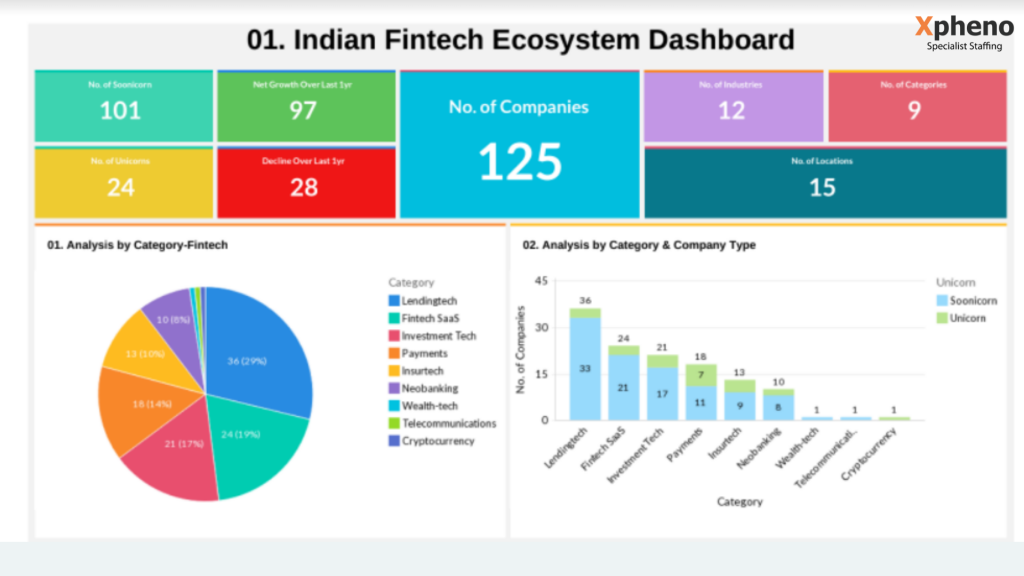

Fintech has been changing industries and economies around the world. The rise of investment, payment, SaaS and lending platforms is a clear sign of the digitized direction of modern finance. Xpheno collected data on 125 Fintech Unicorns and Soonicorns in India to track important insights on the rapidly developing Fintech landscape. According to our data, out of the 125 companies, 36 belong to the lending tech domain, followed by Fintech SaaS and Investment tech companies, 24 and 21 respectively.

Another noteworthy trend found was that the lending tech sector has the greatest number of Soonicorns (33 in total). However, financial experts suggest lending tech platforms could become high risk zones with lack of moderators. Its growth spurt has some hidden risks that must be noted and rectified, and that we are going to explore in this blog post.

What is Fintech?

Fintech, short for financial technology, includes different technologies and business models for payment, lending, investment, banking and more. It digitizes financial services and attempts to make them fast, accessible, and secure in comparison to traditional ways of financial activities.

Fintech enterprises now provide cashless payment options, digital insurance and virtual currencies, all part of financial solutions disrupting the older financial services industries.

From businesses to governments, all are aiming to swiftly move towards financial digitization to make their documentation, identification and transaction processes quick and hassle free. It has made the paperwork a lot less tedious and transactions a lot faster. You can do identity verification, send documents, receive payment and a lot more using digital platforms where everything is available one tap or one click away.

Fintech Adoption and Digital Credit

Fintech has opened gateways for financial inclusion and business opportunities with its fast processing loans and payments. Fintech payment portals like Paytm and Razorpay offer quick transactions and micropayment options that help meet urgent needs of the underserved consumers.

Fintech lending platforms give access to online personal and business loans with installments, bad credit and other choices with personalized rates and terms.

Now Fintech companies are offering new forms of financial services, including pay per service and buy now pay later models for customers who were conventionally deemed unfit for credit.

However, to sustain a secure and dynamic mobile money and digital credit ecosystem requires firewalling. A strong firewalling system ensures protection of customers from failure of business’ IT systems to Mobile Network operators, as well as cyber breaches and identity theft by employees. Firewalling of digital services could however lead to additional permanent costs that hinder the profitability for Fintech enterprises, hence gets disregarded by many emerging startups.

Buy Now Pay Later Model (BNPL)

Several Unicorns and soonicorns in the Indian fintech landscape are now providing the BNPL financing option. It allows the customer to buy a product on a short term loan, and pay it back in lump sum or in EMIs. Just like credit cards it offers interest-free loans, but for a shorter period (15 days to 1 month). However, it doesn’t require the additional charges and verification processes of credit cards and makes taking a loan hassle free.

According to RazorPay’s report on rise in Fintech during Covid, the Indian BNPL market saw more than 637% increase in 2021.

The BNPL model has raised concerns since it carries the risk of excessive and unregulated lending in first time borrowers, ultimately leading the borrower to a debt trap. Instances of customer privacy breaches and illegal lending platforms have also risen, pointing towards the need for better systems.

Peer to Peer Lending

Peer to Peer (P2P) is another such business model in Fintech that has glaring problems. Peer to Peer lending platforms allow customers to get loans directly from other investors. The sites enable the transactions on a set interest rate based on the risk category of the loan applicant. A study by Procedia Computer Science identified the problems in the P2P lending model, including information asymmetry, problems determining credit scores, lack of regulation and policies, and moral hazards. The study further acknowledged the lack of research on improper billing and storage of privacy data, suggesting that the feasibility of lending technology should raise concern.

Web3 technologies

Web 3 is now a movement aiming to create decentralized Finance or ‘DeFi’ using blockchain technology. DeFi apps hold crypto-assets, which grew from 1.9 billion in July 2020 to 42.9 billion in March 2021, according to a report by organization for economic and co-operation and development.

DeFi apps are now being designed for financial activities of lending, trading, investing, transactions and crowdfunding. It has especially gained the attention of retail investors that are largely unprepared and unaware of the underlying risks.

According to our report, cryptocurrency saw 173% growth in the past 2 years. After the Supreme Court removed restrictions by RBI on the regulation of digital currencies in March 2020, India has no law to regulate investment, trading and lending of crypto assets.

The Current State

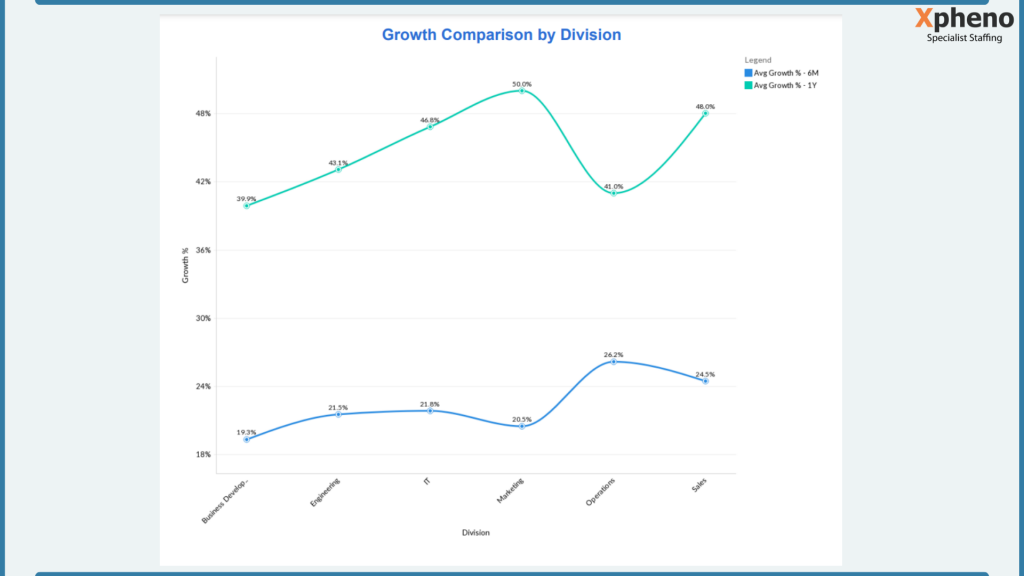

According to our data available, Fintech companies are aiming to scale their ecommerce, investment, banking and insurance services more through broadening their marketing and sales force, along with developing their product development systems. The data highlights that growth in sales and business development departments surpassed IT and Engineering in top fintech companies.

Companies are also working to increase profitability by improving distribution networks and leveraging existing markets.

Conclusion:

The Fintech Lending unicorns-to-be must note that the opportunities of inclusivity has also enhanced security and market risks that always exist in finance. Fintech has eased the processes, but availing payment and credit services, the risks to consumer protection, cybersecurity, market integrity, and threats of money laundering should not be overlooked. The lack of governance can lead to a fragile money-lending ecosystem. Companies and governments should collaborate to bring in credit regulation. Creating robust firewalling, strong governance and legal certainty can lead the Fintech lending ecosystem to become the future of finance.