ECONOMICS COMMENTARY Jan 17, 2023

Rajiv Biswas

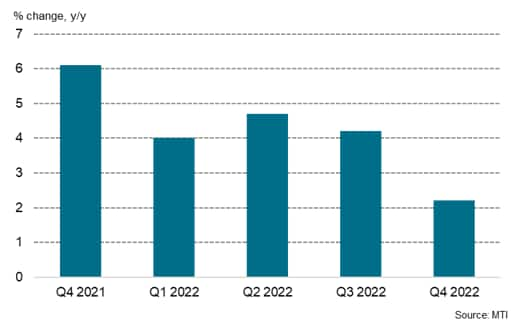

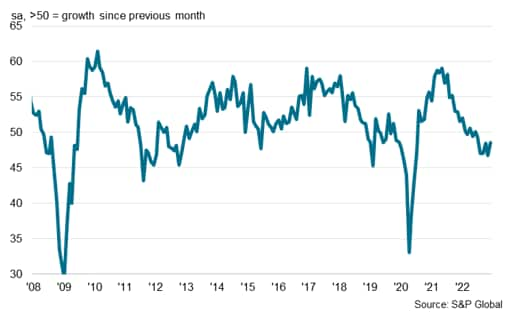

The Singapore economy grew at a pace of 3.8% year-on-year (y/y)in 2022, helped by significant easing of pandemic-relatedrestrictions. However, Singapore's manufacturing sector facedincreasing headwinds during the second half of 2022 due to theslowdown in the US, EU and mainland China. This has been mitigated by improving conditions in the servicesector, notably the rebound in international tourism, businessconventions and air travel as border restrictions are easing acrossmuch of the Asia-Pacific region. The reopening of internationalborders in mainland China is expected to further boost the reboundin international tourism inflows. Singapore's advance estimate for Fourth Quarter GDP for 2022showed a moderation in the pace of growth to 2.2% y/y, comparedwith 4.2% y/y in the Third Quarter. On a quarter-on-quarter basis,GDP growth slowed to 0.2% q/q in Q4 2022, compared with 1.1% q/q inQ3 2022. Singapore real GDP growth The service sector recorded a small contraction of 0.4% q/q inQ4 2022, although showing positive growth of 4.1% y/y. The gradualremoval of many COVID-19 related restrictions since April 2022supported buoyant growth in the accommodation and food services,real estate, administration and support services segment, whichgrew by 8.2% y/y. The headline seasonally adjusted S&P Global SingaporePurchasing Manager's Index (PMI) eased from 56.2 in November to49.1 in December. Posting below the 50.0 neutral threshold, the PMIsignalled a deterioration in private sector conditions following atwo-year growth period, albeit at a mild rate. S&P Global Singapore PMISingapore economy shows some moderation

Manufacturing sector slowdown

Latest statistics from Singapore's Economic Development Boardshowed that manufacturing output continued to weaken in November,declining by 3.2% year-on-year (y/y). This reflected contraction inoutput of electronics and also chemicals, with together account for53.3% of the total weight of the manufacturing sector.

The slowdown in global electronics demand has impacted onelectronics output, which fell by 12.4% y/y in November, withoutput in the key semiconductors segment declining by 14.0% y/y.Chemicals output fell by 11.3% y/y in November, with petrochemicalsoutput declining by 17.5% y/y due to the impact of both weak demandas well as plant maintenance shutdowns.

Singapore manufacturing output

Overall, total manufacturing output growth during the firsteleven months of 2022 was up 3.3% y/y. However, the electronicssector will face continuing headwinds in the near term due to weakgrowth momentum expected for the US and EU in 2023.

Inflation pressures

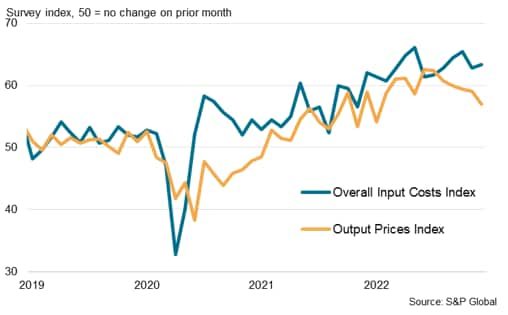

According to the December S&P Global Singapore PMI survey,input cost inflation rose at the end of 2022, attributed to higherpurchase costs and wages. Cost pressures heightened with higherprices reported across a range of categories such as raw materials,transportation and energy, and was further aggravated by risinginterest rates and currency conversion costs. Despite the rise ininput costs, output price inflation fell according to latest surveyindications. Firms continued to share their cost burdens withclients but at a slower rate in December so as to avoid furtherdampening demand.

Singapore PMI input and output prices

Singapore's CPI inflation rate remained at 6.7% % year-on-year(y/y) in November, the same pace as in October and remaining lowerthan the 7.5 y/y recorded in September. The Monetary Authority ofSingapore (MAS) Core Inflation measure remained at 5.1% y/y inNovember, the same pace as in October and remaining below the 5.3%y/y recorded in September.

The MAS and Ministry of Trade and Industry (MTI) estimate thatfor calendar 2022, CPI All Items inflation is expected to averagearound 6.0%, and MAS Core Inflation around 4.0%.

Moderating global electronics demand adds toheadwinds

The electronics manufacturing industry is a key segment ofSingapore's manufacturing sector, accounting for 40% of the totalweight of manufacturing output, dominated by semiconductors-relatedproduction. The latest S&P Global survey data indicates thatthe global electronics manufacturing industry is facing headwindsfrom the weakening pace of global economic growth.

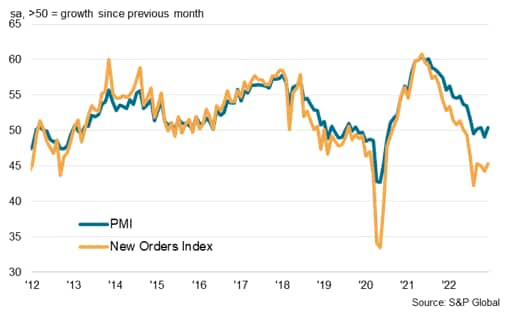

According to the headline S&P Global Electronics PMI survey,the global electronics composite index was at 50.4 in December2022, improving slightly compared to 49.1 in November, but stillshowing a significant slowdown compared with late 2021 and early2022. The latest survey results indicate that the globalelectronics industry is now experiencing neutral conditions,although output and new orders remain weak.

S&P Global Electronics Output PMI

The two principal sub-components of the Global Electronics PMI -new orders and output - both remained in contraction territoryduring December. December survey data indicated a significantreduction in backlogs of work at global electronics manufacturers.Lower new order inflows allowed firms to work through outstandingbusiness in a timely manner, according to panellists.

Weakening economic growth momentum in the US and EU has impactedon consumer demand for electronics, with the economic slowdown inmainland China during 2022 also contributing to the downturn in neworders.

S&P Global Electronics PMI and neworders

Singapore's economic outlook

The Singapore economy recorded a second year of economicrecovery from the pandemic in 2022, growing by 3.8% y/y, aftergrowth of 7.6% y/y in 2021. Singapore's GDP growth in 2022 wasbuoyed by strong growth in domestic consumption and an upturn ininternational tourism expenditure, as COVID-19 restrictions wereprogressively eased in Singapore as well as a growing number ofother Asia-Pacific economies.

However, with increasing headwinds to global growth momentum in2023 due to expected weak growth in the US and EU at the outset of2023, the outlook for Singapore's manufacturing sector and sometrade-related services is for weaker growth in 2023. With domesticdemand in mainland China expected to gradually improve during 2023,this should help to mitigate the impact of slowing export ordersfor Singapore's manufacturing sector from the US and EU.

The increase in Singapore's Goods and Services Tax by 1% from 7%to 8% implemented on 1st January 2023 will also act as a slightdrag on economic growth, raising fiscal revenue by an estimated0.7% of GDP per year.

In 2023, taking into account the 1% increase in GST from 1stJanuary 2023, headline and core CPI inflation are projected toaverage 5.5%-6.5% and 3.5%-4.5% respectively. MAS Core Inflation isprojected by the MAS and MTI to remain elevated over the next fewquarters, with risks still tilted to the upside, due to factorssuch as potential renewed shocks to world commodity prices andpersistent global inflation pressures. Although prices of energyand food commodities have eased from their peaks, businesses willface higher utility prices and rising unit labour costs in thenear-term. The MAS and MTI expect that MAS Core Inflation willmoderate in the second half of 2023, as tightness in the domesticlabour market eases and global inflation pressures moderate.

The medium-term outlook for Singapore's manufacturing sector issupported by a number of positive factors.

The medium-term global demand outlook for Singapore'selectronics industry remains favourable. The outlook forelectronics demand is underpinned by major technologicaldevelopments, including 5G rollout over the next five years, whichwill drive demand for 5G mobile phones. Demand for industrialelectronics is also expected to grow rapidly over the medium term,helped by Industry 4.0, as industrial automation and the Internetof Things boosts rapidly growth in demand for industrialelectronics.

In the biomedical manufacturing sector, significant newmanufacturing facilities are being built by pharmaceuticalsmultinationals. This includes a new vaccine manufacturing facilitybeing built by Sanofi Pasteur and a new mRNA vaccine manufacturingplant being built by BioNTech.

The aerospace engineering sector is currently experiencing rapidgrowth as the reopening of international borders in APAC isboosting commercial air travel across the region. Singapore's roleas a leading international aviation hub is likely to continue tostrengthen over the medium-term, helped by strong growth in APACair travel and its role as a key Maintenance, Repair and Overhaul(MRO) hub in APAC.

In the service sector, Singapore is expected to continue to be aleading global international financial centre for investmentbanking, wealth management and asset management. Singapore willalso continue to be a key APAC hub for shipping, aviation andlogistics, as well as an important APAC hub for regionalheadquartering.

However an important long-term challenge for the Singaporeeconomy will be from ageing demographics, which will result inrising social welfare costs and could gradually reduce Singapore'slong-term potential GDP growth rate.

Read the accompanying press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&PGlobal Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, IHS Markit Inc. All rights reserved. Reproduction in wholeor in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [ {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-jan23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-jan23.html&text=Singapore+economic+expansion+moderates+as+global+economy+slows+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-jan23.html","enabled":true},{"name":"email","url":"?subject=Singapore economic expansion moderates as global economy slows | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-jan23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+economic+expansion+moderates+as+global+economy+slows+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-jan23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"} ]}

I'm Rajiv Biswas, Asia Pacific Chief Economist at S&P Global Market Intelligence, and I bring a wealth of expertise in economic analysis and global market trends. My background includes extensive research and analysis of economic indicators, providing insights into various aspects of economic performance.

In the article dated January 17, 2023, I delve into the economic landscape of Singapore, offering a comprehensive analysis of the country's economic performance in 2022 and providing forecasts for 2023. Let's break down the key concepts discussed in the article:

-

Singapore's Economic Growth in 2022:

- The Singapore economy grew at a rate of 3.8% year-on-year (y/y) in 2022, attributed to the significant easing of pandemic-related restrictions.

-

Factors Affecting Manufacturing Sector:

- The manufacturing sector faced headwinds in the second half of 2022 due to a slowdown in the US, EU, and mainland China.

- The electronics and chemicals segments, which account for a significant portion of the manufacturing sector, experienced declines in output.

-

Services Sector Resilience:

- The service sector, particularly in accommodation and food services, real estate, administration, and support services, showed positive growth, contributing to overall economic resilience.

-

Purchasing Managers' Index (PMI):

- The S&P Global Singapore PMI signaled a deterioration in private sector conditions in December, marking the end of a two-year growth period.

-

Inflation Pressures:

- Input cost inflation rose at the end of 2022, driven by higher purchase costs and wages.

- Despite rising input costs, output price inflation fell, as firms shared cost burdens with clients.

-

CPI Inflation and Monetary Authority of Singapore (MAS) Projections:

- Singapore's CPI inflation rate remained at 6.7% y/y in November, with projections for 2022 averaging around 6.0%.

- MAS Core Inflation is expected to remain elevated, with a projection of around 4.0% for 2022.

-

Outlook for 2023:

- The article anticipates weaker growth in 2023, influenced by global economic headwinds, especially in the US and EU.

- The increase in Singapore's Goods and Services Tax (GST) is expected to slightly dampen economic growth.

-

Long-Term Challenges:

- Aging demographics pose a long-term challenge, leading to rising social welfare costs and a potential gradual reduction in Singapore's long-term potential GDP growth rate.

-

Medium-Term Outlook and Positive Factors:

- Despite challenges, positive factors supporting Singapore's medium-term outlook include strong demand in the electronics industry, growth in biomedical manufacturing, and the aerospace engineering sector's rapid expansion.

In conclusion, my analysis indicates a nuanced economic landscape for Singapore, with a careful consideration of both short-term challenges and long-term opportunities for growth.

For further insights, you can refer to the original article by S&P Global Market Intelligence, authored by Rajiv Biswas.