In the stock market, certain companies shine brighter than others. They have the potential for high returns and steady growth. The article delves into the strategies of three companies that have captured attention with solid performance and strategic maneuvers.This has led to this list of high-return stocks.

On the list. The first one recently made headlines with its stellar earnings, boasting a surge in both stock price and revenue. The earnings reflect the company’s high financial standing and operational edge. Meanwhile, the second one is delivering heavy growth in operating margin and EPS. It is at the edge of semiconductor photomasks. On the other hand, the third one’s solid surge in topline and operating income during Q4 2023 signals its growing market lead in the business services domain. This company sets ambitious targets for 2024 and prepares for the strategic Webhelp merger.

Read more to learn about these companies’ continued growth trajectory and expansion. Learn the fundamentals working behind these high-return stocks.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Palantir (PLTR)

Source: Spyro the Dragon / Shutterstock.com

Palantir (NYSE:PLTR) reported a blockbuster performance in its fourth-quarter earnings, as the stock surged by more than 30%. The surge was driven by a 20% increase in revenues, which reached $608 million year-over-year, coming in above the consensus estimate. Its adjusted net income nearly doubled, underscoring that the company’s financial health and operational efficiency remain very robust.

Additionally, the core of the Palantir success story is based on the two leading platforms (Gotham and Foundry) for the public and commercial segments, respectively. More precisely, strong growth was posted on the commercial side of the business, especially in the U.S. market, where commercial revenue grew by 70% in the second half of the year. Hence, this reflects the power of its innovative AI-based tools and the ability to land large enterprise customers and compete well with rivals in the cloud-based analytics landscape. All in all, it’s one of those high-return stocks to buy.

Looking ahead, Palantir expects the key commercial drivers of its business, like network effects from deployments with current customers, expanding relationships into more parts of client organizations, and launching new products and services, to continue to perform well.

Not surprisingly, revenue projections for the upcoming quarters suggest an 18%–20% increase. This is slightly adjusting expectations but still promising in the context of the company’s long-term vision. The forecast denotes a shift in its strategy toward sustainable growth amidst a competitive and fast-changing market.

Finally, Palantir’s journey through the fourth quarter of 2023 into 2024 is a narrative of strategic realignment, operational efficiency, and market adaptation. Hence, the company’s financial performance and strategic initiatives underscore a commitment to innovation, growth, and value creation.

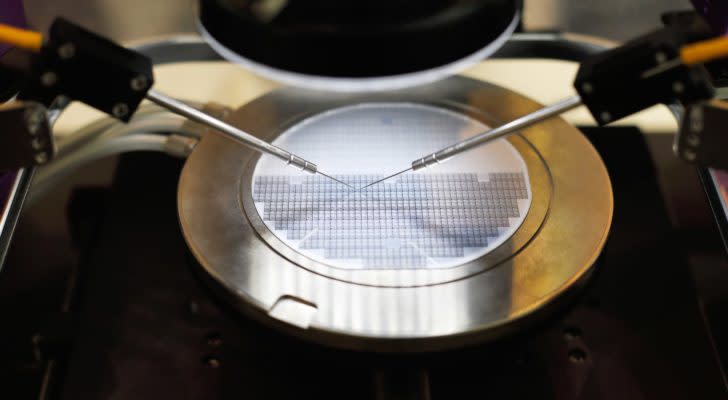

Photronics (PLAB)

Source: Shutterstock

Photronics (NASDAQ:PLAB) is a critical player in the semiconductor industry, particularly in photomask fabrication, which is considered one of the most critical steps in semiconductors’ design and production phases. Amid the ups and downs experienced by the industry, Photronics has remained resilient to growth, which is remarkable as it marks a sixth year of revenue growth.

It is impressive to note the expansion of the operating margin from8%to approximately 30% within six years, which reflects operational efficiency in the company. However, the operating margin expanded from 8% to around 30% over six years, plus there was a massive increase in EPS. That means Photronics will become one of the biggest suppliers of semiconductor photomasks.

Additionally, the market for IC photomasks is approaching$4 billion annually. The total market for IC and FPD photomasks is $7.5 billion. Photronics is a leader in this market, with trailing 12-month revenue of $892 million and consensus expectations of$935 millionin revenue for FY24 and $1 billion for FY25.

Finally, the increase in demand for AI-related semiconductors and the prevailing global shortfall of photomasks are real opportunities for Photronics. These may not only strengthen Photronics’ revenue streams but also give an impetus to its pricing power and operating margins. Its position as a low-cost producer and high operating leverage further strengthen its competitive position. Hence, it is ideal for it to continue gaining success within the semiconductor industry.

Concentrix’s (CNXC)

Source: Golden Dayz / Shutterstock.com

The solidification of Concentrix’s (NASDAQ:CNXC) global position in the business services domain has shown a remarkable growth trajectory during the fourth fiscal 2023 quarter. The company reported a massive 36% revenue surge to$2,230.8 million. This includes a marginal benefit from the foreign exchange movement, which stands as a testament to the market dynamics.

Operating income was $180.4 million, or 8.1% of revenue, and non-GAAP operating income was $340.8 million, or 15.3%. This indicates both efficiency in management and the ability to register good returns from its operations. Similarly, adjusted EBITDA further indicates this strength at a margin of17.8%. This generated a powerful cash flow even after considering integration costs. Hence, it demonstrates the company’s sound financial health and efficiency in running operations.

Additionally, Concentrix heads into fiscal 2024 with ambitious targets, projecting revenues in the $9.510 billion to $9.700 billion range. This outlook reflects cautious but optimistic company growth against fluctuating exchange rates and global economic conditions. On the other hand, operating and non-GAAP operating income signal that Concentrix will continue to maintain its profitability and operational efficiency. The EPS guidance further points to the company’s strong belief in its financial strength and strategic direction.This makes it one of those high-return stocks to consider.

Finally, the Webhelpmergeris strategic for Concentrix and will open a new chapter in its growth and ambition to be the global market leader. This will enhance the Concentrix service offering and reach globally, creating an unbeatable platform for future growth and value creation. Therefore, the synergies may increase revenue and profit and offer a stronger competitive position in the global market.

As of this writing, Yiannis Zourmpanos held a long position in PLTR. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.comPublishing Guidelines.

Yiannis Zourmpanos is the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth business analysis.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

“America’s Top Trader” Issues A.I. Code Red: Act Now or Miss Out

It doesn’t matter if you have $500 or $5 million. Do this now.

The post From $10k to $100k: 3 Stocks With the Potential for Astronomical Returns appeared first on InvestorPlace.