All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Are you looking to trade penny stocks successfully? 💎

Many investors are, yet very few manage to do so—penny stocks are known for their high volatility and risk. That being said, the potential of high returns in a short time is too good to resist for many. One way to help you turn the odds in your favor is by choosing the best trading platform for you.

That’s because penny stocks are usually valued correctly—they are truly only worth pennies at best. And, to find the ones that might explode in the future, you need something to help you separate the wheat from the chaff. That’s where trading software comes in.

Each platform has some distinct features that set it apart from the competition—Robinhood is known for its great, intuitive interface and simplicity.

In its Q2 report in 2021—the first as a public company—the company reported a whopping 130% year-on-year increase in the number of users. Robinhood attracts many, often first-time investors because of its user-friendly interface and commission-free trading.

Robinhood also offers a wide variety of penny stocks and a few helpful tools, but these aren’t worth much when you don’t have the right knowledge to use them. To find the penny stocks you’re looking for and avoid costly mistakes, you need to educate yourself on Robinhood and its penny stock offering.

In this article, we’ll show you how buying penny stocks on Robinhood works, how to find the best ones, and the risks that come with buying penny stocks on Robinhood. We’ll also take a look at the pattern day trading rule and how Robinhood squares up to the competition.

What you’ll learn

- Penny Stocks on Robinhood

- Step by Step: Robinhood Penny Stocks

- Buying Penny Stocks on Robinhood

- What are the Risks?

- Pattern Day Trading Rule

- Why Robinhood is Popular Among Traders

- Final Words

- FAQs

Penny Stocks on Robinhood: Explained 🪙

Robinhood—just like many of its competitors—allows its users to buy and sell penny stocks. They are traded like any other stock on the platform, but require a little extra effort to find.

Where Are Penny Stocks? 📍

Thanks to its ease of use, finding penny stocks on Robinhood isn’t rocket science. After logging in to the website or app, you’re greeted by a simple but clear interface—giving you an overview of your portfolio, the day’s biggest movers, and more.

On the desktop version homepage you can also select any sector you’re interested in and you’ll get a list of stocks active in that particular sector. To find penny stocks, you can filter out stocks with a price tag above $5—penny stocks are stocks under $5.

With a variety of other filters at your disposal, you can narrow down your search to find the penny stock you’re looking for. Once you’ve made up your mind and you’re ready to pull the trigger, it might be useful to know how to buy.

How to Pull the Trigger 🔫

Luckily, the process of buying is also made quite easy by Robinhood—it doesn’t require more than a few clicks. After depositing funds on the platform and selecting the stock of your liking, you’ll have a variety of order types to choose from.

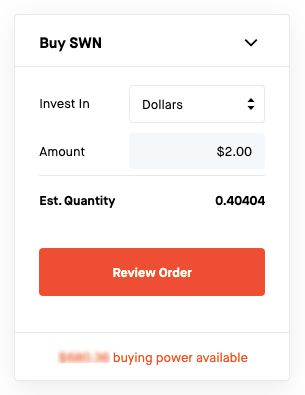

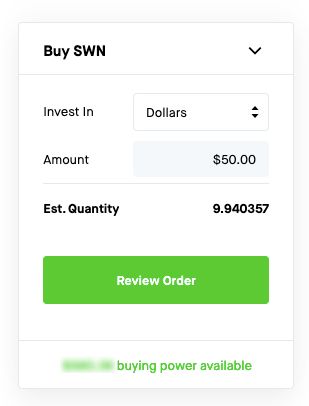

A neat feature of Robinhood is the possibility to buy fractional shares—you can choose a dollar amount or a specific number of shares when buying. Don’t forget to review your order—check if everything is correct.

If everything checks out, you submit the order and you’re off to the races. Keep in mind to always do your due diligence before buying any investment—you wouldn’t be the first one getting burned trading penny stocks.

Robinhood’s Penny Stock Offering 💰

With Robinhood, you’ll be able to choose from hundreds of different penny stocks across all major sectors—with prices ranging from $0.10 to $5. Although you’ll have much to choose from, the drawback is that there are also many penny stocks you won’t have access to.

This is because Robinhood only offers penny stocks that are listed on the NASDAQ or the New York Stock Exchange (NYSE)—two of the biggest exchanges in the world. This makes access to penny stocks on Robinhood relatively limited because most penny stocks trade over-the-counter—or OTC.

The OTC market—also known as the “pink sheet” market—is much easier to list on than the big exchanges. Thanks to fewer requirements, the penny stocks on OTC markets are usually much more volatile and less liquid—making it harder to buy and sell them.

On the upside, thanks to stricter listing requirements, penny stocks available on Robinhood are (relatively) less risky than those on the OTC markets. Don’t load up the truck just yet, we still have to get to the risk section!

How About the Competition? ⚔️

To see how Robinhood’s offering stacks up to the competition, we’ll take a look at the leading penny stock brokers. Although all brokers serve the same purpose—trading securities—each of them has its unique benefits and downsides.

The biggest difference is that many of them—E*trade and Charles Schwab, for example—do offer access to OTC markets. That’s in addition to penny stocks listed on major exchanges and—in the case of some brokers—also international penny stocks.

Whereas Robinhood only offers access to US-listed penny stocks, some competitors—such as Interactive Brokers—give you the possibility to invest across many markets in dozens of countries.

Fees

Commissions

$0

$0

Account minimum

$0

Starts at $3*

Minimum initial deposit

$0

$0

General

Best for

DIY stock trading

New investors

Highlight

Pioneer of commission-free stock trading

Value-based investing

Promotion

Free stock

$5 bonus¹

Rating

8.0/10Visit Robinhoodon Robinhood's website

8.0/10Visit Stashon Stash's website

Fees

Commissions

$0

Vary

Account minimum

Starts at $3*

$0

Minimum initial deposit

$0

$0

General

Best for

New investors

Active traders

Highlight

Value-based investing

Huge discounts for high-volume trading

Promotion

$5 bonus¹

Rating

8.0/10Visit Stashon Stash's website

8.0/10Visit Interactive Brokerson Interactive Brokers' website

Fees

Commissions

$0

$0

Vary

Account minimum

$0

Starts at $3*

$0

Minimum initial deposit

$0

$0

$0

General

Best for

DIY stock trading

New investors

Active traders

Highlight

Pioneer of commission-free stock trading

Value-based investing

Huge discounts for high-volume trading

Promotion

Free stock

$5 bonus¹

Rating

8.0/10Visit Robinhoodon Robinhood's website

8.0/10Visit Stashon Stash's website

8.0/10Visit Interactive Brokerson Interactive Brokers' website

Whether access to OTC markets and international markets is a benefit is in the eye of the beholder. Most penny stocks are listed on OTC markets for a reason—they don’t meet the criteria for a listing on one of the big exchanges.

If you’re an experienced and active trader, the lack of OTC and international penny stocks might be a deal-breaker. For others, however, it might be a benefit as the penny stocks on Robinhood are generally more liquid and less volatile.

Finding Penny Stocks on Robinhood: Step by Step 🔍

There are hundreds of penny stocks listed on Robinhood, but we can’t buy them all—that would make for a very chaotic portfolio. Luckily, it’s easy enough to filter out penny stocks you aren’t interested in on Robinhood’s website.

Select a Category 🤏

On the homepage—underneath the graph of your portfolio’s performance—you’ll see a section called “Trending Lists”. As the name reveals, this section shows us the most popular investing categories on the platform.

Click on “show more” and you’ll see a list of different sectors and categories:

Next, simply click on the one you’re interested in. You’ll see a list of all companies in that sector. To customize this list—and find only those that offer penny stocks, you’ll have to click the ‘filter’ button:

Now, we want to select the companies with stocks trading between $0 – $5. We do so by changing the price range on the left side of the screen—by choosing a maximum price of $5.

Now that we found the penny stocks in one particular sector or category—like technology—we can narrow down our search, even more, to find the droids we’re looking for.

All of the other parameters are right below the price cap button in the box on the right of your screen. Keep in mind that popular collections and the filter system are only available on the desktop version.

Let’s Sort It Out 🏦

Are you looking to buy the dip or—in contrast—buy into a stock with a lot of good momentum? Robinhood lets you sort by stocks trending down or up under “Price Change”—remember that the trend is not always your friend.

Select “rising” or “falling”—depending on what you’re looking for—and the time period. If you’re looking for a stock that has been rising for a month, simply click on rising and change the number of days to thirty.

Are you looking for a small or big company? Sorting by market cap will help you find companies of the right size. Under “Market Cap” you can choose between small, middle-sized and large companies.

We can also sort by analyst ratings—this way we’ll only see stocks analysts have a positive—or negative—opinion on. Under “Analyst Ratings”, select 50% or higher for stocks with good analyst ratings or 49% or lower for bad ones.

Penny Stock Research 🔬

Although these parameters are helpful tools, one downside of Robinhood is the lack of important company data and technical analysis tools—crucial for penny stock traders. This makes it hard to do any thorough research on penny stocks on Robinhood itself.

To have a shot at success with penny stock trading, good research and technical tools are indispensable. Since Robinhood lacks these, you’ll need to venture out to other platforms and websites before pulling the trigger on Robinhood.

One feature missing on Robinhood is “paper trading”—the possibility to practice with fake money. This—especially when it comes to beginners—is a useful feature that’s offered by some of Robinhood’s competitors—such as Webull.

How to Buy Penny Stocks on Robinhood 💸

After all your thorough research and all-nighters looking at charts, you made up your mind and you’re ready to put your hard-earned money to work. After connecting your bank account with Robinhood, you put funds on your account and you’re ready to roll.

Log into Robinhood and find the stock you want to buy—remember the last section?

Click on the stock and you’ll be taken to the stock page —here you will see the stock’s chart and some basic info.

In the box on the right side of your screen, you can enter the number of shares or dollar amount you want to invest. Robinhood will give you the option to choose between different types of orders—crucial for risk management.

Order Types 📊

When you click on the three dots in the upper-right corner, you’ll see a list of available order types. Before you select one, let’s have a closer look at some of the most common ones—market, limit, and stop-loss.

The default setting will be a market order—meaning that you buy or sell a stock at the market price at that very moment. When you choose a limit order, an order will only take place at the limit you chose or at a better price.

When you have a specific price in mind, a stop order might be a good option. A stop order is an instruction to buy or sell automatically after a stock reaches a predetermined price. The stop order—also known as a stop-loss—can greatly minimize your risk of trading penny stocks.

Review ⭐

After you’ve chosen an order type and entered how much you want to invest, click on “Review Order’’ and carefully check if everything looks alright. Make sure you review everything carefully—Robinhood won’t give you back your money after mistakes.

When you’re ready to submit your order, simply click on the “buy” button—or swipe up if you’re using the app. Congratulations on your first buy—your new addition will show up in the portfolio for you to follow.

What Are the Risks? ⚠️

It’s an understatement to say trading penny stocks successfully isn’t easy, but using a great platform can increase your odds. Robinhood is one of the most popular platforms for trading penny stocks around—but is it also the best?

That’s a hard question to answer with so many popular stock trading apps out there—instead we’ll look at some of the risks Robinhood takes out—or adds—to trading penny stocks and stocks in general.

Penny Stock Risks ⚡

In an ideal world, we’d all buy safe blue-chip stocks or funds and be satisfied with the average market return. But in reality, many of us look for more exciting returns, and those normally come with increased risk.

So, let’s have a look at the risks penny stock traders face on any platform first—spoiler, there are many. One of the main difficulties with researching penny stocks is the lack of information on them—that’s because often there’s barely a track record.

Penny stocks normally come from small-sized companies and they’re rarely followed by analysts—not being listed on big exchanges makes them illiquid assets and not interesting to follow for analysts.

This illiquidity also makes it harder to buy and sell your stock—and what’s a great paper gain worth when you can’t sell? It also causes penny stocks to be way more volatile than “big” stocks—be ready to face large swings.

Are you interested in investing because of the dividends? Then, you might have to skip this category entirely. Penny stocks rarely pay dividends—and dividend investing is just not as exciting without the dividends.

Robinhood Risks 🚨

Robinhood has faced its fair share of controversy—most notably criticism about the company taking advantage of young traders. Others would say the platform empowers young traders—either way, you always have to be aware of the risks you’re taking.

As mentioned before, Robinhood’s selective offering—compared to other platforms—does take out some of the risks of trading penny stocks. On the other hand, the platform lacks important tools which are essential for making good trades.

There are plenty of charts on Robinhood—but for performing technical analysis traders will need to go to other websites. Since there’s often a lack of good fundamental information on penny stocks, technical analysis is a very important aspect of penny stock trading.

It’s also hard to find much fundamental information about a penny stock on Robinhood. You can scroll through news articles and some basic information—for information on a stock’s dividend or to check a company’s track record, you’ll have to venture out to other websites.

The Pattern Day Trading Rule 📋

Who doesn’t love some good regulation?

That’s right, most of us—but we still have to deal with it regardless. Day trading is no exception—there is a rule called “Pattern Day Trading” which will likely affect you when you decide to day trade.

Simply put, this rule prevents traders with a small balance from making more than three intraday trades in any given 5-day period—trading days, not weekdays. If you have less than $25.000 in your account, this rule applies to you.

Keep in mind that margin doesn’t count here—only cash and securities. If you violate the PDT rule, you won’t be able to day trade for three months. A solution to PDT is to make sure you have more than $25.000 in your account before the end of the trading day.

A Possible Workaround to PDT? 🤔

Luckily, there’s another way to avoid triggering the PDT rule—by downgrading to a cash account. Robinhood offers three different types of accounts—cash, instant, and gold. The PDT rule does not apply to cash accounts—but there’s a catch.

Cash accounts don’t have access to instant deposits and instant settlements—good to keep in mind before downgrading. When you sign up for a Robinhood account, you’ll automatically get an instant account—to downgrade, you’ll need to contact the support team.

Simply send them an email and let them know you’re looking to downgrade—there’s an extra step if you have a gold account. You’ll have to downgrade from gold to instant first by going to “settings”. Once there, tap “Robinhood Gold” and then “Downgrade from Gold”.

Why Robinhood is Popular Among Traders 🤲

Although Robinhood does have its drawbacks, the platform remains one of the most popular for trading penny stocks. It offers hundreds of penny stocks to choose from and the search capabilities to easily find the penny stock you’re looking for.

It’s also geared towards beginners, which makes it very accessible to anyone—no matter the trading experience. Unlike some of its competitors, Robinhood is very user-friendly—making it easy to trade and to find information.

The different order types—especially the stop-loss—allows traders to manage their risk better. That’s especially important for risk-hungry penny stock traders—even for a genius trader.

The Popularity of Penny Stocks 💳

That’s all well and good, but why do so many traders focus on penny stocks, to begin with? The answer is hardly surprising—traders are lured in by the astronomical returns of certain penny stocks in the past.

Hoping to copy the success, traders take on above-average risk in the hope of realizing above-average returns. It’s certainly possible to achieve high returns with penny stocks, but it doesn’t take long to find stories of people losing their life savings trading penny stocks.

Final Words🏁

Trading penny stocks is a risky endeavor and navigating the world of trading platforms can be a daunting task for—new—traders. That makes educating yourself even more important, so you’ve taken an important step by reading this article.

You’ve learned how buying penny stocks on Robinhood works, how to find the best penny stocks on the platform, and the risks of trading penny stocks on Robinhood. We’ve also taken a look at the Pattern Day Trading rule and why trading penny stocks—on Robinhood—is so popular.

Robinhood Penny Stocks: FAQs

Are Marijuana Stocks Available on Robinhood?

Yes, there are many marijuana stocks available on Robinhood. You can find them by going to “popular lists” and clicking on “cannabis.” To narrow down your search to marijuana penny stocks, change the maximum price to $5.

Is It Possible to Get Rich off Penny Stocks?

Yes, it is possible to get rich off penny stocks if you have a strategy and luck on your side. Trading penny stocks—however—remains very risky compared to trading other types of stocks and assets in general.

Has Apple Ever Been a Penny Stock?

No, Apple has never been a penny stock—adjusted for its stock splits, Apple’s historical low is a share price of around $8. A penny stock has a share price of under $5—as defined by the SEC.

Is There a Limit on How High a Stock Can Go?

No, there is no ceiling on how high a stock’s share price can go—theoretically. Some of the largest and most established companies were once penny stocks with a share price of only a few dollars.

Is Robinhood Stock Available on Robinhood?

Yes, you can buy Robinhood stock on Robinhood under the ticker HOOD as it’s listed on the Nasdaq exchange. Interestingly, Robinhood allocated a sizable portion of its IPO shares to individual investors in an attempt to democratize the IPO process.

All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

About the author

Tim Fries

Tim Fries is the cofounder of The Tokenist. He has a B. Sc. in Mechanical Engineering from the University of Michigan, and an MBA from the University of Chicago Booth School of Business. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firm specializing in sensing, protection and control solutions.