Many Americans are stumbling toward golden years that will be heavily tarnished.

A new GOBankingRates survey of more than 1,000 adults found that 28% of people have nothing saved for the future, 39% aren’t contributing to a retirement fund and another 30% don’t think they’ll ever be able to retire.

Check Out: 7 Bills You Never Have To Pay When You Retire

Learn More: One Smart Way To Grow Your Retirement Savings in 2024

While these numbers worry the experts, they don’t shock them.

“The statistic that 30% of Americans have $0 saved for retirement is alarming but not surprising,” said retirement planning expert Mike Kojonen, founder and owner of Principal Preservation Services. “Through countless consultations, I’ve observed a prevalent lack of awareness about the cost of retirement and a significant underestimation of how much needs to be saved.”

Sponsored: Protect Your Wealth With A Gold IRA. Take advantage of the timeless appeal of gold in a Gold IRA recommended by Sean Hannity.

People Have a Good Idea of What They’ll Need, but Most Aren’t Anywhere Close

The study found that a quarter of people think they can retire with less than $500,000. Another quarter think it will take somewhere between half a million and a million. Another 30% expect their retirement to cost higher in the seven figures.

But there’s a huge disconnect between what people think they’ll need and what they have saved.

Nearly three out of four people — 71% — are heading toward retirement with five-figure nest eggs at best. Ten percent have $50,000 to $100,000, 33% have less than $50,000 and 28% have exactly zero dollars saved for retirement.

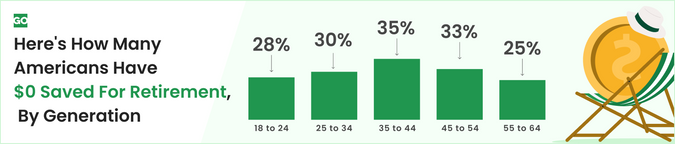

While it might be unsurprising and understandable that 28% of the adults ages 18-24 have no retirement savings, most older adults aren’t doing much better. Between 25% and 35% of all demographics between the ages of 18 and 64 report having nothing saved for their golden years.

Discover More: 7 Ways Shopping at Costco Helps Retirees Stick to a Budget

Many Pass Up Valuable Tax-Advantaged Savings Accounts

Unlike your brokerage account, retirement funds enjoy a special tax status that shelters your savings from the IRS. With pre-tax accounts like 401(k)s and traditional IRAs, you’ll pay taxes on late-life withdrawals, but every dollar you contribute reduces your taxable income. With after-tax Roth accounts, you pay nothing on your gains after 59 1/2 and can even tap your contributions before then — but many people are missing out on both.

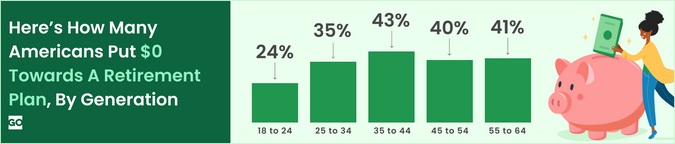

Thirty-nine percent — more than triple the second-biggest group — contribute nothing to tax-advantaged retirement accounts. The No. 2 largest share, just under 13%, contributes only 1% to 3% of their income. Another roughly 13% contribute a healthier 4% to 6%.

Lack of Access or Lack of Initiative?

Financial expert Edward Piazza, president of Titan Funding, thinks much of the problem is “inadequate access to retirement savings plans, especially for those in gig or part-time employment.”

While lack of access certainly plays a role, it doesn’t tell the whole story.

According to the Bureau of Labor Statistics (BLS), 69% of private industry workers have access to an employer-based retirement plan but only 52% participate, for a take-up rate of just 75%.

But even those without access to employer-based funds can open self-directed retirement accounts for free with just a few dollars and just a few clicks through a no-fee brokerage or bank.

“Exploring IRAs or Roth IRAs could be beneficial for those without access to employer-sponsored retirement plans,” Piazza said.

Considering how many people are under no illusions about the direness of their predicaments, you’d think that more would have taken the initiative.

The Masses Are Unprepared — And They Know It

The study did have a silver lining. Nearly a quarter of respondents, 23%, think they’ll be able to retire early. Roughly another quarter, 24%, anticipate retiring by 65, which technically is early — at least by the standards of the Social Security Administration.

But a slight majority is not as optimistic.

About 23% believe they’ll have to wait to retire until after they turn 65. But almost 30% –roughly the same share as those with no nest eggs — believe they will simply never be able to retire at all.

“While alarming, the statistic that nearly 30% of Americans have $0 saved for retirement does not surprise me,” Piazza said. “This highlights a widespread financial literacy gap and underscores many challenges in balancing immediate financial needs with long-term savings goals.”

The Keys Are Financial Literacy, an Early Start and a Something-Is-Better-Than-Nothing Attitude

Several experts highlighted obstacles like inflation and debt, but there was a consensus that too many people know too little about money, start saving too late, aren’t consistent enough in contributing whatever little they might have and are too quick to spend on wants without treating saving for retirement as a need.

“The primary causes, in my view, stem from a blend of insufficient financial education, the absence of a proactive saving culture and the societal shift toward instant gratification, which often prioritizes current spending over future savings,” Kojonen said. “From my experience, starting the conversation about retirement as early as possible is crucial. It’s never too soon to begin retirement planning. To avoid this bleak late-life outcome, I advocate for increased financial literacy efforts and early intervention. Education on the basics of budgeting, the magic of compound interest and the significance of starting to save early could shift the current retirement readiness landscape.”

If You’re Young, Start Now; If You’re Not, Get Help

The study revealed that Gen Z is getting an early jump and quickly moving in the right direction. An impressive 16% of 18- to 24-year-olds put 4% to 6% of their incomes in a tax-advantaged retirement account, more than any other demographic. Another 8% contribute a hefty 7% to 9% — also more than any other age group — and one in 10 are sheltering 10% of each paycheck in a tax-privileged account for their golden years.

They’re on the right track; and, with time on their side, compounding will do most of the heavy lifting for them if they stick with it.

The older sets, however, don’t have the luxury of four or five decades of growth. Their best bet is to make every dollar work as hard as possible by investing some of those dollars in professional help.

“Consulting with a retirement planning professional can provide customized strategies tailored to individual needs and goals,” Kojonen said. “Many people come into our offices with retirement accounts but lack a comprehensive retirement plan. This gap between having funds and having a strategy to utilize those funds effectively for a solvent retirement is where many fall short.

“I emphasize the importance of understanding one’s financial situation thoroughly — knowing what you own and owe. Implementing simple yet seldom-discussed strategies, such as tax-efficient withdrawals and timing Social Security benefits, can significantly impact the longevity of retirement savings.”

More From GOBankingRates

7 Household Products To Always Buy in Bulk at Costco

Average Cost of Groceries Per Month: How Much Should You Be Spending?

7 Things to Do With Your Savings in 2024 to Grow Your Wealth

4 Reasons You Should Be Getting Your Paycheck Early, According to An Expert

This article originally appeared on GOBankingRates.com: Retirement 2024: 28% of Americans Have $0 Saved for Their Golden Years