You can have the best startup idea in the world, but unless you have the money to finance its growth, your idea might not reach its full potential. In some cases, you might run out of money before your business ever gains traction.

That’s where startup funding comes into play.

Raising money from investors is one of the most common ways to fund growth. However, it’s important to understand how the process works so that you can make the best decisions for your business.

For instance, what’s the difference between a pre-seed and seed round? How do you know when you’re ready to raise a Series A? Do you even need to raise a Series D round? How much should you raise?

In this guide, we’ll answer all of those questions and more, plus explain what to expect at each funding stage.

Table of Contents

How Startup Funding Works

Before we get into the nitty-gritty, it’s important to understand why startups raise money in the first place.

Without getting too much into the weeds, I’ll just say that growing and scaling a large business costs a lot of money. More money than most startups have in the bank, and more than they’re able to generate from revenue alone.

Between salaries, marketing, and product development, you can easily burn through tens of thousands of dollars each month just to operate a startup.

Without outside funding, it’s very difficult for most startups to sustain, let alone grow fast enough to gain market share. As a result, founders look to investors to give them money in exchange for equity (i.e. ownership) in their business.

Those investments allow founders to fund the growth of their startup as it matures from an idea to a fully operational business, and eventually becomes a large company that can sustain itself or is ready for an exit.

In a webinar with the Founder Institute, the founder of our company compared the fundraising process to the old racing arcade game Cruis’n USA.

In the game, you race against other cars and have to reach checkpoints throughout the course before your time runs out. Each time you reach a checkpoint, you get more time on the clock. If you fail to reach the next checkpoint in time, you lose.

Startup funding works very similarly.

Every time you raise money, you get a little more time (or runway) for your startup to reach the next checkpoint (i.e. the next fundraising round).

You start with a pre-seed or seed round. The money you get from that stage adds more time on your clock to get to the next checkpoint—your Series A. Then you use the Series A money to get you through to your Series B and so on.

With each fundraising round, your business should be growing, maturing, and reaching certain milestones to show investors your startup is worth the investment.

Throughout the rest of this guide, we’ll explain what the milestones are for each fundraising round, which types of investors to seek for each round, the average funding amount, and more.

Pre-Seed Funding

What is Pre-Seed Funding?

Pre-seed funding is the earliest stage of financing for a startup, typically occurring in the ideation or concept stage before the startup has developed a minimum viable product or generated any revenue.

This funding round is usually used to help the startup build a team, develop a prototype or proof of concept, conduct market research, and validate its business model.

Pre-seed funding is typically provided by friends and family, angel investors, or incubators/accelerators, and the funding amount can range from a few thousand to tens of thousands of dollars.

Pre-seed funding is critical for startups to get off the ground and start building momentum towards the next funding rounds, such as seed funding, Series A, B, and beyond.

While it’s often not considered an “official” fundraising round, you can think of a pre-seed round as a warm-up for the seed round.

When a company gets pre-seed funding, it’s not going to make Techcrunch headlines and the public probably won’t even know about it. In fact, a lot of companies skip this stage entirely and go right to their seed round.

However, if you’re in the very early stages of your startup and need some initial capital to build your MVP, a pre-seed round can provide that.

How Mature Should Your Company Be for Pre-Seed Funding?

At this stage, you’re very early on in the process. You might have an MVP or even just a mockup in Figma that shows how your product will work. But you likely won’t have a team built out or a fully developed product just yet.

Here’s a look at some of the things you should have when you’re seeking pre-seed funding:

- Define the problem you’re trying to solve

- A new or novel solution for that problem

- A basic understanding of your market

- Fundraising plan (how will you fund the business over time?)

- An MVP (even if it’s a product mockup in Figma)

- A plan for how you’re going to start getting early users or customers

During your pre-seed round, people are investing in you as a founder just as much (if not more) than your actual business idea. Make sure you’re able to show why you’re the right person to build and grow the company.

What’s the Average Investment Amount for Pre-Seed Funding?

The amount of pre-seed money companies raise varies tremendously. Many sources cite the average amount as less than $1,000,000. However, that is on the higher side for pre-seed funding.

A report from DocSend that analyzed 174 startups at the pre-seed stage found that the average pre-seed funding amount was roughly $500,000 or less.

In some cases, your pre-seed funding amount can be even lower, depending on where you’re getting the investment from and how much you need. That’s a great segue into our next section…

What Types of Investors Offer Pre-Seed Funding?

Most pre-seed funding comes from the founders, friends, and family. Again, this is part of the reason why it’s not considered an “official” funding round.

Many founders will bootstrap this part of their startup, particularly if they already have the skills to build an MVP and do some market research.

If you do need outside funding, this is when friends and family can sometimes get involved. This is also one of the differentiators between pre-seed funding and later rounds—it’s often funded by your personal network.

Another major difference between pre-seed funding and subsequent rounds is that pre-seed money is often raised on a SAFE or a convertible note, which you can learn more about here.

Since pre-seed companies are pre-revenue, a SAFE can keep you from having to value the company so early on.

What Should You Use Pre-Seed Funding For?

- Building a founding team: Bring on co-founders, early employees, or advisors to help develop your company’s product or service.

- Conducting market research and validation: Identify market opportunities, analyze competitors, and validate their product or service concept.

- Developing a prototype or proof of concept: Develop a prototype or proof of concept to test the viability of your product or service.

- Creating a pitch deck to attract seed stage funding: Hire a designer or expert to help make a pitch deck to secure seed stage funding. This deck should include information about the product or service, target market, and business model. You can learn more here.

Seed Stage Funding

What is Seed Stage Funding?

Seed stage funding is the first formal round of financing for a startup, typically occurring once the company has developed a minimum viable product, demonstrated some traction, and has a clear plan to grow its business.

This funding round is usually used to fund initial product development, build out the founding team, and conduct market research. Seed stage funding is typically provided by angel investors, venture capital firms, or crowdfunding platforms.

The funding amount in seed stage can range from a few hundred thousand to a few million dollars, depending on the startup’s valuation and funding requirements. Seed stage funding is critical for startups to scale their operations and attract further investment in subsequent funding rounds, such as Series A, B, and beyond.

How Mature Should Your Company Be for Seed Funding?

When you’re seeking seed funding, your company should be more developed than it was in the pre-seed stage.

Although the lines between pre-seed and seed funding can get blurred sometimes (particularly for tech companies), some of the milestones you should reach by the time you raise a seed round are:

- A fully functional product (you’ve gone beyond mockups and Figma files)

- Some level of product-market fit

- People who use and like your product

- More developed market research

- Minimally viable team (these should be your first hires)

Some companies already have some revenue at this stage—as much as a couple hundred thousand dollars in annual revenue—but it’s not always necessary. What you should have, however, is proof that people like and want to use your product.

While revenue is the best way to show people value your product, you can also show it through social proof like user feedback, social media mentions, and press coverage. You want to demonstrate to investors that you’re building something people are willing to pay for so that they know your business is financially viable.

What’s the Average Investment Amount for Seed Funding?

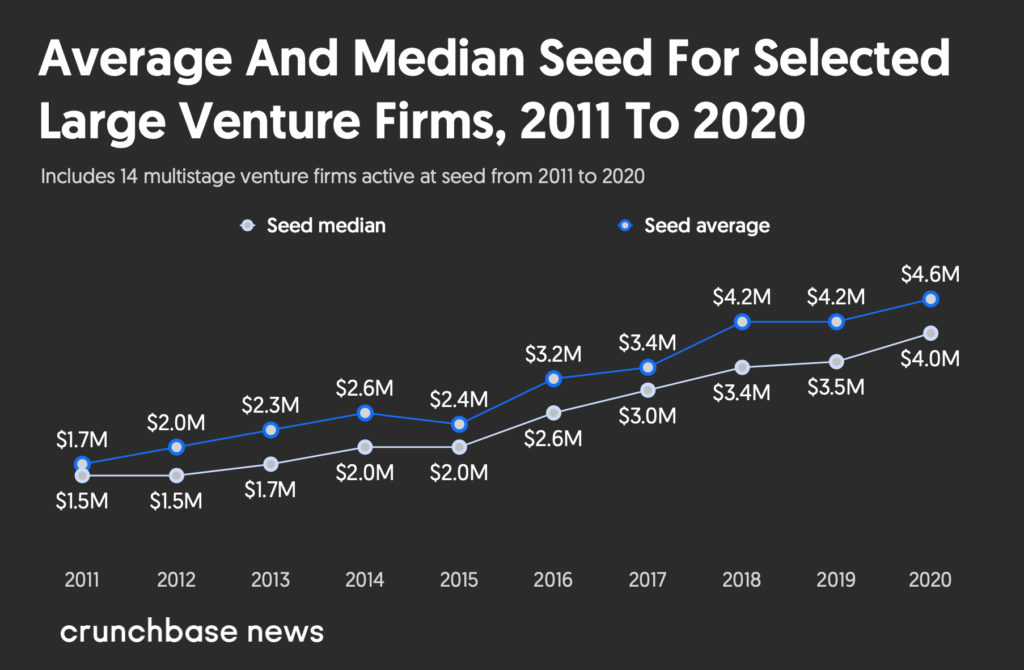

We’ll start by saying the average seed round amount has grown dramatically over the past decade. Today’s seed rounds are almost comparable to Series A rounds from a decade ago.

According to data from Crunchbase, the average seed round is $4.6M. This data is based on the average deal size of 14 different funds. As you can tell from the chart below, this amount has grown exponentially over the past decade.

Of course, this can vary greatly depending on your industry.

For instance, Gong raised $6 million in its seed round and OpenSea raised $2 million.

Again, the most important thing is to only raise what you need. Raising too much too soon can make it harder to raise money later on.

Creating a financial model can help you figure out how much you need to raise and when. Shameless plug, but Finmark makes that process a lot easier. You can learn more about it here!

What Types of Investors Offer Seed Funding?

Your seed round is when you’ll start talking to experienced investors. Depending on how much you’re raising, friends and family are still on the table as well.

However, if you’re looking to raise hundreds of thousands of dollars or even millions, you can look to angel investors and venture capitalists (VCs).

Learn more about the difference between angel investors and VCs.

Also, keep in mind that you don’t need a laundry list of investors. If you can find 1-2 VCs or angels for the round, you don’t need to crowd your investor pool.

What Should You Use Seed Stage Funding For?

- Scaling initial product development: Scale the development of your initial product (MVP)

- Hiring additional team members: Start building your foundational team. For tech companies, this might include engineers or product people. For other companies, it could be marketers or operational people.

- Conducting further market research and validation: Continue getting feedback via surveys and customer interviews to refine the product or service and prepare for your next funding round.

- Building a customer base: Use your seed round funding to test customer acquisition strategies and start building a customer-base.

Series A Funding

What is Series A Funding?

Series A funding is the second round of financing for a startup, typically occurring once the company has proven its business model and has demonstrated early revenue growth.

This funding round is typically used to scale the business, develop new products or services, and expand into new markets. Series A funding is typically led by venture capitalists and institutional investors and can range from several hundred thousand to several million dollars.

How Mature Should Your Company Be for Series A Funding?

By the time you’re ready for a Series A, you’ve gone from “I think this could really work” to “I’ve proven this works, now it’s time to scale.”

Some of the markers of a company ready for a Series A are:

- You’ve achieved product-market fit

- You have a proven revenue model

- You’re generating $500k-$4M in annual revenue

- You’ve built your core team

At this point, your business is growing, but you’re at a point where in order to capitalize on the momentum, you need more money.

The part of startup growth that often gets overlooked is how much it costs to scale. Your Series A round allows you to keep growing without being limited by the amount of cash you have in the bank.

What’s the Average Series A funding amount?

According to data from Crunchbase, the average funding amount for a Series A round in 2022 was $19.8 million.

It’s not uncommon for startups to raise tens of millions for their Series A. In fact, it’s actually becoming more of the “norm”.

Just like the other fundraising rounds, the goal with your Series A shouldn’t be to raise as much money as possible. Your goal is to raise enough to get you to the next stage of your business.

What Types of Investors Offer Series A Funding?

Typically, Series A rounds are led by VCs since you’re raising millions of dollars.

One thing to keep in mind is that at this stage, VCs expect fast growth. When you’re pitching them, you need to be able to show that you have a plan to grow 3-5x in the next 12-18 months, and how their investment will help you get there.

As for which investors to look to, Crunchbase shared some interesting data to point you in the right direction.

Also, there’s a strong chance your seed round investors will be interested in putting in more cash during your Series A, so that’s a good place to start.

What Should You Use Series A Funding For?

- Scaling customer acquisition and retention: Start investing in marketing and customer support to scale customer growth.

- Developing new products or services: Create and test new features (or add-on products/services) to explore new revenue streams.

- Expanding into new markets: Explore new customer segments or even geographics. For instance, if you’ve traditionally served SMBs, your Series A round might give you the ability to go upmarket and market to larger companies.

- Building out the core team: Expand your team to manage and scale growth. The Series A funding may give you the ability to hire more senior and experienced roles.

- Preparing for a Series B funding round: Prepare for a Series B funding round by demonstrating growth and market traction, as well as refining your pitch deck and developing a roadmap for future growth.

Series B Funding

What is Series B Funding?

Series B funding is the third round of financing for a startup, typically occurring once the company has achieved significant growth, demonstrated product-market fit, and has a clear path to profitability.

This funding round is usually used to scale the business further, invest in research and development, and hire additional talent. Series B funding is typically larger than the Series A round and is often led by venture capitalists and institutional investors, but can also involve strategic investors or corporate venture capital firms.

The funding amount in Series B can range from a few million to tens of millions of dollars, depending on the startup’s needs and growth potential.

How Mature Should Your Company Be for Series B Funding?

Very few companies make it to a Series A round (around 20-30% according to one report). Even fewer make it to Series B and beyond.

Your Series A was all about scaling and fast growth. Your Series B is a continuation of that, with plans for expansion.

If your company was a person, it’d probably be the equivalent of a stable adult by the time you’re considering a Series B. In other words, a lot of the doubt and questions about whether or not it’s going to be successful are gone.

At this stage, your business likely looks something like this:

- A large customer base

- A proven and consistent acquisition strategy

- Solid leadership team

- The ability to grow 2x year over year (YoY)

The name of the game for your Series B is expansion. You should be trying to expand on nearly every level. Expanding your market share, international reach, customer base, team, brand, and everything in between.

What’s the Average Series B funding amount?

According to Crunchbase data, the median Series B funding amount through Q1 of 2023 is $25 million. The total amount of Series B funding has taken a pretty steep dive from the 2021, as noted in the graph below.

The funding amount for a Series B can vary greatly from business to business. For instance, ClickUp raised $100 million during its Series B at the end of 2020, whereas Gorgias raised $25 million around the same time.

The point is, you shouldn’t gauge your Series B amount based on other startups. It’s crucial to raise the amount your business needs. Building a financial model can really come in handy for this.

Even if you’re at the pre-seed or seed stage, if you plan to fundraise at all, I highly recommend building a model to get a better understanding of how much you need to raise and when.

What Types of Investors Offer Series B Funding?

VCs. More than likely, it’ll be many of the same investors as your Series A round, particularly if your business is reaching its growth goals and milestones.

If your business is growing and all your KPIs are trending in the right direction (revenue, churn, acquisition, etc.) then raising more money becomes a lot easier at this stage. It’s also the reason why investors are open to investing more money at this point.

What Should You Use Series B Funding For?

- Scaling operations and infrastructure: Consider investing in new technologies, systems, and processes to support growth.

- Hiring key executives: If you haven’t already, you might use Series B funding to hire key executives to help manage your company’s growth, such as a CFO or COO.

- Investing in sales and marketing: Scale customer acquisition by investing into larger marketing campaigns or growing your sales team.

- Conducting strategic acquisitions: If your balance sheet and financial forecst can support it, you might consider acquiring complementary businesses or technologies to expand your company’s product portfolio and reach new markets.

Series C Funding

What is Series C Funding?

Series C funding is the fourth round of financing for a startup, typically occurring once the company has achieved significant traction, established a clear market position, and has a plan to continue scaling its operations.

This funding round is usually used to further expand the business, acquire complementary companies, or prepare for an initial public offering (IPO).

Series C funding is typically led by venture capital firms, private equity firms, or hedge funds and may also include participation from existing investors or strategic investors. The funding amount in Series C can range from tens of millions to hundreds of millions of dollars, depending on the startup’s valuation and funding requirements.

How Mature Should Your Company Be for Series C Funding?

Your company should be fully matured at this point. Meaning, you’re a key player in your industry and have significant market share.

Some other common milestones for a company heading for Series C funding are:

- You’ve started to expand internationally

- You’re nearing profitability

- You have multiple revenue streams and a diverse revenue model

At this stage, the primary way to keep seeing significant growth is to spend a significant amount of money.

Since you’re a market leader, chances are people who are looking for the type of product you sell are aware of you, and your acquisition channels operate like well-oiled machines.

Therefore, doing things like creating additional products or acquiring other companies will have a significantly bigger impact on your growth than spending more money on ads or marketing campaigns.

You’re no longer just fueling growth through generating awareness for your product. You’re fueling growth by exploring new revenue channels.

What’s the Average Series C Funding Amount?

We looked at a couple of data reports to determine the average Series C amount. According to Fundz, the average amount of funding for a Series C round in 2020 was $59 million.

We also looked at data from Crunchbase on the average Late-Stage funding amount (which includes series C and beyond). Their data showed the average late stage investment amount to be around $60 million in Q3 and Q4 of 2022.

Series C raises continue with the same overall trend we’ve seen for startup funding in general, in that the average funding amount has increased significantly over the years.

As a result, it’s not uncommon for startups to raise upwards of $100 million or more in their Series C round.

What Types of Investors Offer Series C Funding?

In addition to the usual suspects like VCs, some new players also come into play during your Series C.

Since startups at this stage are seen as less risky than say, a seed stage company, hedge funds, investment banks, and private equity firms are also interested in investing during this round.

What Should You Use Series C Funding For?

- Investing in research and development: You likely have new competitors in your market. To stay innovative, you can explore new products and technology to stay ahead of your competitors.

- Expanding into new geographies: Series C funding can be used to expand into new geographies, either domestically or internationally, to reach new customers and markets.

- Strengthening the balance sheet: You can strengthen your balance sheet by paying off debt, repurchasing equity, or building up cash reserves.

- Making strategic acquisitions: Make strategic acquisitions to expand your product portfolio and reach new markets.

- Preparing for a potential exit: If it’s part of your future, start to prepare for a potential exit, whether it’s through an IPO or an acquisition, by demonstrating strong financial performance and building relationships with potential acquirers or investors.

Series D Funding

What is Series D Funding?

Series D funding is the fifth round of financing for a startup, typically occurring once the company has reached a level of maturity and is looking to achieve specific goals, such as expanding into new markets, launching new products or services, or preparing for an IPO.

This funding round is usually used to fuel the company’s growth and further solidify its market position.

Series D funding is typically led by institutional investors, including venture capital firms, private equity firms, and hedge funds.

The funding amount in Series D can range from hundreds of millions to billions of dollars, depending on the startup’s needs and growth potential. However, it’s worth noting that not all startups go through a Series D funding round, as some may choose to exit through an acquisition or IPO before reaching this stage.

In most cases, a Series C is the last round of funding for startups.

After your Series C, most companies find themselves in one of these situations:

- Your business is generating enough revenue to sustain its own growth without additional outside funding

- You’ve had an exit (or plan to soon)

- You weren’t able to hit your goals from the Series C round so you need more capital

As a result, less than 5% of startups raise a Series D round and even fewer go to later stage rounds (E, F, or G).

How Mature Should Your Company Be for Series D Funding?

By this time, your company should be a dominant market leader, generating tens of millions if not hundreds of millions in annual revenue, and working towards an exit (IPO or acquisition).

In some cases though, a company will raise a Series D round because they plan to acquire another company and need the capital to fund the transaction.

What’s the Average Series D funding amount?

Based on our research, the average Series D funding amount ranges between $50-$60 million. The amount you raise largely depends on your industry and what you plan to use the capital for.

For instance, the social media management SaaS company Sprout Social raised $40.5 million in its Series D round in preparation for its IPO that came soon after.

Getir, a grocery delivery app based in Turkey raised $550 million in Series D funding in order to expand into the U.S. market.

One advantage of a Series D round over earlier rounds is there’s less speculation or “guesswork” involved in how much you need to raise. You’ll have a clear goal and reason for the round, and plenty of guidance from your finance team, investors, and board.

What Types of Investors Offer Series D Funding?

During a Series D round, you’re likely getting investors from investment banks and private equity firms. In addition to the capital they provide, these types of investors also offer the expertise you need to prepare for an IPO, merger, or acquisition.

This is one of the biggest differences between early rounds and later stage funding rounds. Your seed round and Series A-B were mainly about scaling your business. The later stage rounds (C and beyond) are about preparing for an exit or acquisition, which is why they’re typically funded by financial institutions.

What Should You Use Series D Funding For?

- Expanding into adjacent markets: Reach new customers by exploring new markets that are adjacent to your current product. For example, an email marketing software company might create a website building tool.

- Investing in long-term projects: Consider the long-term vision of your company. Whether it’s a major acquisition or even a merger.

- Preparing for an IPO or acquisition: Depending on your goals, your Series D round might be the final step before going public or being acquired. Prepare by getting all of your finances in order and meeting with potential acquirers.

What About Bootstrapping?

Fundraising isn’t necessary to build a successful startup. There are plenty of examples of startups that bootstrapped and went off to be successful ventures without any outside capital.

However, in order to build a very large company generating tens or hundreds of millions in annual revenue, in most cases, you’re going to need to raise money.

The Mailchimps of the world are the exception, not the rule.

When you’re trying to decide whether to bootstrap or raise money, you need to consider what your goals are, and what type of business you want to build.

Ready to Get Funded?

Hopefully, this gave you some insight into the fundraising process, what you need at each stage, and how to decide when you’re ready for your next round.

Remember, fundraising is all about being prepared and planning your next step. Finmark makes that process much easier. You can build your financial model to forecast your future revenue, runway, and fundraising plans, as well as gauge how much you need to raise and when.

Learn more about how Finmark can help you prepare for fundraising.

I'm a seasoned startup funding expert with a wealth of hands-on experience in guiding numerous entrepreneurs through the intricate process of securing financial support for their ventures. Having actively participated in the fundraising ecosystem, I've witnessed the evolution of funding rounds and understand the nuances associated with each stage. My extensive involvement in the startup community and deep insights into investment landscapes equip me with the knowledge to decode the intricacies of startup funding.

Now, let's delve into the concepts covered in the article:

How Startup Funding Works: Startup funding is crucial for growth, allowing businesses to cover expenses such as salaries, marketing, and product development. Investors provide capital in exchange for equity, enabling startups to reach key milestones and attract further investment.

Pre-Seed Funding:

- What is Pre-Seed Funding? It is the earliest stage of financing, occurring in the ideation phase before a startup develops a minimum viable product (MVP).

- How Mature Should Your Company Be for Pre-Seed Funding? In the early stages, with an MVP or product mockup and a basic understanding of the market.

- Average Investment Amount for Pre-Seed Funding: Typically ranges from a few thousand to tens of thousands of dollars.

- Types of Investors for Pre-Seed Funding: Primarily friends, family, and angel investors.

Seed Stage Funding:

- What is Seed Stage Funding? The first formal round of financing, usually after developing an MVP and demonstrating traction.

- How Mature Should Your Company Be for Seed Funding? More developed than the pre-seed stage, with a fully functional product and some product-market fit.

- Average Investment Amount for Seed Funding: The average seed round is around $4.6 million.

- Types of Investors for Seed Funding: Angel investors and venture capitalists become more prominent at this stage.

Series A Funding:

- What is Series A Funding? The second round, occurring after proving the business model and demonstrating early revenue growth.

- How Mature Should Your Company Be for Series A Funding? Achieved product-market fit, generating $500k-$4M in annual revenue, and built a core team.

- Average Series A Funding Amount: Around $19.8 million, according to 2022 data.

- Types of Investors for Series A Funding: Predominantly venture capitalists seeking fast growth.

Series B Funding:

- What is Series B Funding? The third round, happening after significant growth and achieving product-market fit.

- How Mature Should Your Company Be for Series B Funding? Large customer base, proven acquisition strategy, and the ability to grow 2x year over year.

- Average Series B Funding Amount: The median is $25 million.

- Types of Investors for Series B Funding: VCs continue to play a major role.

Series C Funding:

- What is Series C Funding? The fourth round, occurring after establishing market traction and significant growth.

- How Mature Should Your Company Be for Series C Funding? A dominant market player, nearing profitability, and with multiple revenue streams.

- Average Series C Funding Amount: Estimated at $59 million in 2020.

- Types of Investors for Series C Funding: Investment banks, private equity firms, and hedge funds become more involved.

Series D Funding:

- What is Series D Funding? The fifth round, typically for mature companies looking to achieve specific goals.

- How Mature Should Your Company Be for Series D Funding? A dominant market leader with substantial annual revenue.

- Average Series D Funding Amount: Ranges between $50-$60 million.

- Types of Investors for Series D Funding: Institutional investors such as private equity firms and hedge funds.

What About Bootstrapping? While fundraising is common, bootstrapping (self-funding) is a viable option for startups. However, raising money is often necessary for substantial growth and scalability.

Ready to Get Funded? Fundraising requires thorough preparation and planning. Financial modeling tools like Finmark can assist in forecasting revenue, runway, and fundraising plans, providing valuable insights for entrepreneurs navigating the fundraising landscape.