Series 79 is a Financial Industry Regulatory Authority (FINRA) examination that tests a financial professional’s knowledge of securities products and regulations. The exam is designed to ensure that individuals are qualified to work in the securities industry. This assessment, which is also called the Investment Banking Representative Exam, evaluates an entry-level registered representative's ability to fulfill their duties as an investment banking representative. The Series 79 is developed to guarantee that new representatives are prepared to work within the new investment banking landscape that has changed significantly in recent years. Passing the Series 79 exam allows representatives to register with FINRA and execute the critical functions of an investment banking representative. Representatives who pass are allowed to offer advice or facilitate transactions that include debt or equity offerings, mergers or acquisitions. Additionally, state authorities may demand a license in order to advise on tender offers, financial restructuring, asset sales, and corporate reorganizations. The following are basic information about the exam: A prerequisite to be able to take the exam is an affiliation with a FINRA member firm or another SRO member firm. Eligibility requirements are found in FINRA Rule 1210. In order to earn the Investment Banking registration, a corequisite qualification is to pass the Securities Industry Essentials (SIE) exam together with the Series 79 exams.What Is Series 79?

Importance of the Series 79 License

Series 79 Exam

Requirements

Upon understanding the prerequisites, a candidate must enroll for an exam. This step is followed by setting a schedule for the exam and taking the exam on the appointed date.

Cost

Taking the exam will cost an applicant $300. There might be additional costs for the exam preparation. The cost of self study materials range from $299 to $650 depending on the training provider.

Exam Details

Exams are closed-book. Candidates are not permitted to bring any reference materials inside the testing room. They have two and a half hours to complete the exam.

It can be conducted at a local testing location or online under supervision, with evaluation and sign-on procedures.

Exam facilities supply four-function calculators, scratch paper, pencils, headphones with noise cancellation. Online takers are provided access to an online calculator and virtual notepad.

Exam Composition

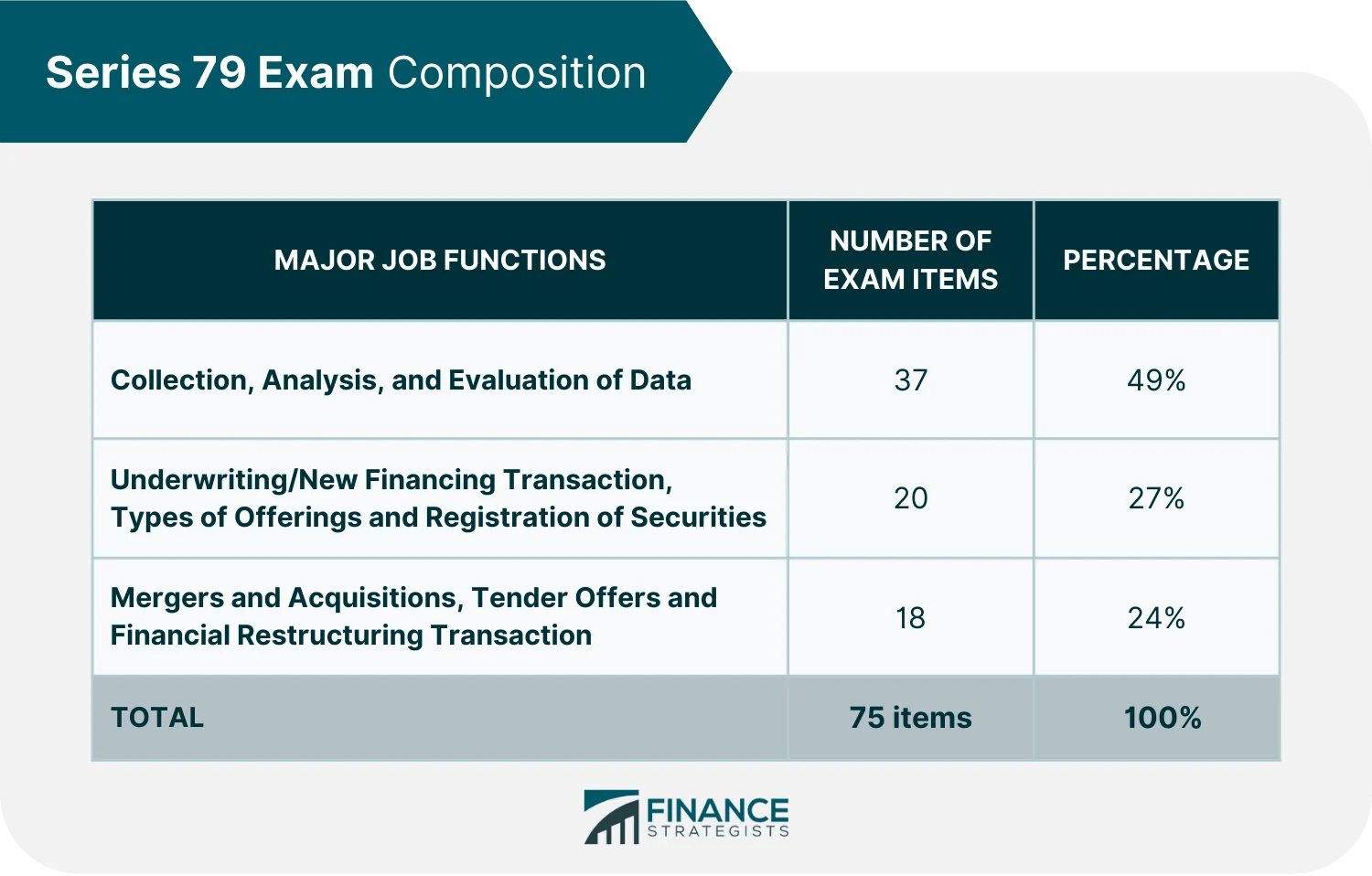

The Series 79 exam is composed of items evaluating the breadth and depth of knowledge necessary for the examination.

The sections include the three primary responsibilities of an investment banking professional.

The first job function examined covers trend and business analysis, securities offerings, and M&A activities. Data from investors and shareholders, alternative funding, and the due diligence procedure are also evaluated.

The second section examines knowledge of underwriting and new financing. This includes types of offering and securities registration. Questions on filing requirements, underwriting agreements and commitments will also be asked to the test takers.

The last section of the examination examines knowledge of mergers and acquisitions, tender offers, and financial reorganization activities.

Candidates may be questioned on their understanding of sell-side M&A transactions, buy-side deals, rules regarding tender offers, and the bankruptcy process.

The table below details the distribution of test questions for each key job function.

Series 79 Permitted Activities

Series 79 license holders can do the following transactions:

- Debt and Equity Offerings (Private and Public)

- Mergers and Acquisitions

- Tender Offers

- Asset Sales

- Financial Restructurings

- Divestitures

- Corporate Reorganizations

- Business Combinations

The Bottom Line

Series 79 is an assessment that investment banking representatives must pass in order to qualify for their position.

This exam covers important topics such as debt and equity offerings, mergers and acquisitions, financial restructuring, and more.

Those who wish to become registered representatives must first pass the Securities Industry Essentials (SIE) as a corequisite.

Candidates are required to be sponsored by a FINRA member firm or another SRO member firm to take the exam.

Acquiring the license permits financial professionals to suggest advice or handle particular transactions such as debt or equity offerings, mergers or acquisitions, and divestitures.

Series 79 FAQs

The Series 79 is a FINRA examination that tests a financial professional's knowledge of securities products and regulations. The exam is designed to ensure that individuals are qualified to work in the securities industry.

Yes, to be eligible to take the qualifying tests, candidates must be affiliated with and sponsored by a FINRA or other appropriate self-regulatory organization (SRO) member company. Passing the Securities Industry Essentials (SIE) exam is a co-requisite of the Series 79.

The passing score is 73%. In April 2019, FINRA indicated that the passing rate was 87%.

The Series 7 license is for general securities representatives, while the Series 79 is an investment banking representative license. The Series 7 allows individuals to sell all types of securities, while the Series 79 focuses on transactions involving debt and equity offerings, mergers and acquisitions, tender offers, and other corporate reorganizations.

The Series 7 covers a broader range of topics, while the Series 79 focuses on investment banking products and regulations. However, Series 79 is considered harder because examinees are required to apply analytical reasoning and mathematical concepts. Despite understanding the questions, translating the concepts into equations can be challenging.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on Amazon, or check out his speaker profile on the CFA Institute website.