Updated - March 16, 2024 at 09:18 PM.

The yellow metal remains an attractive investment option despite ruling at all-time highs

By Hari ViswanathBL Research Bureau

The yellow metal has been hitting all-time highs in recent days and reached a peak of $2,182.75 last week. This is when stock indices too globally are hitting all-time highs. Interest rates too are at all-time highs as far as current rate cycle is concerned. Such a trifecta, while not unique, is usually rare.

This is because, when economic growth is good, investors prefer stocks over bonds and gold. Further, when interest rates are high, as they are now, then too investors typically tend to prefer bonds and fixed income over gold, given the high yields.

So amidst this, what is driving the yellow metal to highest point?

As such there is no clear way to value gold. Its price and fluctuations in it are a reflection of investor perception of various macro economic variables and expectations on how it will play out in the future. Geopolitical uncertainty, concerns on inflation are some of the factors that result in investors flocking to real assets such as gold.

This time, a confluence of such factors appears to be creating a ‘goldilocks’ spot for gold now. Here are the factors driving it.

Double talk on inflation

After being completely wrong and terming inflation as transitory, developed market central banks did make up for the lost ground in 2022 with unprecedented increases in interest rates. However, post some hawkish stance till the middle of last year, there have been confusing signals with different members of the US FOMC giving contradictory statements on inflation expectations and timing of interest rate cuts.

Recent comments from the Fed Chair have been contradictory too. While Jerome Powell told the House Banking Committee on March 7 that more evidence is required that inflation is declining and the need to be careful on timing of interest rates cuts, he diluted this hawkishness the very next day while answering questions from the Senate Banking Committee, saying ‘interest rate cuts are not far away.’

These statements have only added to questions on the seriousness of the central bank to bring inflation down to the target 2 per cent, especially when recent inflation prints in the US for the months of January and February have been coming in hotter than expected. This is one factor that is driving gold today.

As we mentioned above, when interest rates are high, investors prefer bonds over gold. However, this is only when they are convinced that the central bank has kept interest rates at the level required to tame inflation. When that confidence is lacking, gold tends to outperform. It is not just US Fed, but lack of clarity from the ECB too has added to the momentum on gold.

Geopolitics and central bank buying

Total gold demand in 2023 has been highest on record at 4,899 tonnes, according to World Gold Council (WGC). Significant contribution to this was from central banks across the world. Their net purchases in 2023 stood at 1,037 tonnes, which is only slightly lower compared to the record net purchases of 1,082 tonnes they made in 2022.

Central banks do not seem to have done with the purchases yet. They added 39 tonnes to gold reserves in January 2024, more than double of 17 tonnes made in December 2023. So, central banks have been net buyers for eight consecutive months. Turkey and China were the leading buyers, as per WGC. Market observers cite that those purchases, especially by China, extended to February as well.

The Reserve Bank of India bought 9 tonnes in January this year, largest monthly addition since July 2022. RBI’s gold holdings now stand at 812 tonnes.

Central banks buying gold could be due to two reasons. One is their need to diversify from reserve currencies, especially when inflation is high and the reserve currencies can lose some value.

But the other major factor now that could be driving central banks of countries such as China and Russia is geopolitics. The sanctions imposed on Russia post the onset of the Russia-Ukraine war highlight the financial risks for some belligerent countries, of which China is one. As the second largest holder of US treasuries after Japan, given risk of sanctions if and when it takes the military route to unify Taiwan, gold is one asset it will look to continue to buy with its reserves. In recent years it has already been an aggressive buyer of gold.

Global debt

While the above two factors reflect demand for gold based on current risks and uncertainties, another factor that,in a subtle way, could be boosting gold demand is the question mark on how the monetary and fiscal experiments that global central banks and governments embarked on to deal with economic crisis will unwind. In their aggressive attempts to support economic growth at any cost, debt levels have zoomed.

Advanced economies such as the US, Japan, the UK, France, etc, have piled on debt since the global financial crisis. For example, in the US, government debt as a percentage of GDP has zoomed from around 60 per cent in 2007 to over 120 per cent now. Government debt as percentage of GDP is well over 200 per cent in France and Japan. What are the long-term consequences of excessive money printing? Answers to these are not clear, but real assets such as gold are good hedges in case there is no smooth unwinding. This too is factor that could be putting the yellow metal in a sweet spot.

Takeaways for Indian investors

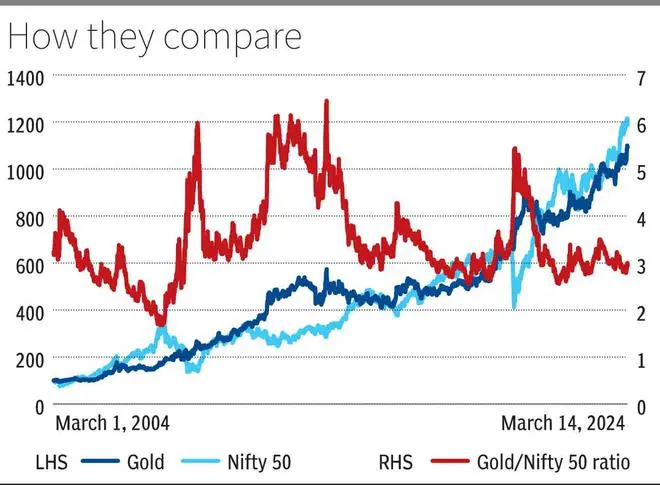

Gold in general has turned out to be as good an investment as equities in the long term and in some cases even better. For example, in the last 20 years, gold, in dollar terms, has given CAGR returns of 9 per cent, beating S&P 500 CAGR of 8 per cent and Dow Jones’ 7 per cent CAGR. Gold in the last 20 years in rupee terms has grown at a CAGR of 12.74 per cent as against the Nifty 50’s CAGR of 13.5 per cent.

More importantly, historically, during crisis times, gold has proven to be a perfect hedge in a portfolio. During calendar year 2008, when Nifty 50 was down 52 per cent, gold prices in India were up by 29 per cent. Similarly in year 2020, another crisis year for the global economy with a short but deep bear market, while Nifty 50 managed to end in the green with returns of 17 per cent, gold performed better with returns of 28 per cent.

In current circ*mstances too with markets at all-time high levels with risks of correction due to high valuations, gold can be a good diversifying investment for investors. Another interesting factor to note is the Gold/Nifty 50 ratio (see chart). The ratio (10 grams gold price/Nifty 50), currently at 2.97, is 15 per cent below its 20-year average of 3.5. During times of previous markets downturns when stocks fell and gold prices went up, it has peaked at above 5 times.

Given the structural factors mentioned above driving gold prices as well as proven historical performance as good hedge, gold remains an attractive investment option in the portfolio of long-term investors, despite the fact that it is ruling at all-time highs. Gold funds/ETFS, Sovereign Gold Bonds remain good options for investors who don’t want to deal with the hassle of buying and storing physical gold.

With inputs from Akhil Nallamuthu

Related Topics

- gold bond

- gold and precious material

- ETF

- stock market

- commodity markets

- RBI and other central banks

- Dow Jones

- Nifty

COMMENT NOW

COMMENT NOW