Why Use Forex Hedging Strategies?

The hedge forex strategy is a common trading method that can be profitable even in your first trade. Most traders prefer this strategy because it protects them from price fluctuations due to exchange rates.

Even if there is no guarantee that risks will be eliminated, forex traders can benefit from this strategy as it minimizes losses or limits the risks to a specific amount. This helps to protect your interest from market volatility.

Professional traders use this strategy mostly when they predict the market will favor their positions. Instead of entirely closing the trade, they take the trade in the opposite direction.

It is an excellent strategy to use if you are positive about your speculations. It is a matter of confidence, having enough knowledge about market swings, and the willingness to risk your trades.

Make Your Forex Trades Simple

Forex scalping is not for everybody. You must be able to sit behind your computer for hours and also think and act quickly. This is why you need a simple forex scalping strategy that will guide you and help you avoid mistakes. Remember, you will be placing trades throughout the day, and sometimes it can become demanding. A good strategy will help ease your work.

Make Consistent Profits

In forex scalping, you can make a lot of profits, but then again, you can also make losses. Like other trading styles, this one is also risky, and that is why many traders consider using the best forex scalping strategies to ensure they are making consistent profits. Another thing is that scalping strategies help you avoid big losses as it allows you to know where to set your stop loss.

When Should I Use A Hedging Forex Strategy?

If you want to use forex hedging strategies to trade, you must understand the market. This means you must know when the markets are volatile because not all hours are suitable to forex hedge.

Apart from that, you have to follow forex market updates to know when the currency pairs are about to decline. It will help you know when to hedge.

In most cases, traders are advised to trade during the market opening hours as there are overlaps. Overlaps mean that there are higher price ranges, which creates opportunities.

Alternatively, traders can take advantage of indicators to know when to hedge. One of the best indicators to use is;

Moving Averages

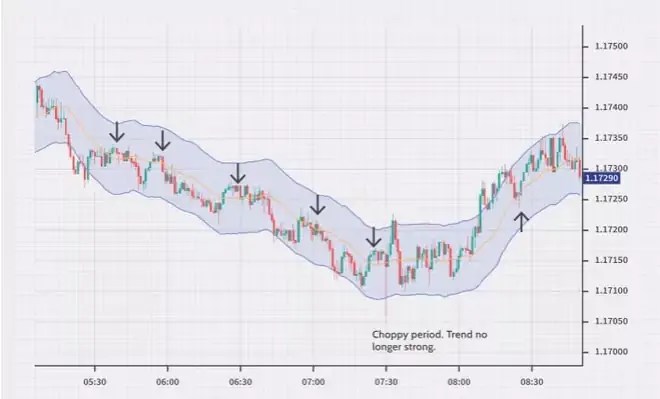

This type of indicator is price-based and shows an average security price in a given period. Using themoving average indicatoris a suitable way to determine market momentum, know about trends, and understand support and resistance areas.

Many traders use this indicator to predict charts, and it can also help you know when prices are about to fluctuate. Although it is not used for predictive purposes, it can help you analyze and interpret data which will help you understand how the market is performing.

The Best Forex Hedging Strategies

There are threehedging strategiesforex traders use to minimize risks. You can also use these strategies as they can be great methods of protection against exchange rate fluctuations. They include:

Taking an Opposite Direction

In normal circ*mstances, trades usually open trade and select one direction depending on their prediction. When it comes to this hedge forex strategy, you can place your trades on the long and short positions. In short, you can open a long trade and a short trade. This will depend on how you have interpreted the data and the market predictions.

Pros and Cons of Day Taking an Opposite Direction

Pros:

- You can make money from the second trade

- There is no need of using another currency pair

Cons:

- The method requires a closing strategy

Trading with Forex Options

This is the best hedging forex strategy as it helps you safeguard your positions against volatility. When trading using this strategy, you can choose either buying call options or selling put options.

For example, if you are long on a forex pair, you can buy the put option if you feel various factors will influence the market, and the pair will fall.

Pros and Cons of Forex Options

Pros:

- Limits your exposure, which helps to limit losses

- It protects your equity portfolio

Cons:

- It requires experience and the right knowledge

Hedging with Correlating Currency Pairs

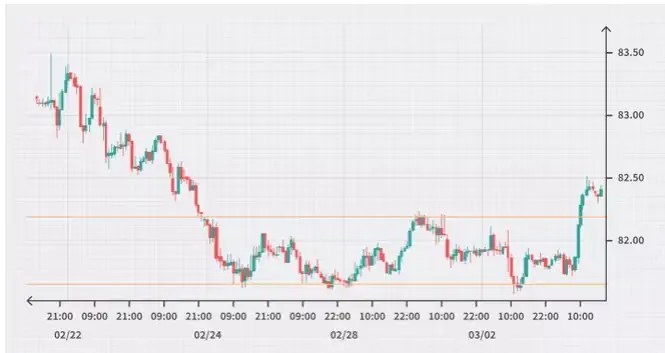

This is another hedging strategy forex traders love. It involves using two negatively forex pairs like USD/CHF and EUR/USD.

In this case, the counter currency is the USD, and because both are negatively correlated forex pairs, when the USD/CHF falls, the EUR/USD will most likely rise.

You can use the information to go short on USD/CHF and long on EUR/USD. By having both trades open, you will be protecting your exposure to the US dollar. You can use various currencies to apply this strategy.

Pros and Cons of Correlating Currency Pair hedging strategy

Pros:

- You can make profits on one of the pairs or both

- You can easily predict how various currencies will perform

- It has multiple opportunities

Cons:

- It is very risky as you are exposed to volatility in both forex pairs.

- You need to have a good understanding of currency pairs by using the counter currency.

How Do I Start Forex Hedging?

Forex hedging is mainly used by advanced traders who have a deep understanding ofmarket volatility. If you are also ready to use a forex hedging strategy, here are the steps you will need to follow:

Open an Account

Use any trading platform to open a live account. This is usually a simple process, and the company will guide you.

Select a Currency Pair

After getting an account, choose your preferred currency pair. There are many forex pairs you can select. Also, do your research.

Choose Your Hedging Strategy

Above are some forex hedging strategies you can use. Select one and make sure you understand it in depth.

Stay Updated on Forex News

In forex trading, following the news is crucial. It allows you to predict market changes and which positions to open.

Get a Mobile App

Download an app that will provide you with important notifications on trading opportunities.

Use Technical Indicators

Forex indicators help make the trading process effortless. It is always essential to use them to know when to enter and exit a trade.

Apply Risk Management

Risk management skills are part of forex trading. Ensure you understand the concept of take-profit order and stop-loss to minimize losses.

Guides About Trading Strategies

Frequently Asked Questions About Forex Hedging Trading Strategies

-

Is forex hedging profitable?

If you have the right skills, forex hedging can be very profitable.

-

Is it hard to hedge in forex?

Forex hedging strategy requires you to practice and understand the market. Once you understand these things, hedging won’t be hard.

-

When should I take profits when hedging?

You can take profits from the second trade in forex hedging. This is when the market has moved against your first trade.