Semiconductor ETFs include Nvidia (NASDAQ:NVDA) reach new heights. However, not all semiconductor ETFs are the same. Both funds can focus on semiconductors, but there are other things investors need to consider, such as the types of semiconductor stocks they own, the weighting of those stocks in their portfolios, returns over time, and fees. There can be a big difference.

Two popular semiconductor ETFs, the iShares Semiconductor ETF (NASDAQ:SOXX) and First Trust NASDAQ Semiconductor ETF (NASDAQ:FTXL). Although both have invested in this space, they have taken different approaches and generated different returns over time. I’m bullish on both of his ETFs, but one is a better choice than the other based on several factors I’ll evaluate in this article.

What is the strategy of SOXX ETF?

SOXX is a BlackRock index ETF (New York Stock Exchange:BLK) According to the fund, iShares provides investors with “exposure to U.S. companies that design, manufacture, and sell semiconductors” by investing in “an index comprised of U.S.-listed stocks in the semiconductor sector.” . SOXX essentially invests in the 30 largest U.S. stocks classified by ICE as semiconductor companies.

SOXX was founded in 2001 and has $12.8 billion in assets under management (AUM).

What is the strategy of FTXL ETF?

FTXL, on the other hand, invests in an index called the Nasdaq US Smart Semiconductor Index. First Trust describes the index as a “modifier-weighted index created and maintained by Nasdaq, Inc.” (NASDAQ:NDAQ). Designed to provide exposure to US companies within the semiconductor industry. ”

The stocks in this index are ranked based on three factors. Momentum based on last 12 months return on assets, last 12 months gross profit, and 3, 6, 9, and 12 month price appreciation.

Based on these scores, the lowest scoring 25% of stocks in this universe are removed from the index, leaving a remaining group of 30-50 stocks in which FTXL can potentially invest. These remaining stocks are weighted based on the following 12 stocks. -Monthly cash flow can be weighted up to 8% and down to 0.50%.

The index is then reconstituted and rebalanced every six months. As explained below, these different approaches create two portfolios with some overlap and important differences.

How do their portfolios compare?

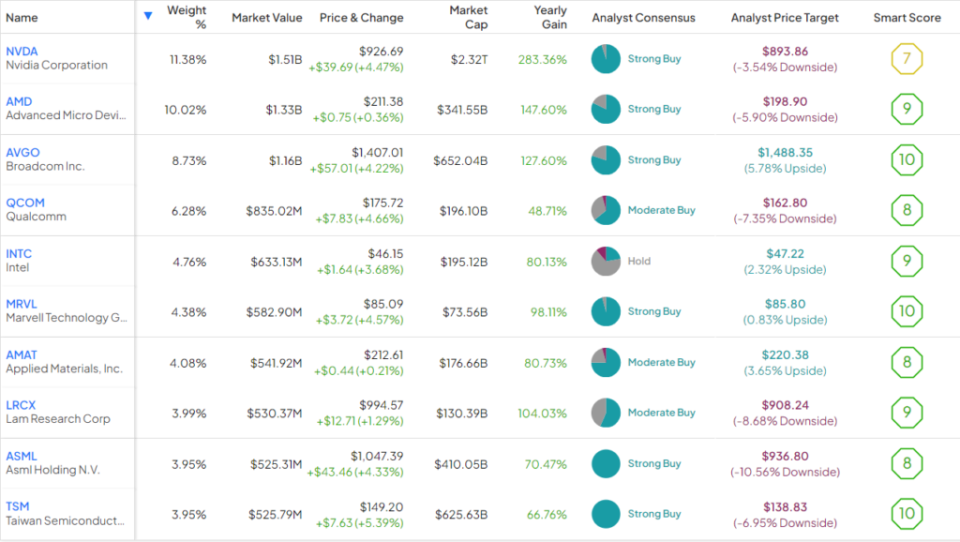

SOXX holds 30 stocks, with the top 10 stocks accounting for 61.7% of the fund.An overview is shown below. Top 10 holdings in SOXX Use TipRanks’ holdings tool.

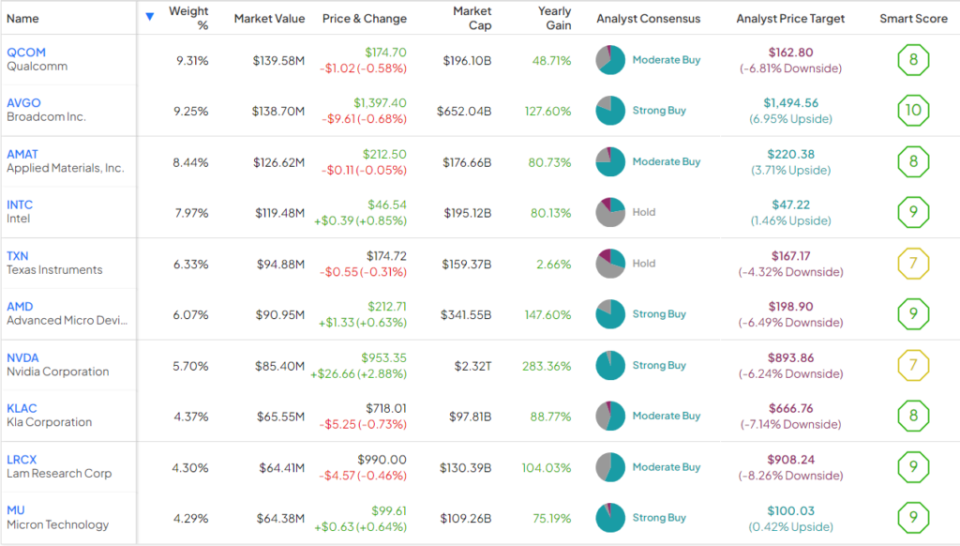

FTXL, on the other hand, holds 32 stocks, with the top 10 stocks accounting for 65.9% of its holdings, so the two funds are very similar in terms of diversification.An overview is shown below. Top 10 holdings of FTXL Use TipRanks’ holdings tool.

As you can see, SOXX has the top two stocks, Nvidia and Advanced Micro Devices (NASDAQ:AMD). These big positions bode well for his SOXX, as Nvidia is up his 283.4% over the past year and Advanced Micro Devices is up his 147.6%.

At the same time, FTXL holds a large position in its top holding, Qualcomm, with 9.2% (NASDAQ:QCOM). This stock has gained 44.5% over the past year. This is great, but Nvidia’s Astronomical Achievements and Advanced Micro Devices. Note that FTXL also owns these shares, but in smaller proportions of 5.7% and 6.1%, respectively.

Both funds hold large positions in Broadcom (NASDAQ:AVGO), another major winner in the chip space, grew 127.6% over the past year.

TipRanks’ Smart Score system has 9 of the top 10 stocks on SOXX with an Outperform equivalent Smart Score of 8 or higher, and 8 of the top 10 stocks on FTXL with a Smart Score of 8 or higher. Masu.of smart score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score of 1 to 10 based on eight key market factors. A score of 8 or higher corresponds to an outperform rating.

Both ETFs achieved a corresponding amount of outperformance. ETF Smart Score While these are both strong portfolios, SmartScore rates SOXX’s top holdings a little more favorably, and as we discuss in the next section, SOXX’s top holdings outperform FTXL. Masu.

Competitive performance

When it comes to performance, these two ETFs are long-term winners. As of February 29, FTXL has produced impressive annualized returns of 11.8% over three years and 24.5% over five years.

Meanwhile, as of the same date, SOXX has posted even more impressive three-year annualized returns of 17.2% and five-year annualized returns of 30.3%.

FTXL was launched in 2016, so it’s not yet possible to compare the two ETFs over a 10-year time horizon, but SOXX’s 25.3% 10-year return over the past 10 years is superior.

FTXL’s returns are good, but SOXX’s returns are even better, and its long track record of excellence gives SOXX a clear advantage in this category. Both ETFs have solid strategies, but SOXX strategy Simply investing in the 30 largest U.S. semiconductor stocks produced stronger performance over time than FTXL’s more nuanced strategy.

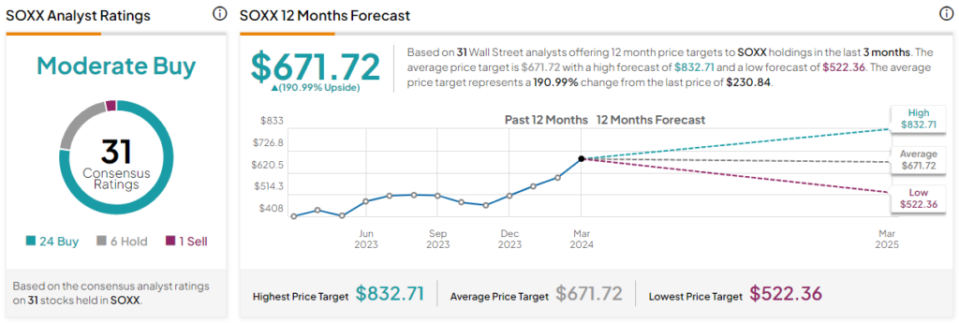

Is SOXX stock a buy, according to analysts?

Turning to Wall Street, SOXX has a Moderate Buy consensus rating based on 24 Buy, 6 Hold, and 1 Sell ratings assigned over the past three months.of SOXX average price target $671.72 means a potential upside of 191% from current levels.

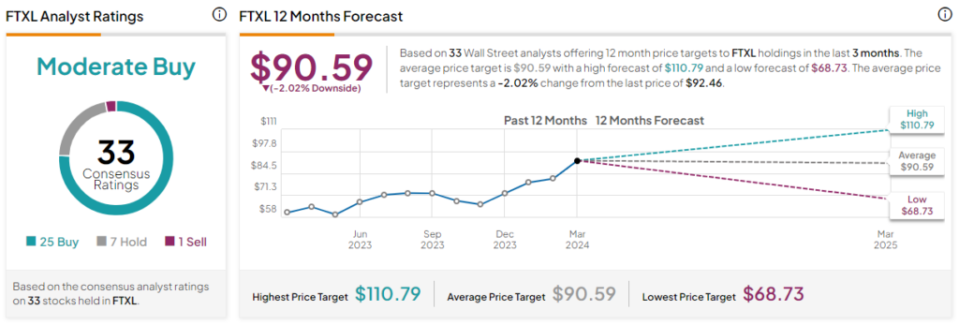

Is FTXL stock a buy, according to analysts?

Turning to Wall Street, FTXL has a Moderate Buy consensus rating, based on 25 Buy, 7 Hold, and 1 Sell ratings assigned over the past three months. .of FTXL average target price $90.59 means a potential downside of 2% from current levels.

Cost Comparison

Regarding fees, SOXX’s expense ratio of 0.35% is a better deal than FTXL’s expense ratio of 0.60%. An investor who invests $10,000 in SOXX will pay an annual fee of $35, while an investor who invests $10,000 in FTXL will pay an annual fee of $60.

These price differences become more complex and more apparent over time. For example, assuming each ETF earned 5% annually, an investor who invested $10,000 in SOXX would pay $443 in fees over the next 10 years, while an investor who invested the same amount in FTXL would pay $443 in fees over the next 10 years. will pay $750.

add all

Both of these are great ETFs that invest in strong stocks and have generated significant returns for investors. However, the returns generated by SOXX are significantly better than his FTXL, and the fees are also significantly lower, making SOXX the clear winner here. Additionally, TipRanks’ Smart Score system shows a slightly more favorable outlook for SOXX’s top holdings, with the analyst believing his SOXX has more upside potential and expects SOXX’s dominance to grow even further. I’m watching it.