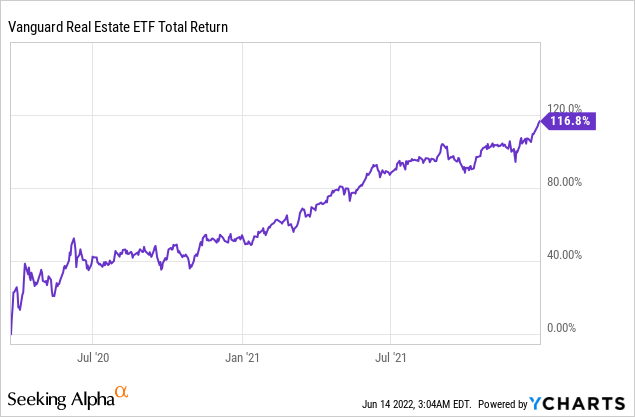

At High Yield Landlord, we are loading up on these REITs and others while they are still offered at historically low valuations. The last time REITs were so cheap was early into the pandemic, and they then more than doubled in the following year:

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,000 members on board and a perfect 5/5 rating from 400+ reviews:

We are currently holding a limited-time sale with 50% off the annual plan!

Start Your 2-Week Free Trial Today!