The Permanent Account Number (PAN) card andAadhaar card are critical identification documents for Indian citizens.The Income Tax (IT) department issues the PAN card, while the Unique Identification Authority of India (UIDAI) issues the Aadhaar card.

PAN is a unique identification number issued to individuals and businesses for tax purposes. The Aadhaar number is a 12-digit unique identification number issued for all residents. However, the IT department has made linking PAN and Aadhaar cards mandatory.

Circular on PAN-Aadhaar Linking

The IT department issued a circular that it is mandatory for all PAN-holders (except those who fall under the exempt category) to link theirPAN-Aadhaar within 30th June 2023. Initially, the IT department mandated to link PAN-Aadhaar by 31st March 2022 and then extended it to 30th June 2022. However, people who linked their PAN-Aadhaar between 1st July 2022 to 30th June 2022 had to pay a fine of Rs.500.

Subsequently, the IT department extended the last date to link PAN-Aadhaar to 30th June 2023.PAN holders who link PAN-Aadhaar between 1st July 2022 to 30th June 2023 must pay a penalty of Rs.1,000. PAN card will become inoperative from 01st July 2023 if PAN holders do not link it with their Aadhaar card. The IT department has mandated linking PAN-Aadhaar to regulate and curb tax evasion.

Who falls under the exempt category for PAN-Aadhaar linking?

The exempt category people need not link PAN-Aadhaar within 30th June 2023. The exempt category is as follows:

- Individuals residing in the states of Jammu and Kashmir, Assam and Meghalaya.

- A non-resident taxable person as per the Income-tax Act, 1961.

- People aged more than 80 years (Super Senior Citizens).

- Persons who are not citizens of India.

Last date to link PAN with Aadhaar card

The last date for PAN-Aadhaar linking is 30th June 2023. PAN cards not linked with Aadhaar will become inoperative after 1st July 2023.

Importance of linking PAN with Aadhaar card

- The PAN card of a person will become inoperative when it is not linked to an Aadhaar card.

- PAN-Aadhaar linking is required when filing the Income Tax Return (ITR).The IT department may reject the ITR when PAN and Aadhaar are not linked.

- PAN and Aadhaar cards are required to be submitted to get government services, such as applying for a passport, obtaining subsidies and opening a bank account. Thus, it is difficult to access government services when PAN and Aadhaar cards are not linked.

- When the PAN-Aadhaar is not linked, getting a new PAN card may be difficult if the old one is damaged or lost since it is mandatory to mention the Aadhaar card number while applying for a new PAN card.

Consequences of not linking PAN with Aadhaar card

When the PAN-Aadhaar cards are not linked within the last date, it becomes inoperative as a result of which:

- Taxpayers cannot file ITR or claim ITR with inoperative PAN cards.

- The pending returns will not be processed, and pending refunds will not be issued to inoperative PAN cards.

- The TCS/TDS will be applicable at a higher rate.

- The TCS/TDS credit will not appear in Form 26AS, and TCS/TDS certificates will not be available.

- Taxpayers will be unable to submit 15G/15H declarations for nil TDS.

- The following transactions cannot be done since the PAN card will be inoperative:

- Open a bank account.

- Issue of debit/credit cards.

- Purchase of mutual funds units.

- Cash deposit with a bank or post office during a day exceeding Rs.50,000.

- Purchase of a bank draft or pay order in cash exceeding Rs.50,000 in a day.

- A time deposit with banks, Nidhi, Non-Banking Financial Corporations (NBFCs), etc., exceeding Rs.50,000 or aggregating to more than Rs.2,50,000 during a financial year.

- Payment for one or more prepaid payment instruments as defined by the Reserve Bank of India (RBI) through bank draft, pay order or banker’s cheque aggregating to more than Rs.50,000 in a financial year.

- Sale or purchase of goods or services by any person more than Rs.2,00,000 per transaction.

- All bank transactions exceeding Rs.10,000.

However, the PAN can be made operative again in 30 days, upon intimation of Aadhaar number to the prescribed authority after payment of fee of Rs.1,000.

Penalty for non-linking of PAN with Aadhaar card

The taxpayers who have not linked their PAN-Aadhaar within the last date of 30th June 2023, can do so by paying a late penalty of Rs.1,000. They must pay the penalty before filing for the PAN-Aadhaar link on the Income Tax website. However, they need to ensure they have a valid PAN number, Aadhaar number and mobile number to pay the penalty.

How to activate inoperative PAN card and link with Aadhaar card?

When the PAN card is not linked with the Aadhaar card, it becomes inoperative. However, individuals can re-activate their PAN card by paying the penalty for non-linking PAN with an Aadhaar card.

Follow the below steps to pay the penalty for re-activating an inoperative PAN card:

Step 1: Visit theIncome Tax e-Filing Portal.

Step 2: Click the ‘e-Pay Tax’ option under the ‘Quick Links’ heading.

Step 3: Enter the ‘PAN’ number under ‘PAN/TAN’ and ‘Confirm PAN/TAN’ column, enter mobile number and click the ‘Continue’ button.

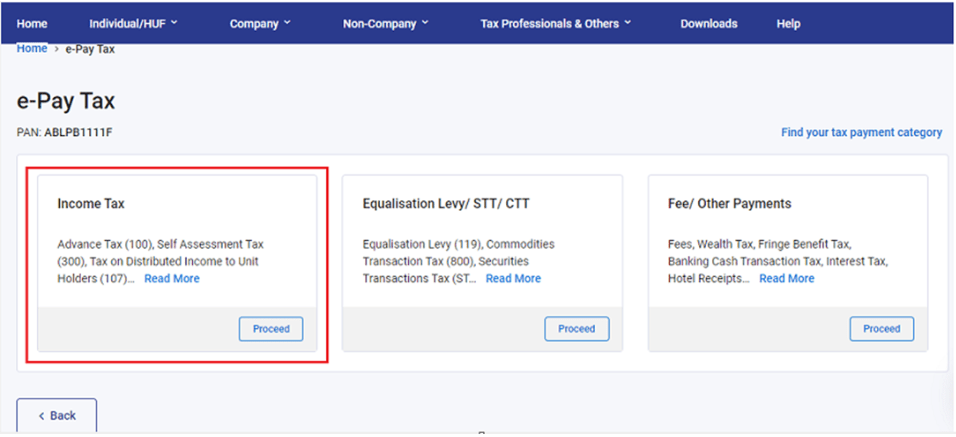

Step 4: After OTP verification, it will be redirected to e-Pay Tax page. Click the ‘Continue’ button.

Step 5: Click the ‘Proceed’ button under the ‘Income Tax’ tab.

Step 6: Select Assessment Year as ‘2023-24’ and ‘Type of Payment (Minor Head)’ as ‘Other Receipts (500)’ and click the ‘Continue’ button.

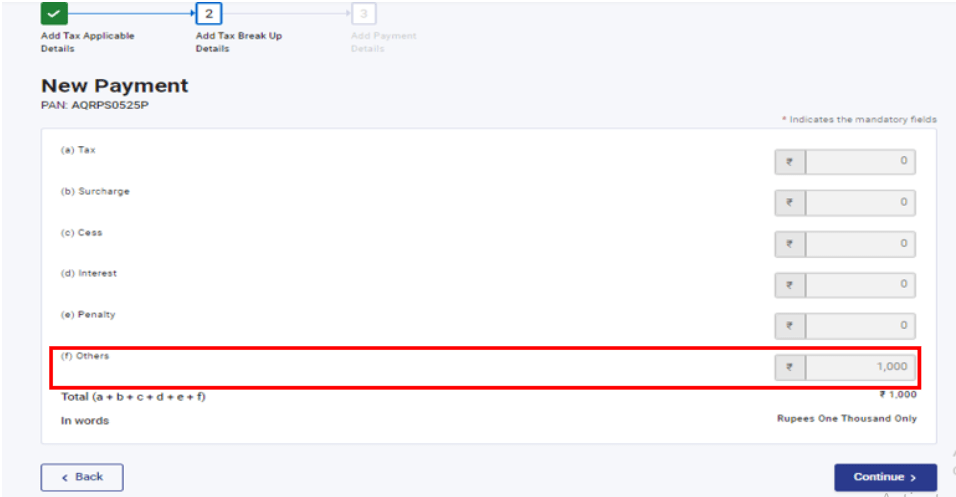

Step 7: The applicable amount will be pre-filled against ‘Others’ option. Click ‘Continue’ button and make the payment.

You can pay the late penalty on Income Tax e-filing Portal through net banking, debit card, over the counter, NEFT/RTGS or payment gateway option. However, you can pay the penalty through the payment gateway option when you have a bank account with the following authorised banks:

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Jammu & Kashmir Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Punjab & Sind Bank

- Punjab National Bank

- RBL Bank

- South Indian Bank

- State Bank of India

- UCO Bank

- Union Bank of India

After making the payment, proceed to link your PAN with Aadhaar card.

How to link a PAN with an Aadhaar card?

Taxpayers can link their PAN with their Aadhaar after four to five days of paying the penalty by following the steps below:

Step 1: Go to theIncome Tax e-filing portal.

Step 2: Under the ‘Quick Links’ heading on the left-hand side of the homepage, click on the ‘Link Aadhaar’ option.

Step 3: Enter the ‘PAN’ and ‘Aadhaar Number’ and click the ‘Validate’ button.

Step 4: A pop-up message stating ‘Your payment details are verified’ will appear when the penalty payment has been verified. Click the ‘Continue’ button to submit the linking request.

Step 5: Enter the required details and click the ‘Link Aadhaar’ button.

Step 6: Enter the OTP received on the mobile number.

Step 7: The request to link the PAN-Aadhaar card will be successfully submitted.

A taxpayer can also visit aPAN card centre, fill out the appropriate form and submit it with photocopies of PAN and Aadhaar cards for PAN-Aadhaar linking.

Frequently Asked Questions

Is it compulsory to link PAN with the Aadhaar card?

Yes. The IT department has made it compulsory to link PAN with the Aadhaar card by 30th June 2023, or else the PAN will become inoperative.

What happens if the PAN card is not linked to the Aadhaar card?

When the PAN is not linked with the Aadhaar card, the PAN card becomes inoperative from 1st July 2023. The taxpayers cannot file their ITRs, get tax refunds or access financial services, such as opening a bank account, or a Demat account, getting credit/debit cards, etc., when the PAN becomes inoperative.

How to check if my PAN card is linked to an Aadhaar card?

Any person can check if the PAN is linked with an Aadhaar card by following the below steps:

Step 1: Go to theIncome Tax e-filing portal.

Step 2: Under the ‘Quick Links’ heading on the left-hand side of the homepage, click on the ‘Link Aadhaar Status’ option.

Step 3: Enter the ‘PAN’ and ‘Aadhaar Number’ and click the ‘View Link Aadhaar Status’ button.

A message will appear on the screen stating that your PAN is linked with the Aadhaar number.

Is it necessary to get an Aadhaar card for super senior citizens?

No. Super senior citizens (aged above 80 years) are exempted from linking PAN with Aadhaar. Thus, their PAN card will not be operative after 1st July 2023 even if they have not linked with an Aadhaar card.

Is PAN-Aadhaar linking free?

No. Taxpayers who link their PAN with their Aadhaar number after 1sy July 2022 to 30th June 2023 should pay a penalty of Rs.1,000 before submitting a request for PAN-Aadhaar linking.

Can we link PAN and Aadhaar cards from mobile?

Yes, you can go to the Income Tax e-filing portal on your mobile and follow the steps provided above for linking PAN-Aadhaar to submit a request for PAN-Aadhaar linking within the last date.

As an expert in taxation and financial regulations, I can affirm that my knowledge in this domain is extensive, having closely followed the developments and changes in Indian tax laws and identification systems. I have a comprehensive understanding of the Permanent Account Number (PAN) and Aadhaar card, their issuance authorities, and the recent mandatory linking directives by the Income Tax (IT) department.

PAN and Aadhaar Overview: The Permanent Account Number (PAN) is a unique identification number issued by the Income Tax department to individuals and businesses for tax purposes. It is a crucial document for various financial transactions and tax-related activities. On the other hand, the Aadhaar card is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI) for all residents, irrespective of their citizenship status.

Mandatory PAN-Aadhaar Linking: The IT department has made it mandatory for all PAN holders, except those falling under exempt categories, to link their PAN with Aadhaar. The initial deadline was March 31, 2022, later extended to June 30, 2022, and subsequently to June 30, 2023. Failure to comply with this linking requirement attracts penalties, initially Rs. 500 for the period between July 1, 2022, and June 30, 2022, and Rs. 1,000 for the period from July 1, 2022, to June 30, 2023.

Exempt Categories for PAN-Aadhaar Linking: Certain categories of individuals are exempt from the mandatory linking, including residents of Jammu and Kashmir, Assam, and Meghalaya, non-resident taxable persons, individuals aged more than 80 years (Super Senior Citizens), and non-citizens of India.

Consequences of Non-Linking: The failure to link PAN with Aadhaar by the specified deadline results in the PAN becoming inoperative from July 1, 2023. This has severe implications, such as the inability to file Income Tax Returns (ITR), process pending returns or refunds, and apply for various financial services.

Penalties and Re-activation: A penalty of Rs. 1,000 is levied on individuals who fail to link their PAN with Aadhaar by the deadline. The inoperative PAN can be made operative again within 30 days by providing the Aadhaar number to the prescribed authority and paying the requisite fee.

Procedure for Linking PAN with Aadhaar: The penalty can be paid through the Income Tax e-Filing Portal using various payment methods, including net banking, debit card, over the counter, NEFT/RTGS, or payment gateway. After the penalty is paid, the PAN can be linked with Aadhaar by visiting the e-Filing portal, entering the necessary details, and validating the process with an OTP.

Frequently Asked Questions (FAQs): The article addresses common queries, such as the compulsion of linking PAN with Aadhaar, consequences of non-linking, checking the linking status, exemption for super senior citizens, the cost of linking, and the ability to link using a mobile device.

In conclusion, the PAN and Aadhaar linking is a critical compliance requirement imposed by the IT department to streamline taxation processes, prevent tax evasion, and ensure the effective functioning of financial systems in India. The comprehensive information provided in the article serves as a valuable guide for individuals seeking clarity on this matter.