- HubPages»

- Personal Finance

Updated on February 5, 2013

Contact Author

By: Rhonda Lucas

February 2013

Necessity is Indeed the Mother of Invention

With this lingering recession, no one can spend money the same way they did just a few years ago. Food prices have continued to go up, along with fuel prices, while salaries have stayed the same, and in some cases, even dropped. I know my salary has not increased, but my rent has gone up and I am paying more for the very basic necessities of life.

Desperate times call for desperate measures. Last year, I had to begin microscopically inspecting every dime coming in and going out of my wallet. In the process of doing that, I have found, I believe, some new ways to make a dollar go farther. So I decided to share them with you. I hope you can benefit from my creative ways of saving and not only survive these difficult times, but actually have money left over every month to either put towards paying off some high interest loans, or just simply setting something aside for a rainy day. I have talked to many people who are in exactly the same boat I was in . . . . . . . living from paycheck to paycheck, with no money set aside for emergencies.

Create a Budget and Stick to It !

1. Analyze What You're Spending Your Money On!

Sit down and figure out just where all your money is going, by making a list of your regular monthly living expenses, credit card and retail purchases, entertainment; car, health and life insurance and loans.

Find out where every penny went, and decide where you can reduce your spending.

I read the book You’re Broke Because You Want to Be by Larry Winget. One of the first things he advises after you create a budget is to stop eating out!!!

Take a look at all the money you spent during the month on eating out. Add it up and you will be shocked at how much you spent. When you spend money eating out, you have nothing to show for it!

Once you’ve created a budget and decided where you can cut back stick to it. At the end of the month, see if you were able to stick to your budget and if you actually had money left over at the end of the month then think about making further cuts. For example, you can challenge yourself to cut $10.00, $20.00, or even more from your budget the following month. Challenge yourself every month.

Do you really NEED that?

2. Only buy what you NEED!

Do you really need that new purse? No, you don't! You don't need it, unless of course, your ONLY purse was recently stolen!

Does your son or daughter NEED that new video game? No, they don't! What did people do BEFORE video games? They played board games, or cards or here's a thought, they went outside and played or went for a bike ride!

It's okay to tell your child "no". Or just be up front with them and tell them you can't afford it because you're trying to put money in savings so the family can take a nice vacation. Help them see that there is not going to be an endless flow of cash for their every desire.

If you and your family don't absolutely have to have the item to insure your survival or satisfy your hunger, don't buy it!!! You SAID you wanted to save money right? Well, it means making sacrifices and having self-control! Get used to it!

3. Don't Even Think About It

Resist the urge to splurge because you were able to save some money this past month.

Financial advisors will tell you that after you've put a budget in place and are able to put some money in savings, your first goal should be to save enough money to pay all your family's living expenses (including rent or house payments) for six months.

Everyone should have money set aside for emergencies like loss of a job, or a long-term illness of you or your spouse.

4. I Said Stop Eating Out!

When I said you should stop eating out, it included, lunches as well. You will save a ton of money if you make your lunch and take it to work, instead of grabbing fast food. People who buy their lunch everyday ususally reason: "it's only $5.00 bucks!" That is cheap. However, multiply that times five. That's at least $25.00 a week or $100.00 a month. If you want to save money you cannot afford to blow $100.00 a month on eating lunch out.

All you have to do is get up early and pack some leftovers, or make a sandwich or a simple salad. Better yet, make your lunch the night before. Then all you have to do is grab it on your way out the door and you won't be able to say "I ran out of time to make my lunch this morning."

5. Challenge Yourself

See how many days you can go without spending ANY money. It will be difficult at first. But if you will stop and ask yourself "do I really NEED this?" You'll probably decide that "no", you don't really NEED that. Be tough.

Only YOU have control over how and when, you spend YOUR money. So when you are about to spend some money, tell yourself "I don't need this. I know I can keep from spending money for at LEAST 24 hours."

When you've gone a whole 24 hours without spending any money, try going another 24, and keep doing it as long as possible.

6. Do you have a 401K?

If your employer offers a 401K and you are not putting money into then start. Most companies will also put money in it for you when you open it. Some companies will even match your contribution, so if you haven't started yours, get it started now.

If you already have a 401K, try increasing your contribution buy $25.00 or $50.00 per month. If you make it $50.00, that's another $600.00 per year.

But, before you increase your 401K contribution, you should do #3 above, and first set aside six months worth of living expenses.

7. Are you scheduled to get a raise?

If you get a raise, pretend you didn’t. Put that extra money aside. You lived on that amount before your raise, try doing it for as long as you can.

8. Plan Each Trip in Your Car

Before heading out the door with your grocery list, ask yourself if there is any other errand in the vicinity.

For example, I got a coupon from my auto dealership for service and oil change. My address had recently changed, and since the Dept. of Motor Vehicles is right next door to the dealership, I got my new driver’s license while I waited for them to finish working on my car.

9. Could you lower your payments by refinancing you car or house?

Check into refinancing your car to lower your payments. Then if your situation improves, send in an extra payment whenever possible. There’s nothing wrong with paying it off early!

10. Getting a studen loan?

Don’t borrow more than what you need on your student loan. You will have to pay it back.

11. Already Have a Student Loan?

Do you have a student loan in default, or in danger of going into default?

If you are in diar straits, you can ask to put your loan in “forbearance”. While it is in forbearance, you will continue to accrue interest, but it won’t default.

Warning: This is only a temporary reprieve. You will have to set up payments after the forbearance period has ended or your loan will go into default.

12. Is Your Student Loan in Default?

If your student loan is already in default, call them as soon as possible and see if you can make payment arrangements to get it out of default. They are more than willing to work with you to help you get back on track.

Defaulted student loans are reported to the IRS! And next time you file your tax return, if you’re due a refund, guess what? The IRS will take what they need to pay your student loan and if there is anything left, they will send you the rest!

So, if you want all of your refund, you better get your student loan out of default.

13. Did you owe the IRS Last Year?

Don’t owe again this year. By going to www.irs.gov and using their Withholding Calculator, you can make sure you are having the proper amount of federal taxes withheld from your payroll check, so you won’t owe again.

14. Prepare your Federal tax return early!

What if you just did your tax return and you found out that you are going to owe the IRS? You have until April 15th to save up the money and file your taxes at the last minute. OR if you are truly strapped for money, you can file your taxes by April 15th, without sending in a payment.

When the IRS finishes processing your return (about 6 – 8 weeks after receiving it), they will just send you a bill and tell you that you need to call the IRS toll-free number and set up an installment agreement with them.

However, just so you know, the interest on your balance begins accruing April 16th. One good thing is, the IRS doesn’t even know you owe them the money until they finish processing your return.

WARNING: You must file on time, even if you owe and can’t pay! Otherwise, you will get slapped with a “FTF penalty”. That stands for “Failure to File” by April 15th. So go ahead and file on time, even if you can’t pay what you owe.

15. Don't Borrow the Money to Pay Back the IRS

The IRS will work with you in paying them back!

The only time they will cease bank accounts, property or anything else, is if you deliberately ignore their letters.Don’t make that mistake or you will ruin your chances to have them work with you in paying it back.

The reason I say don’t borrow the money to pay the IRS back, is because the IRS only charges 4 to 4-1/2 percent interest on the unpaid balance (this may have changed slightly for the current filing season). However, credit card companies and banks will charge you a lot more to borrow the money.

So if you’re going to owe someone, you might as well owe the IRS and only pay 4.5% versus upwards of 18% or more to other financial institutions.

Also, depending on your income, you can take up to 60 months to pay the IRS back. And, if you set up automatic withdrawals from your bank account, they will cut the interest rate a quarter of a percent.

There is a one-time set up fee of $105.00 to set up an installment agreement, which will be taken out of your payment first, then the rest will be applied to your balance. However, if your income is below a certain amount, you can get the fee reduced to $45.00, or even have the fee waived. Ask the representative about it when you call to set it up.

Final warning about an IRS installment agreement – Don’t default on your installment agreement. If you do, they will report it to the credit bureaus and this will negatively affect your credit rating.

16. Suspending Your Account with the IRS

Also, it is not widely known, but you can have your account “suspended” if you owe the IRS and are not able to pay. This is for persons who are unemployed or have no way of paying it back at that time. This is only if your situation is very desperate.

When your account is suspended, the IRS will stop collection activities and won’t bother you. However, please note, that interest still continues to accrue on the unpaid tax while your account is in suspense.

Also, while your account is in suspense, you will only get a statement once a year letting you know your current balance.

I have worked at the IRS and I once suspended an account for a woman who was unable to work because she was receiving cancer treatment.

Don’t be afraid or ashamed to call the IRS and tell them your situation, they will work with you.

17. IRS May Waive Your Penalties

Let’s say you had a good history of filing your returns on time, and always paying what you owe on time, and all of a sudden you had a bad year and you owed the IRS thousands.

So you set up payments and have a couple of years of paying on time and you are almost to the point where you have paid off your original amount of tax.

One thing to know is that when you make payments to the IRS, all of your payments go towards the principal (or original amount of tax owed) first. Once that is paid, your payments go to interest, after that, your payments go to pay off your penalties.

So, keep track of your payments or just call the IRS occasionally and ask for your balance, so you will know when you have paid off the “original” amount of tax owed.

Once you have paid the original amount off, you can ask for a “one-time abatement” (or waiver) of the penalty portion!!!! Therefore, depending on how much you originally owed, the penalties could be quite substantial.

Many people are not aware of this option. Also, you may only ask for this waiver if you have filed all tax returns for the last five years. You cannot have any outstanding filings.

One more thing, you will never be able to have the interest waived, it’s against the law. You can only ask for an abatement of the penalty portion.

One more thing: The IRS will not waive the "Failure to File" penalty (mentioned in #14 above). They will only do a one-time abatement (waiver) of the "Failure to Pay" penalty (failure to pay all you tax by April 15th).

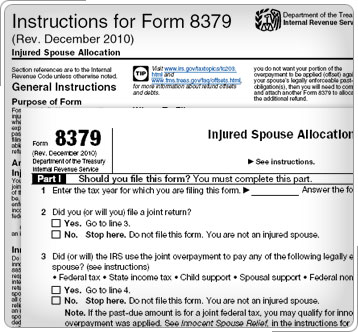

18. Are You an Injured Spouse?

Another little known fact about IRS provisions is the Injured Spouse Allocation – Form 8379. Let me explain. This Form used to be referred to as the Injured Spouse Claim.

When would you use this Form? Well, let’s say for example that this is your second marriage and your spouse has a student loan in default or owes the IRS on a joint tax debt with their ex-spouse.

And let’s also say that your spouse was unemployed or earned very little during the tax year, but you (the Injured Spouse) worked all year and paid most, or all, of the federal tax between the two of you and are expecting a refund.

Well, when you file your tax return, the IRS will use your refund to pay the student loan, or old tax debt from you spouse’s previous marriage, and then you’ll get what’s left; that is unless, you file a Form 8379.

NOTE: You cannot file this form unless you are filing “Married Filing Jointly”. You may send the Form 8379 in with your tax return, OR if you have already filed your return and then find out that the IRS is keeping your refund to pay the student loan, or other debt, you can still file the Form 8379 and get the Injured Spouse’s portion of that refund.

This Form is used to allocate, the income, tax, exemptions and credits to each spouse, in order to determine the Injured Spouse’s portion of the refund. If you are the Injured Spouse (the one without the student loan or other federal debt, such as an IRS debt from a previous marriage, alimony, child support or Social Security) you can claim all the exemptions except one. The spouse that has the federal debt has to claim his or her own exemption. But if you had most of the earnings and exemptions, then you will be allocated most of the refund.

Exception: There are community property laws in some states. If that is the case in your state, you will only be entitled to half of the refund, and the other half will go towards your spouse’s federal debt.

NOTE: Tax preparation services will charge you a little extra to file this Form 8379. But beware! After having processed Injured Spouse claims at the IRS, I have seen Form 8379 filings that weren’t even necessary. The tax preparer just wanted to make a little extra money off you.

The tax preparer should ask you, “Do either you or your spouse have any outstanding federal debts such as a student loan, IRS debt, alimony, child support or social security?” If they don’t ask you this question, then they are not doing their job. You don’t want to pay extra for something that is not even necessary.

If you’re not sure if you have a past debt that the IRS might want to pay, you can always call the IRS ahead of time and find out if there are any debts recorded against you or your spouse.

The IRS has very limited staff because of budget cuts by Congress. So it just bottle-necks the paperwork flowing through the Injured Spouse unit when tax preparation services send in Form 8379’s that weren’t even necessary.

19. Stop Clipping Coupons

Time is money. Don’t waste your time clipping coupons. You can spend hours doing this! And most of the time, they expire before you get to use them.

Or you have to buy 3 to get one free and you don’t even know if your family will like the product, so it may just sit on the shelf in your pantry then probably get thrown out a year later.

20. Get Out Your Needle and Thread

Instead of discarding clothes because you lost a button or a seam came loose, mend or repair them.

Plan a sewing day once a month or whenever needed. Have everyone put their mending in a basket. When the basket is full, plan a day of mending and sewing.

21. Pillow Makeover

Pillows can be pretty expensive. Don’t buy new throw pillows.

Make new pillow cases for the ones you already have from scrap fabric you have around the house or can get from the thrift store.

I like to do this, just to give the living room a new look once in a while.

22. Shop Thrift Stores for the Things You Need

How many times have you given away perfectly good clothes to the thrift store? Maybe you got a sweater has a gift and you never wore it, or you've gained or lost weight and can no longer wear them. So you give them to the thrift store.

I buy MOST of my clothes from the thrift store. People think I went out and bought new stuff. SOME of the items will still have the original price tag on them! I find bargains every time I go.

I shop at a great thrift store. They will give you a 30% off coupon when you bring in a donation. Also, a couple of times a year, they will offer a card that gets a stamp for every ‘grocery bag size’ donation you bring in. When you have 15 stamps on your card, you get 50% off your next purchase of $50.00 or more.

23. Thrift Store Idea #1

Have you lost a button on a blouse, coat or shirt? I have purchased a torn or stained blouse at the thrift store, just for the beautiful buttons on it!!!

If you have to replace 6 or 8 or even 10 buttons, you can easily spend more on NEW buttons than you did on the blouse. Search the rack for ugly shirts and blouses with great buttons!

24. Thrift Store Idea #2

For a thrift store outfit makeover, I paid $3.00 for a great skirt. The only problem, it had a tear in it. What did I do? Well the skirt was too long for me anyway. I cut off the bottom (above the tear) and hemmed it.

With the material I cut off, I made a trim to go around the neck and sleeves of a plain black short-sleeved pullover top that I already had and sewed the trim on. Now it looks like I purchased the items as one outfit. The entire outfit cost about $7.00.

Also, I found a full-length wool Calvin Klein winter coat marked at $29.99 and there was nothing wrong except the seam came loose on one of the pockets flaps. When I got up to the register, it was 50% off coats day!!!!! So I got the coat for $15.00 and all I had to do was take a few little stitches to sew the pocket flap down.

25. Thrift Store Idea #3 - Clothes Have Stains? No Problem!

Once, I bought a very nicely tailored Anne Taylor blazer that was black and white, with a white collar. Well the white collar had some stains on it and it was a dingy white color.

I liked the style of the blazer so much, I bought it hoping I could get the stains out. Then I thought, I have to get this collar sparkling white again, but I can’t put bleach on it because it will ruin the black part, and I wanted something that was about the consistency of paste, that contained bleach.

I used Softscrub! It was thick enough to allow it to sit on the stains without getting the bleach on the rest of the garment. It looked great when I was finished with it. Everyone thought it was brand new!!!

26. Thrift Store Idea #4

Buy an attractive flat sheet at the thrift store and use it as a bed skirt.

27. Dress Makeover

I had a dress that I really liked, but was tired of it and the collar was really out of style. So I took the collar off and made the long sleeves into short sleeves and it looked like a completely different dress. I loved my “new” dress.

28. Dry Clothes Inside Out

They say that your clothes will last longer if you wash and dry them inside out.

I can see that this makes sense, if you don’t mind taking the time to turn them right side out, when you’re done.

29. Don't put Lingerie in the Dryer

To make my delicate lingerie and bras last longer, I will wash them in the washing machine, but I hang them up to dry. The heat of dryers will wear out your delicates very quickly.

30. Put Used Wrapping Paper to Good Use

I got this one from Martha Stewart. Take used or outdated wrapping paper and run it through a shredder and use the shredded paper to pack fragile items you’re going to store or line the inside of a gift box.

31. Do-It-Yourself - DIY

Scour the internet for DIY projects. You would be surprised at what you can make out of something that you might have thrown out.

On Pinterest, a person had converted a table that had a broken leg into a “console table” They actually cut the table in half where the table splits and the cut side was placed against the wall.

You can paint it any color and use it as an entryway table or put in your living room to display family phots.

32. Take Inventory

Inside your pantry door keep a list or inventory of the items that you have in stock.

When you use the last one of something circle it.

When you get ready to go to the store, grab the list and get the circled items. OR, if you don’t want to go to that level, then as soon as you use the last of something, immediately write it on your list before you do anything else! That way you don’t forget to buy it next time you go to the store.

This will save extra runs to the store, saving you time and money on fuel costs.

33. Save Those Leftovers!

My mom taught me this one. Do you have only a couple of spoonfuls of vegetables left after dinner? Don’t throw them out.

Keep a tightly sealed container in the freezer and every time you have left over veggies, pull the container out of the freezer, add the left over veggies and return it to the freezer.

When the container is full, make a vegetable soup!

34. Buy Dried

Resist the urge to buy precooked canned goods, such as beans. Buy the dry version at a fraction of the cost.

35. Processed Food vs. Fresh

Processed foods cost a lot more than fresh or fresh-frozen. Also, fresh is always healthier than processed.

Trade that bag of donuts for a bunch of bananas.

Trade that bag of Doritos for some homemade popcorn and shake a little parmesan cheese over it.

Get on Pinterest or Cook.com and search for healthy low-cost snacks and meals.

36. Buy In Bulk

Buy in bulk only if you are going to use it before it expires.

If you don’t think you can use something before it expires, think about going in with a friend and splitting it.

37. Get a Vacuum Sealer for Food

I invested in a vacuum sealer for food. That way you can cook large portions and individual servings, like a turkey and freeze portions.

This saves TIME because you’re in the kitchen once and it saves you MONEY because the vacuum sealer will keep your food from getting freezer burn.

American's waste nearly half their food. It's like throwing money away. http://www.huffingtonpost.com/2012/08/21/food-waste-americans-throw-away-food-study_n_1819340.html

38. Buy Generic

Most often you can buy generic brands of foods without sacrificing quality.

I really like Classico pasta sauce. However the price of a jar is double the price of the generic.

Sometimes the generic is a little blander, so I will just add some oregano, basil and garlic powder and we’re good.

39. Save Your Receipt

When you have finished with your grocery shopping, save your receipt and create a spreadsheet that lists the items and their prices.

Before you go to the store use this list to create your grocery list then total it. By figuring out how much you will be spending, you will keep from overspending.

40. Set a Challenging Limit

Take this one step further and set a limit to what you are willing to spend.

With my husband out of the country, I am only buying groceries for me. I decided to challenge myself to keep my weekly grocery bill down to $45.00 (this includes non-food items), and surprisingly I was able to do it.

I was only able to do it because I kept a price list of the items I purchase quite often, as suggested above.

After totaling my list, if it was MORE than $45.00, I would decide which items I could delete from the list, without denying myself proper nutrition.

See what you already have in the pantry that could be used as an ingredient to go along with what you’ll be buying. This leads me to my next tip.

41. Meal Planning

Plan your meals for the week. Purchase only what you need for those meals and nothing else!

You will save fuel on extra trips to the store if you get everything you need for the whole week.

42. Fix BEFORE You Buy

Try fixing an item, instead of buying a new one.

For example, does your backpack have a tear in it? Instead of buying a new one, get some heavy duty thread and repair the tear and make it last longer.

43. Repair Your Sole

Get your expensive leather shoes repaired instead of buying a new pair.

See how long you can make them last.

44. Store Rain Water

If you live in a house, you can direct rain water from your gutters into trash cans or storage tanks and use the water to water your garden or houseplants.

45. Trim Your Family's Hair Yourself

You CAN trim your hair and your family's hair.

I have trimmed my own hair for years. Now I am not a licensed hair stylist, but I watched when the stylist would trim my hair.

No, I am not perfect at it, so once or twice a year I will have it professionally cut and styled. But for the most part, I do it myself.

There are YouTube videos that can be very helpful.

46. Free Shipping!

Take advantage of free shipping offers on items you use a lot and purchase online.

Are there products that you ONLY purchase online? I buy vitamins from Puritan's Pride online. Not only do they have quality vitamins at great prices, but they will run a sale and offer free shipping on your order.

Even if you're not quite ready to place another order of what ever you buy, go ahead and buy a little early, if they are offering free shipping.

47. Great Savings Sent to Your Inbox

Subscribe to Groupon, Living Social and Amazon Local. When you sign up for these, you’ll get daily coupons and vouchers in your inbox that you can choose to purchase.

These sites network with businesses in your area and get them to offer coupons on goods and services at half the price, just so they can gain exposure for their business.

Last year I purchased “buy one get one free” horseback riding for an hour. My 26-year old daughter and I had a great time and we didn’t feel guilty, because the price was so cheap!

48. Discount Codes for Online Purchases

I was at work about to purchase some deposit slips for our office. We purchase them through Intuit. Well my boss said “try going to www.retailmenot.com and see if you can find a discount code to save money.”

I found a discount code for 50% off checks, entered the code at checkout, and it worked for my deposit slips too!

So whenever you purchase something online, go to www.retailmenot.com first to see if you can find your product there and get the discount code.

49. Turn Thermostat Down

Try turning your thermostat down just one or two degrees for a month in the winter and up one or two degrees in the summer. You're probably not even going to notice the temperature change.

Keep track of when you did it and next month when you get the bill, compare and see how much you saved.

I have a separate thermostat in my bedroom and I have it turned down to 65 in the winter. I sleep better when the room is cool and not hot and dry. I also have a very warm comforter on my bed so I am not freezing.

50. Slow Down

Ease off the gas pedal when you drive.

Do you have a tendency to go a little over the speed limit because you leave the house JUST in time to arrive at work at 8:00 a.m. on the dot? Save money on fuel, leave a little earlier and go the speed limit.

See how long you can get your gas to last. There have been many times that I have made a tank of gas last two weeks!

51. Keep Up the Maintenance on Your Vehicle

Keep up the maintenance on your vehicle. It will save you money in repairs later down the road.

52. Online Car Service Coupons

To keep up the maintenance on your car, check the internet for coupons on tune-ups and oil changes. There are plenty of local shops that want your business, so you can find great deals.

52. Save on Music

Do you like listening to music? Don’t buy CD’s at retail stores. You can get them for half the retail price if you buy them on Amazon or Ebay.

Also, I pay VERY close attention to what I am paying for shipping. Sometimes it seems like you are getting a GREAT price on the CD but get nailed on the shipping. Myself, I will only buy a CD when the shipping is free, or less than a dollar. Otherwise, they can keep it.

53. Do You Have Dogs?

Do you have dogs? Dogs that need haircuts like mine? Trim their hair yourself. It gets really hot in Missouri in the summer. So I shave my dog’s hair close in the summer so they are not so hot.

It can be $35.00 or more to get a dog groomed. I spent $50.00 on the dog shears from Ebay and they paid for themselves the first time I used them.

54. Save on Pet Supplies

Speaking of the dogs, every summer I have to buy flea treatments for them. They can be quite costly. I found the cheapest prices for flea treatments online at www.1800petmeds.com . And they will even ship it free.

55. Good Nutritious Dog Food - Delivered

I also purchase dog food online in 20-25 lb. bags through www.petflow.com and they will also ship for free.

I won’t buy bargain brand dog food to save money. I take very good care of my dogs and won’t feed them cheap dog food. I get a great price for quality dog food that does not contain corn fillers that can cause skin allergies.

56. What Other Talents Do You Have?

You may have a full-time job. But are there other skills that you have that you could put to good use and therefore, supplement your current income?

Myself, I write articles and publish them online. I am also trying to break into voice over work. But my full-time job is in the field of Accounting.

Maybe you are good at organizing. How about getting into professional organizing? How about photography? Are you exceptional at playing a musical instrument? Maybe you could offer lessons.

Think about what your hobbies are. Is there a way you could make money at your hobby? Do some research and see if there's a way for you to make some extra money doing what you love.

Make Sacrifices Now, Benefit Later!

I’m sure there are some of these suggestions that you’ve heard before. But sometimes, we forget some of those money-saving tips that have been around for a while and need a reminder.

I hope you found some tips that were new and hopefully they will also be ones that you will use to improve the financial situation for yourself and your family.

It is my aim to pass along my knowledge to help others. We are all just here to try to make a living, support our families and also, if we are fortunate, get to enjoy life to the fullest.

You will need to make sacrifices for the things you want. Life is not always so easy.

Your economic situation can change in a moment. So, your goal should be to be ready for whatever life brings your way.

© Copyright RLucas 2013. All Rights Reserved.

I'd like to know what you thought of my ariticle.

4.3 out of 5 stars from 3 ratings of This Money-Saving Hub

MSTFT

UA-38270509-1