Updated - March 16, 2024 at 10:13 AM.

Adverse stress test results need not be a trigger to sell your funds, but it is important to understand the risks and make an informed decision based on your risk appetite and investment time horizon

By Aarati Krishnan

For over three years now, mutual funds that invest in small and mid-cap stocks have been the toast of Indian investors. With three-year returns on these funds at 24 per cent and 22 per cent respectively, they have been attracting the lion’s share of equity inflows. The bountiful inflows, in turn, prompted these funds to accumulate more small and mid-cap stocks, thus keeping the party going.

But in the last couple of weeks, the Securities and Exchange Board of India (SEBI) has been warning that the party is getting too wild. It has also decided to curtail the booze, by asking fund houses to conduct stress tests of all their small and mid-cap funds, to assess if they could meet sudden redemption demands. This has set off a correction in small and mid-cap stocks and levelled net asset values (NAVs) of funds.

Mutual funds have been conducting liquidity stress tests of their mid-cap and small-cap funds and have started disclosing this data from March 15.

Here’s all that you need to know.

What’s a stress test?

Ever done a treadmill test for a health check-up? In this test, your heart rate is monitored while you walk or run at a brisk pace on a treadmill. This helps your doctor gauge if your heart functions well when subjected to abnormal activity.

Stress tests of financial institutions are similar. They help regulators or others gauge whether an institution can function normally if market conditions turn hostile. Every six months, Reserve Bank of India conducts stress tests of banks to assess if they will fall short of capital or liquidity, if they face stress situations. Stress testing of small and mid-cap funds is an attempt to determine how funds fare if they face large and sudden redemption demands.

Why do we need it?

In India, it is not just bond market liquidity that dries up when adverse events crop up. The liquidity for mid- and small-cap stocks can dry up too. This wasn’t a very big issue as long as small- and mid-cap mutual funds managed relatively small assets. But with the flood of money in the past year, small-cap funds have grown to manage ₹2.49 lakh crore and mid-cap funds ₹2.95 lakh crore by end of February 2024.

The biggest funds in these categories are now at ₹25,000 crore to ₹60,000 crore. At this size, selling even a 1 per cent position will mean putting through stock sales of ₹250 crore to ₹600 crore, which markets can struggle to absorb. If such sales were to happen in stocks with low liquidity, impact costs may be high, resulting in disproportionate NAV declines.

How are these tests conducted?

At the end of each month, small- and mid-cap funds will calculate how long it will take to liquidate 50 per cent and 25 per cent of their portfolios based on four assumptions. First, they will arrive at the average trading volumes for all their stock holdings for the past three months. Two, they will exclude the bottom 20 per cent illiquid stocks. Three, they will assume a three-fold spike in volumes on a hypothetical trading day when markets are under stress (higher market volatility usually spikes volumes). Four, they will calculate how many days it may take to sell their holdings, if able to participate to the extent of 10 per cent of a stock’s traded quantity on the given day. This yields the number of days a fund will take to liquidate 25 per cent or 50 per cent of its portfolio.

Funds will disclose this data in a standard format on their websites every month, starting March 15, 2024. Similar disclosures will be done within 15 days of the end of every month in future. Along with the stress test data, SEBI has also asked funds to disclose the assets held by the top 10 investors, cash positions, trailing returns, portfolio PE and standard deviation.

How should investors interpret the data?

The main data points investors need to look out for are the number of days estimated for liquidating 50 per cent and 25 per cent of the portfolio. They also need to check if the fund has a concentration problem — a few investors holding a large proportion of assets. Funds that take longer to liquidate their holdings will have a greater challenge in meeting exceptional redemption demands. They could also face higher impact costs when selling. Concentrated investors make a fund more susceptible to lumpy redemptions.

What does the first set of data show?

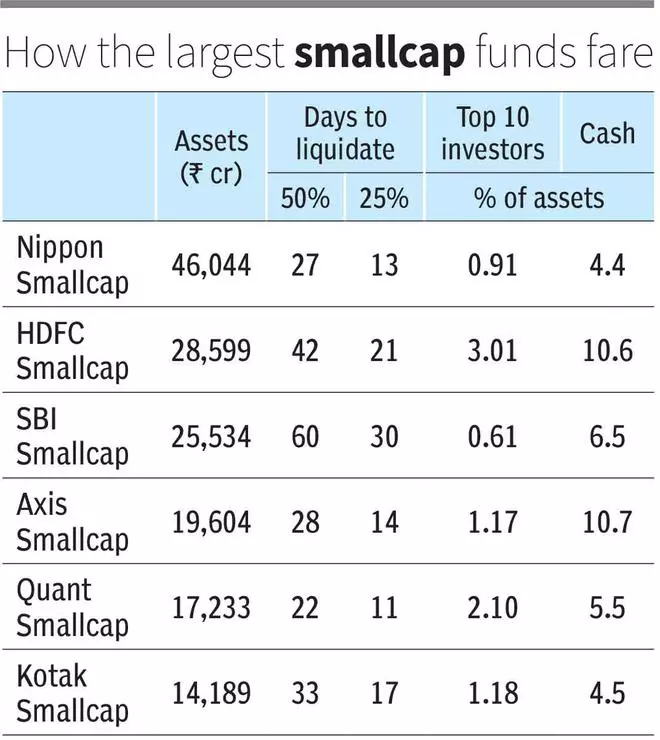

The data shows that small-cap funds have a bigger challenge in dealing with stress scenarios, than mid-cap funds. The biggest small-cap funds reported that they would take anywhere between 22 and 60 days to liquidate 50 per cent of their portfolio and 11 to 30 days to liquidate 25 per cent. They held cash positions ranging from 4.5 to 11 per cent of assets as a buffer. Investor concentration wasn’t an issue, with their top ten investors holding only 0.61 per cent to 2.1 per cent of the assets. Small-cap funds with assets of ₹10,000 crore or more, generally reported a longer time to liquidate.

SEBI rules permit all mid-cap and small-cap funds to hold cash or other equities to the extent of 35 per cent of assets. Small-cap funds that used this leeway to own large-cap stocks seemed to be better placed on liquidity compared to those that didn’t.

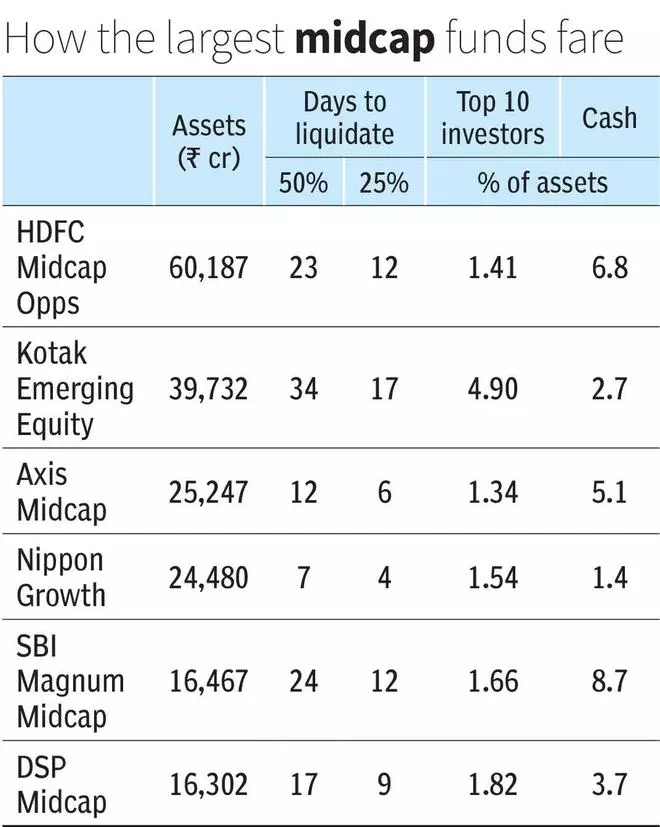

Mid-cap funds seem to carry much lower risk from bulky redemptions compared to small-cap funds. Most mid-cap funds estimated taking about half the time to liquidate 50 per cent of their portfolios as small-cap funds from the same AMC. Investor concentration was slightly higher for mid-cap funds, at 1.3 to 4.9 per cent. Again, funds with significant large-cap holdings were better off.

If a fund says it will take 60 days to liquidate 50 per cent of its portfolio, does this mean it won’t honour redemptions?

No. It is important to keep three things in mind when interpreting this data. One, stress testing is a hypothetical exercise which aims to capture what will happen to a fund in an extreme situation. Cases of mutual funds in India facing redemption demands of 25 per cent or 50 per cent of assets are very rare.

When they’ve happened, it is debt funds that have faced such pressures rather than equity funds. Bond market liquidity in India is erratic and debt funds are patronised by corporate treasuries and institutions, which can trigger lumpy redemptions. Equity funds are held mainly by retail investors. History suggests that, when markets fall, retail investors may stop new investments, but they don’t immediately redeem from equity funds, due to loss aversion.

Two, AMCs are aware of liquidity risks in small and mid-caps and can use the 35 per cent leeway to hold large-cap stocks, apart from cash. SEBI regulations also allow funds to borrow to the extent of 20 per cent of assets to meet short-term liquidity needs. This gives funds a significant cushion.

Three, SEBI’s stress testing requirement is likely to force AMCs that have been flirting with risks to lighten up on illiquid names and own more liquid names. After all, no open-end fund would like stress test disclosures to alarm investors into redeeming.

If an adverse global event were to suddenly unfold or markets were to crash, can the stress scenario play out?

Yes, it can. In fact, this stress testing is based on certain assumptions, such as a spike in trading activity in a stress scenario and individual funds being able to sell 10 per cent of the daily volume. A real-life situation can turn out worse than what is being assumed. It is also very difficult to gauge in normal times, how liquidity or investor behaviour will play out in a crisis. But then, most financial institutions are susceptible to crises if they face an outflow of 25 or 50 per cent of their funds. So, there is no point in staying away from small or mid-cap funds for this reason.

Should investors sell their small-cap and mid-cap funds now?

That small and mid-cap funds are risky and hold stocks with patchy liquidity has been known for some time. Stress testing only quantifies the impact of these risks. Therefore, stress testing cannot be a trigger to sell your funds. But if you were not aware of the risks lurking in these funds when you invested and cannot handle sharp draw-downs in NAV, you should reduce your exposure to them.

You can decide to book profits on any of your small or mid-cap holdings if you have uncomfortably high allocations to them within your equity portfolio or need the money within the next 3-4 years. Selling funds that are a part of your long-term portfolio isn’t a good idea. While exiting funds is easy, re-entering the same funds at the right time when the market is tumbling will be a tough task. That most small-cap funds have stopped lumpsum investments and allow only SIPs makes re-entry harder.

Related Topics

- mutual funds

- SEBI

- stocks and shares

- stock market

- HinduRef

COMMENT NOW

COMMENT NOW