Share

EmailPension benefits are typically a fixed monthly payment in retirement that is guaranteed for life. Some pension benefits grow with inflation. Other pension benefits can be passed on to a spouse or dependent. But pensions aren’t the only financial route to guaranteed lifetime income after you retire.

What makes pensions unique is that the retirement income benefit is determined by a formula that does not take into account the amount of money actually saved. In other words, the amount of the pension stays the same even if the retirement system isn’t keeping up with saving money to pay the benefit.

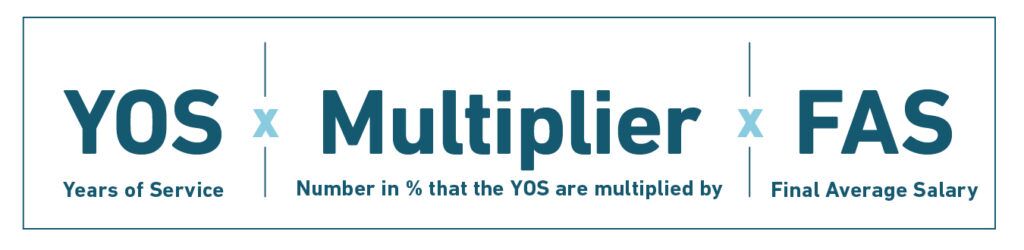

Here is how the formula typically works:

In the formula “years of service” is how many qualifying years a public worker has worked for their employer within the pension plan.

“Final average salary” is defined slightly differently from state to state, but always is a reference to the compensation amount that a pension will be based on. In most states, a final average salary — also called final average compensation — is the average of the last five years of work, or the last three years. Other states use the three or five highest years of salary, rather than the years at the end of your career.

The “multiplier” in the formula is used to determine the percentage of final average salary that will be received as a retirement benefit. Years of service are multiplied using this specific number. That amount becomes a percentage of final average salary. And the result equals the amount ultimately received as a benefit in retirement. The higher the multiplier, the larger the benefit. Multipliers are sometimes known by other terms, such as “accrual rate” or “crediting rate” but they mean the same thing.

A typical multiplier is 2%. So, if you work 30 years, and your final average salary is $75,000, then your pension would be 30 x 2% x $75,000 = $45,000 a year. That $45,000 becomes your guaranteed lifetime income.

Note: Your years of service times the multiplier (in this case, 30 x 2% = 60%) is known as your “replacement rate,” or the percentage of your final average salary that you’ll ultimately receive.

To find out if your retirement plan will provide adequate income, look up your plan’s interactive scorecard in theRetirement Security Report

This article is part of Equable’s Pension Basics series. To learn more about how your pension works, check out the other articles in the series:

1. How Pension Benefits Are Calculated

2. Vesting

3. The Pension Funding Formula

5. Normal Cost

6. Unfunded Liabilities (aka Pension Debt)

7. Actuarially Determined Contributions

10. Governance

11. Pension Myths & Facts:The Assumed Rate of Return Does Not Determine the Value of Benefits

12. Pension Myths & Facts: The Funded Status of Pension Plans Does Not Depend on More Public Employees

Share

EmailAs an enthusiast and expert in retirement planning and pension systems, I bring forth a depth of knowledge derived from extensive research, practical experience, and a comprehensive understanding of the intricacies involved in securing guaranteed lifetime income. My expertise is not merely theoretical; I've actively delved into the nuances of pension structures, retirement income formulas, and the various elements that contribute to a secure financial future post-employment.

Now, let's dissect the key concepts embedded in the provided article on pension benefits:

-

Pension Benefits Overview:

- Pension benefits represent a fixed monthly payment during retirement, ensuring financial stability for the individual throughout their lifetime.

- Some pension benefits may adjust for inflation, adding an additional layer of financial security.

-

Unique Nature of Pensions:

- Unlike other retirement plans, pensions have a distinctive feature wherein the benefit is determined by a formula unrelated to the amount of money saved individually.

-

Pension Formula Components:

- "Years of Service": This parameter denotes the number of qualifying years a public worker has contributed to their employer's pension plan.

- "Final Average Salary": The compensation amount, averaged over a specific period (often the last five years), serves as the basis for the pension calculation.

-

Multiplier Concept:

- The "multiplier" is a critical element in the formula, representing the percentage of the final average salary that an individual will receive as a retirement benefit.

- Multipliers may be referred to as "accrual rate" or "crediting rate" interchangeably.

-

Calculation Example:

- A typical multiplier is provided as 2%, illustrating how the years of service, multiplier, and final average salary combine to determine the annual pension benefit.

- The formula is expressed as: Years of Service × Multiplier × Final Average Salary.

-

Replacement Rate:

- The product of years of service and the multiplier results in the "replacement rate." It represents the percentage of the final average salary that an individual will ultimately receive as a pension benefit.

-

Ensuring Adequate Income:

- The article suggests checking a retirement plan's interactive scorecard in the Retirement Security Report to assess whether the planned pension will provide sufficient income.

-

Equable’s Pension Basics Series:

- The article is part of Equable’s Pension Basics series, aiming to educate readers on various aspects of pension systems and retirement planning.

-

Other Articles in the Series:

- The article refers to other pieces in the series, covering topics such as vesting, pension funding formula, assumed rate of return, normal cost, unfunded liabilities, actuarially determined contributions, paying the pension bill, funded status, governance, and debunking pension myths.

This comprehensive breakdown showcases the intricacies of pension planning, highlighting the importance of understanding the formulaic approach and various factors influencing pension benefits.