These five biggest money mistakes will keep you from getting your finances on track and destroy your dreams

I struggled to write this article about the biggest money mistakes people make. I try being as positive as possible when writing on the blog but I see so many people fall into these money traps that I just had to call a few out.

In my five years talking about personal finances with people and over nearly a decade as an investment analyst, I’ve seen five common money mistakes keep people from reaching their financial goals.

As with investing, sometimes the best thing you can do is avoid making the big mistakes that set you back to zero. Putting your personal finances in order to start moving to your goals isn’t so much what you must do but avoiding these mistakes that defeat your dreams and destroy your motivation to keep going.

Take an honest look at each of these money mistakes. There’s no shame in having fallen for some of them in the past, we’ve all been there. Look at each, what led to it in the past and how you can avoid making the same money misstep in the future.

The Golden Gaffe of Poor Planning

I had a high school teacher that was fond of repeating the 7 P’s – Prior proper planning prevents piss-poor performance.

Procrastination and poor planning is one of the biggest money mistakes that nearly everyone commits from time to time. Procrastination is why we have due dates on bills and why people line up at the post office on April 15th every year.

Just starting the money conversation with family can be painful and most people put it off forever.

Budgeting and saving is no fun, especially when it means cutting back on the things we want today. That’s why it’s so important to have a crystal-clear image of your goals. Create a mental picture of what you want from your financial goals. This will help motivate you to get started saving and support you along the way.

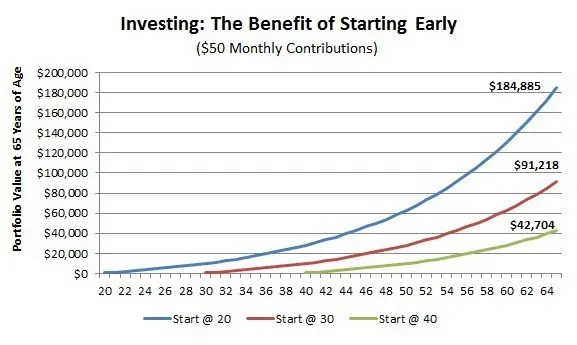

Everyone talks about the importance of starting early with your financial planning but do you know how much it matters? Putting just $50 a month into an investment account can mean nearly $100,000 more for retirement when started in your 20s rather than waiting a decade.

Avoid this money mistake by taking the time to get started now. Write down a date within the week that you are going to take an hour to start planning your financial future. Click through to this page on how to get started with your personal finances in five critical topics.

Budgeting Blunder: Overspending and Credit Mistakes

We are a consumer culture. Americans see at least 2,000 advertisem*nts a day and some estimates put it at closer to 5,000 per day.

That all makes it tough not to overspend. You probably heard from your parents that money doesn’t grow on trees but you can create it out of thin air…with a credit card!

And that’s one of the biggest money problems, that many people think of their credit limit as available cash. It’s too easy to think of your credit limit as the same as your income. Borrowed money isn’t the same as money you earn.

The next time you’re at work, think about the last thing you bought on credit. The last item you really didn’t need but charged it anyway. Think about how much it cost and how much you make in an hour at work. That will help you understand how long you have to work to pay off that credit mistake. OK, don’t think about this too long. I don’t want you to get in trouble at work.

Unfortunately, there are all kinds of mind games we play that makes it harder not to overspend and commit this money mistake.

“I work hard for my money, I should enjoy it.” How many times have you heard that? It’s true that money is no good unless you spend it and you should enjoy what your hard work allows you to do.

The problem is that ‘enjoying’ your money now, especially when it’s spent on something trivial that is only going to make you happy for about five seconds, means you won’t be able to enjoy it later. Avoiding this money mistake goes back to really having a visual image for your financial goals and understanding how much more enjoyment you’re going to get in the future by saving your money now.

Another money mind game we play is that shopping can be ‘therapeutic’ that it can help take your mind off your problems for a second. You’re taking care of you and your needs, right?

This may be true for billionaire Mark Cuban or someone that has more money than they’ll ever be able to spend. For the rest of us with bills, debts and money problems…how much more stress is being created by that 30-minute shopping therapy session?

Finally, there’s YOLO. Remember that? You only live once is used to rationalize all kinds of reckless behavior. I’m not saying you can’t enjoy life or that you shouldn’t take a chance, just that a trendy catch-phrase shouldn’t be used to make life decisions.

It’s true that you only live once, unless you’re one of my Hindu friends, but that life lasts a very long time. Make sure you’re planning for your whole life and not just for today.

Waiting Too Long to Invest Your Money

We’ve already seen how investing ten years earlier can lead to a huge payday later in life, even on a very small monthly amount.

But isn’t paying off debt just as important as investing? Doesn’t it make sense to pay off your debts before putting money in stocks and bonds?

I’ve seen a lot of personal finance blogs telling people to get free of debt before even thinking about investing. It’s some of the worst advice you can get and a huge money mistake.

We know that spending is something that is wired into our brain from the day we’re born. Even the most financially responsible among us have a hard time not running up the credit card every once in a while. Besides shopping sprees and credit card bills, there’s other debt that lets us do great things like buy a house and go to school.

The fact is that you may never be completely free from debt but you will most definitely want to retire someday. There will come a time when you just aren’t able to work anymore and you’ll need something saved away for expenses.

The average monthly check from social security is just over $1,300 and amounts to $16,000 a year. Does that sound like something you could live on and not be totally miserable?

Yes, you should have a plan to pay off your debt especially those high-interest credit cards. Do not wait until you are debt free to start investing and planning for your future. The future will be here whether you’re ready or not.

- List out all your debt in order of interest rate and monthly payments. Make your minimum payments on all and split any additional money between paying extra on the debts with the highest interest rates.

- Consider a debt consolidation loan from one of these peer lending websites to lower your interest rate and total monthly payment

- When you’ve paid off debts with interest rates of 15% or more, start putting part of your additional money in an investment account.

Check your rate on a consolidation loan up to $35,000 to pay off debts. Click for an instant rate quote and approval.

Ignorance is Not Bliss with this Money Mistake

Access to great information about financial planning and investing has never been easier to find. Most people don’t appreciate how much easier it is to get good financial advice these days compared to what our parents went through to plan their finances.

Unfortunately, access to the information doesn’t give you more hours in the day.

Unfortunately, access to the information doesn’t give you more hours in the day.

We’re all busy. After a full-time job, kids and that 30-seconds you find for yourself each day, is there really anything left to learn about personal finance?

Learning about personal finance is like budgeting your money for saving. You need to save money. If you don’t make enough for everything you want, you might have to cut back for a while to save enough for your financial goals.

Unless you have enough money to hire a financial advisor that will do everything for you, you need to spend an hour or two a week to do it yourself. If you don’t have those couple of hours available, you might have to cut back on a few things to find the time.

The upside is that spending a few hours now will pay off in years after you reach your financial goals.

Leaving too much to Risk with Your Money

This final money mistake is one that hits us in so many different ways. There are a lot of ways you can gamble with your financial future, many of them you may not even realize you’re gambling.

It sucks paying for insurance every month. It’s so hard to see the benefit, especially when premiums reach into the hundreds of dollars. Insurance is there to protect you from financial catastrophe and if that word catastrophe scares you, it should.

The average cost of an emergency room visit is $1,400 and each night in the hospital can add thousands to the bill. The average cost of a car wreck is $7,500 and that’s if no one is seriously hurt.

You need insurance. Period. Just think of how much it would suck to sacrifice and save for years, even decades, only to see all your financial dreams lost to one big medical bill.

People take just as much risk by not saving an emergency fund. Insurance can cover the big bills but losing your job will wipe you out just as quickly. An unexpected layoff can push you into bankruptcy and a debt trap of super-high interest rates.

Having investments in stocks and bonds doesn’t count as an emergency fund. Needing money fast may mean selling stocks at exactly the wrong moment, losing thousands when prices are low. Having an emergency fund in safe investments that you can sell quickly can help you pay expenses without dipping into your nest egg.

We don’t stop there when it comes to taking too many risks with our financial lives. People love to invest stocks, jumping at every tip they get to find the next hot stock. How much money do you have in safer investments like bonds and real estate?

Investing isn’t about picking stocks but about matching your long-term goals with the right investments. That means understanding how much return your need and the best asset classes for your investing needs.

How to Not Fall for the Worst Money Mistakes

Instead of thinking of it as avoiding the worst money mistakes, learn from each of these financial fumbles people make and what you can do differently to reach your goals. Some of the best money decisions are also fairly obvious when you look at the alternative.

- List out your financial goals and start planning today

- Make a budget that includes saving and understand credit doesn’t mean income

- Start investing as soon as possible and don’t wait to be debt-free

- Take the time to learn about personal finance and the money habits that will put you on track

- Make sure you have enough insurance and an emergency fund

- Invest in a diversified mix of asset classes rather than just in stocks

These may be the biggest money mistakes but they’re not the only ones. The upside is that by taking a little time to learn about personal finance, you’ll be able to spot money problems before they drain your bank account.