The S&P 500 has experienced its second-best start to a year in the past 25 years, fueling a sense of optimism among investors. However, this achievement has not been the main story of the year. In fact, the bellwether index’s year-to-date gains of 16% have been completely overshadowed by the tech sector’s domination. With AI hype driving the surge, it has become the best-performing sector in 2023, up by 31.5%.

That is a significant amount and actually represents the finest opening half of a year ever recorded by the sector as it has pulled away from the S&P 500 by the biggest gap over a six-month period since 1999.

Is tech set for further gains in the second half of the year? That remains to be seen although the segment is by no means the only game in town. There are other corners of the market that could provide opportunities for investors, and the analysts at Raymond James are keen to point them out. They have been seeking out the equities set to push ahead for the rest of the year and have tagged some non-tech names as Strong Buys.

We ran a pair of their choices through the TipRanks database for a wider view of the prospects and it looks like the rest of the Street agrees with the Raymond James experts – both are rated as ‘Strong Buys’ by the analyst consensus, too. Let’s take a closer look.

Everest Group (EG)

Let’s admit that insurance does not have the same allure as tech and AI but as investing legend George Soros said, “good investing is boring,” and that brings us to Everest Group, a leading global provider of reinsurance and insurance solutions.

Founded in 1973, the company is an established insurance name, its global presence allowing it to serve clients in over 100 countries across 6 continents. Providing tailored solutions to meet customers’ unique needs, Everest operates through its subsidiaries and offers a diverse portfolio of products, including property, casualty, specialty, and life reinsurance, as well as insurance coverage.

Everest has managed to post sequential improvements to the top-line over the past several quarters and that was the case again in the first quarter of 2023. Revenue reached $3.29 billion, climbing from the $3.25 billion delivered in Q4 and amounting to a 13.8% year-over-year increase. The figure also beat the consensus estimate by $190 million.

At the other end of the scale, boosted by ongoing underwriting margin improvement, net operating income reached $443 million, translating to EPS of $11.31 and improving on the $10.31 delivered in the same period last year. However, the bottom-line figure missed the analysts’ forecast by $1.23.

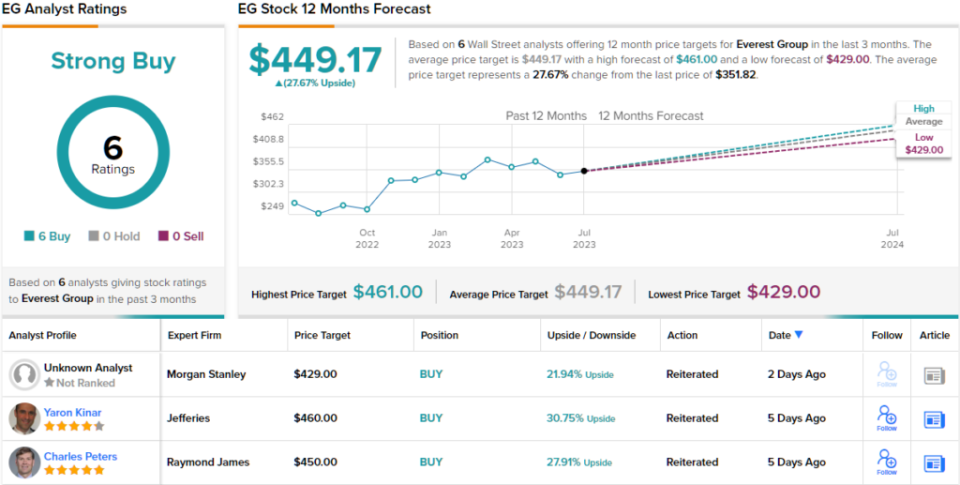

Assessing this firm’s prospects, Raymond James analyst Charles Peters maintains his Strong Buy rating, citing a “positive outlook for Everest to report accelerating revenue and earnings growth.”

Expounding on this, the 5-star analyst said, “Our rating reflects improving reinsurance market conditions with strong trends in pricing and terms/conditions continuing through mid-year renewals. While we acknowledge hurricane/catastrophe related concerns in 2H23, we believe the risk-reward favors [Everest] due to the hard market and our outlook for operating ROBEs of 19%+ over the next two years.”

“We continue to believe there could be upside to our estimates should the company achieve the lower-end of management’s 2023 u/w targets with further improvements in 2024,” Peters summed up.

Along with the Strong Buy rating, Peters’ $450 price target on EG makes room for 12-month returns of ~28%. (To watch Peters’ track record, click here)

Looking at the consensus breakdown, the rest of the Street agrees with Peters’ assessment. With 6 Buys and no Holds or Sells, the word on the Street is that EG is a Strong Buy. The $449.17 average price target is practically the same as Peters’ objective. (See EG stock forecast)

Copa Holdings (CPA)

Let’s now pivot from insurance to the airline industry. Copa Holdings is a Panama-based firm that operates as a holding company for Copa Airlines and Copa Colombia (Wingo). The company has positioned itself as a major player in the Latin American region, offering connectivity between cities in South America, Central America, North America, and the Caribbean, with a wide network of 79 destinations across 31 countries. Copa operates a modern fleet of aircraft (a total of 99 at the end of Q1) and has gained a reputation for its high-quality service, punctuality, and efficient operations.

Travel demand has been on the rise following the Covid-driven lull and Copa has been benefitting from this development. In Q1, revenue increased by 51.7% from the same period a year ago to reach $867.3 million, while beating the Street’s forecast by $27.94 million. The figure also represented a 29% increase vs. pre-Covid 1Q19 levels. The company has also been prudent with costs and that resulted in adj. EPS of $3.99, a figure that outpaced the Street’s $3.25 forecast.

Not only tech stocks have been outperforming the market this year. That display has helped the stock deliver year-to-date gains of 32%. Yet, according to Raymond James analyst Savanthi Syth, there’s more to come.

The analyst rates Copa shares a Strong Buy while her $155 price target implies upside of 40% over the coming months. (To watch Syth’s track record, click here)

Explaining her bullish stance, the 5-star analyst wrote, “We believe the relative attractiveness of Copa’s geographically advantageous and defensible hub has improved. As such, while the inflection in competitive capacity against a lower fuel backdrop is likely to pressure yields, Copa’s cost initiatives coupled with an overall attractive competitive setup (further supported by global supply constraints) should support strong margins.”

Overall, this is another stock that gets the Street’s full support. With a unanimous 8 Buys, the stock boasts a Strong Buy consensus rating. Should the $148.63 average price target be met, a year from now, investors will be pocketing returns of ~35%. (See CPA Holdings stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.