Even if Federal Reserve Chairman Jerome Powell and his cohorts stopped hiking policy rates soon, the 30-year fixed mortgage rate still would climb to 10%, according to Christopher Whalen, chairman of Whalen Global Advisors.

That’s because the Fed’s torrid pace of rate increases in 2022 takes time to seep back into mortgage rates, especially with the fed-funds rate already jumping to a 3%-3.25% range in late September, from almost zero a year before.

“Lenders only slowly adjust their rates,” Whalen told MarketWatch. “They are not used to seeing rates moving this fast, and typically would change rates only once a month or once every other month.”

Borrowers pay a premium above risk-free Treasury rates on mortgages to help account for default risks. The 30-year Treasury rate TMUBMUSD30Y,

Freddie Mac on Thursday said the 30-year mortgage rate was averaging 6.94% in its latest weekly survey, a 20-year high that has severely curtailed demand for new home loans.

But with U.S. inflation showing no signs of a clear pullback from a 40-year high, expectations have been running high for the Fed to increase its policy rate by another 75 basis points at its November meeting, and potentially by the same amount again in December, according to the CME FedWatch tool.

The CME odds on Thursday favored a 4.75%-5% fed-funds rate to kick off February.

“There is a lag effect in mortgages,” Whalen said, adding that even if central bankers decided to hit pause on additional rate increases after their December meeting, the 30-year mortgage rate still would “easily touch 10% by February.”

Whalen, an investment banker, author and specialist focused on banking and mortgage finance, urged the U.S. Securities and Exchange Commission in 2008 to move complex and opaque derivatives “back into the daylight,” after banks and investors saw hundreds of billions of dollars in losses tied to structured debt, including subprime mortgage exposure. He also provided testimony to Congress in 2009 about systemic risks of the banking industry.

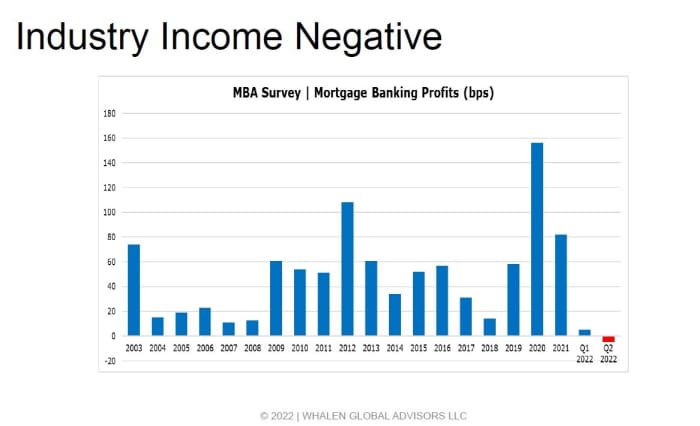

Now, Whalen sees another major shakeout coming in mortgage banking as profitability continues to get pinched (see chart) and the housing market sputters.

Importantly, Whalen also sees potential for home prices to give back all of their pandemic gains if rates stay high for all of 2023.

That’s a bigger call than estimates for a 10%-15% correction in home prices from prices that surged 45% nationally during the pandemic.

But Whalen pointed to speculative home flipping volumes that reached almost $150 billion, or 10% of total home sales in 2022, and the cold blanket of double-digit mortgage rates as catalysts for a steeper home price retreat.

Economists at Mizuho Securities on Thursday pegged median home sales prices as down 2.5% from their peak, in a client note, and characterized the housing market as “deteriorating,” but mostly in line with expectations given the sharp jump in mortgage rates.

Mortgage loan rates can be traced directly to the mortgage-backed securities, or MBS, market, which are bonds that trade on Wall Street, mostly with government backing, that finance the bulk of the near $13 trillion U.S. mortgage debt market.

With the Fed’s race to raise rates, it has jolted financial markets, sunk stocks and led to a stark decline in mortgage bond issuance this year, while also making it more expensive for corporations, municipalities and households to borrow as part of its inflation fight.

“It will take us months to get the bond market and lending market in sync so people can make money again,” Whalen said.

Stocks closed lower for a second straight day on Thursday, leaving the S&P 500 index SPX,

Absolutely, let's delve into the concepts mentioned in the article you provided. The piece discusses critical financial and economic indicators, intertwined with the Federal Reserve's policy impact on mortgage rates and broader market conditions.

-

Federal Reserve Policy Rates and Mortgage Rates: The article touches on the Federal Reserve's actions to increase policy rates. Chairman Jerome Powell's role in setting these rates affects various financial markets, especially mortgage rates. It explains the lag effect between the Fed's rate adjustments and their manifestation in mortgage rates, influenced by lenders' gradual adjustments due to the unprecedented pace of rate changes.

-

30-Year Fixed Mortgage Rates: Christopher Whalen's insight into mortgage rates rising to 10% despite potential halts in Fed rate hikes underscores the intricate relationship between Fed policy changes and mortgage rates. Lenders' slow rate adjustments, influenced by the premium borrowers pay above risk-free Treasury rates, play a pivotal role here.

-

Treasury Rates and Mortgage Bonds: The article mentions the 30-year Treasury rate reaching its highest since 2011, impacting the mortgage market. The link between mortgage loan rates and Mortgage-Backed Securities (MBS) is significant. MBS, essentially bonds backed by mortgages, plays a crucial role in the U.S. mortgage debt market, affecting mortgage loan rates directly.

-

Impact on Housing Market and Home Prices: Whalen's forecast of a potential housing market shakeout and a steep decline in home prices due to speculative activities, high mortgage rates, and decreased profitability in mortgage banking highlights the vulnerability of the housing sector under these conditions.

-

Market Reactions: The repercussions of the Fed's rate hikes on financial markets, including stock market declines, increased borrowing costs for corporations, municipalities, and households, are emphasized. The article also touches on the impact of these actions on mortgage bond issuance and the synchrony required between the bond market and lending market for profitability.

-

Economic Indicators: Discussions around inflation rates, the S&P 500 index, the 10-year Treasury rate, and their respective highs or declines are indicative of the broader economic landscape affected by these financial shifts.

This article provides a comprehensive look at the intricate connections between the Federal Reserve's policy decisions, mortgage rates, bond markets, housing sectors, and broader financial markets, showcasing how these elements intertwine to shape the economic landscape.