After breaking out of a price rut that had constrained values below US$30 per pound since late 2016, the U3O8 spot price broke through that threshold in April 2020 and has been steadily gaining ever since.

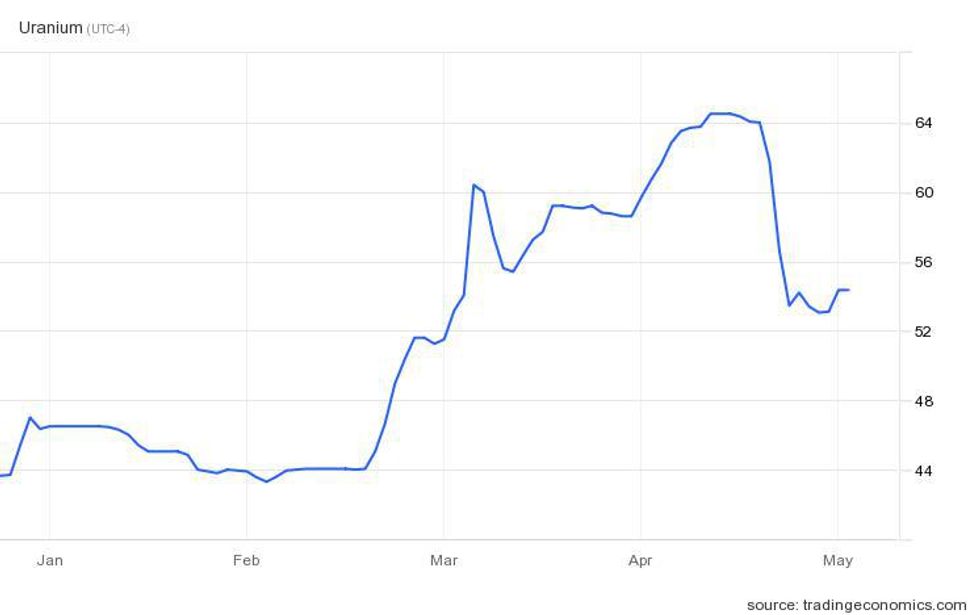

Following years of rangebound movement largely attributed to oversupply following the f*ckushima nuclear accident in 2011, the uranium market has spent the last two years making large gains — the commodity jumped 164 percent from US$24.70 on January 1, 2020, to US$64.51 on April 13, 2022.

When values hit a five year high in mid-April, it marked a 255 percent price uptick since 2017.

Uranium interest stoked by war in Ukraine, new products

Uranium's supply and demand fundamentals have been improving over the last five years, but much of its recent value increase can be attributed to geopolitical events and concerns around energy security and clean energy.

With oil and gas prices soaring, inflation hitting record levels and questions swirling around supply chain security, uranium has begun to garner more widespread attention.

“The first quarter of 2022 bridges the year past — the year of what we in UxC term secondary demand — and the current year — the year of geopolitics,” said Anna Bryndza, executive vice president at UxC. “There is no doubt that Russia’s war in Ukraine is reshaping not only the nuclear fuel industry, but the world at large.”

She noted that the war is also leading to greater interest in uranium from investors. “All of these are building on several years of uranium production optimization and impacts of the COVID-19 pandemic," added Bryndza.

Investment demand has been a key driver for rising uranium prices, with Sprott Asset Management launching both a Physical Uranium Trust (TSX:U.UN) and a Uranium Miners ETF (ARCA:URNM) in the last 12 months.

The two new vehicles have found fast success, with the trust stockpiling 55 million pounds of U3O8 valued at US$2.9 million by May 4, 2022, and the exchange-traded fund (ETF) amassing a net asset value of US$966 million.

When the ETF was announced, John Ciampaglia, CEO of Sprott Asset Management, noted investors' heightened attention on materials needed for the green energy transition.

“As global governments increasingly turn to nuclear energy to address the dual challenges of achieving energy transition and energy security, we expect demand for uranium to remain strong,” Ciampaglia said in a press release. “Uranium mining is critical to the clean energy transition and URNM provides investors with access to producers, developers, exploration companies as well as vehicles that hold physical uranium.”

During an April interview with the Investing News Network (INN), he also spoke about elevated energy prices, which have both reinforced the importance of nuclear energy and been a catalyst for investor appetite.

“Higher oil and gas prices are having two impacts on the uranium market. They are increasing the cost of production and shipping, but this is marginal,” he said. ”More importantly, they are highlighting a key advantage that nuclear power generation has over natural gas power generation.”

Ciampaglia went on to note that uranium and nuclear energy are ultimately more economical. “For nuclear power plants, the cost of uranium represents about 5 percent of total operating costs,” he said. “In sharp contrast, the cost of natural gas represents about 70 percent of the total operating cost for a gas-fired power plant.”

Additionally, nuclear power plants only need to be refueled every 18 months, while natural gas power plants require a constant feed of gas, making them more susceptible to supply disruptions and price shocks.

Growing nuclear capacity a critical factor for sector

Currently the U3O8 spot price is holding in the US$54 range, roughly US$10 off the five year high set in late April. However, this dip may be short-lived if supply becomes constrained by additional nuclear capacity.

According to the World Nuclear Association, there are 100 reactors that are planned and/or ordered on a global basis, with an additional 300 in the proposal phase. This will add to the 440 reactors presently in operation worldwide and the more than 50 that are in the construction process.

The US leads the way in nuclear power generation, producing 19 percent of its electricity this way. At the end of 2021, the country had 93 operating commercial nuclear reactors at 55 nuclear power plants in 28 states.

In a January survey conducted by the Associated Press, two-thirds of US states reported that nuclear power would help take the place of fossil fuels in their region.

“We are excited and not at all surprised to see so many states turning to nuclear energy given the value proposition that nuclear offers,” John Kotek, senior vice president of policy development and public affairs at the Nuclear Energy Institute, told INN in an interview.

Kotek added, “Right now, between state legislation being introduced and new nuclear projects underway in states like Tennessee, Washington, Wyoming and Idaho, nuclear energy is being discussed in half of the country, with the majority considering policies that will directly impact the industry.”

While rollouts in each state will be different, there is a common goal of reducing greenhouse gas emissions.

“There are various motivations behind these policies,” he said. “Many states are recognizing nuclear’s role in decarbonization, while others are looking at new nuclear for the potential economic impacts and reliability. The appetite to learn more about nuclear energy technology is clearly there and continuously increasing.”

On a more macro level, nuclear energy, and its vital role in decarbonization, is becoming a prominent topic in the energy sector and beyond. In fact, during the World Nuclear Fuel Cycle conference held at the end of April in London, Sama Bilbao y León, director general at the World Nuclear Association (WNA), spoke about nuclear energy being taken seriously for the first time.

The head of the WNA explained that if society plans to reach its emissions-reduction goals without leaving anyone or any nation behind, “We need to utilize all the proven solutions available.”

She told attendees, “Nuclear energy is the only energy that can not only provide low-carbon electricity, but can also provide low-carbon heat. This provides us with game-changing opportunities to actually decarbonize not just power grids, but the entire economy.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

- David Talbot: Uranium Supply, Demand and Prices — What to ... ›

- Lobo Tiggre: Gold, Silver and Uranium — What to Watch as "New ... ›

- U3O8 Price Update: Q1 2022 in Review | INN ›

- John Ciampaglia: Uranium Advice for Investors | INN ›

- Uranium Outlook 2022: Prices Have Broken Out, How High Will ... ›

- Uranium Outlook 2022: Prices Have Broken Out, How High Will They Go? ›

- U3O8 Price Update: Q1 2022 in Review ›

- U3O8 Price Update: Q1 2022 in Review ›

- U3O8 Price Update: Q2 2022 in Review ›

Related Articles Around the Web