Back

FRM® Exam

Back

Actuarial Exams

Back

MBA Admission

The factors that affect the value of an option include the value of the underlying, exercise price, time to maturity, risk-free rate, volatility, and income or cost associated with the underlying.

Value of the Underlying

The value of the underlying has a direct impact on the right to exercise an option. For a call option, it is exercisable if \(S_T>X\). As such, the value of the call option (and long forward) appreciates when the spot price of the underlying increases.

In contrast, the put option (and short forward) appreciates when the spot price of the underlying declines. Recall that the put option is in the money if \(S_T<X\).

Exercise Price

The exercise price determines whether an option buyer will exercise the option at the expiration. Remember that the payoff of a call option at maturity is \(\text{max}(0, S_T-X)\). Intuitively, a lower exercise price will increase both the likelihood of exercise and settlement value if it is in the money.

For the put option, the exercise price is the upper bound of the option price. Moreover, the payoff of a put option is \(\text{max}(0, X-S_T)\). As such, a high exercise price increases the value of the put option.

Time to Expiration

The time value of an option represents the likelihood that favorable changes to the underlying price will increase the profitability of the exercise. For both call and put options, a longer time to maturity increases the likelihood of the option finishing in the money, thus increasing the option’s value

Risk-Free Rate

A risk-free rate can be seen as the opportunity cost of holding an asset. A risk-free rate is used in the no-arbitrage valuation of derivatives. Note that the value of a call option at any time before maturity \((t<T)\)is given by:$$c_t=\text{max}(0,S_t-X(1+r)^{-(T-t)})$$

It is easy to see that a higher risk-free rate increases the value of the call option. This is because a higher risk-free rate lowers the present value of the exercise price, provided the option is in the money. For a put option, its value at any time before maturity \((t<T)\)is given by:$$p_t=\text{max}(0,X(1+r)^{-(T-t)}-S_t)$$

Intuitively, a higher risk-free rate decreases the exercise value of a put option due to the same explanation in the call option.

The Volatility of the Underlying

Volatility measures the expected dispersion of future movements of an underlying asset. Higher volatility of the underlying asset increases the chances of call and put options finishing in the money without affecting the downside case – the option expires worthless. For instance, as volatility increases, a broader possibility of underlying prices increases the time value of an option and the likelihood of being in the money.

In contrast, lower volatility decreases the time value of both put and call options.

Income or Cost Associated with Owning Underlying Asset

Income (or other non-cash benefits) accrue to the underlying asset owner,not the derivative owner. In other words, the present value of the income or benefits is subtracted from the underlying price. As such, income decreases the value of a call option and increases the value of a put option.

If the asset owner incurs costs (in addition to opportunity cost), compensation is done to cover the added costs. As such, the present value of the costs is added to the underlying price. Therefore, cost increases the value of the call option and decreases the value of the put option.

The table below summarizes the factors that affect the value of an option.

$$\small{\begin{array}{l|l|l} \textbf{Factor} & \textbf{Value of European Call option} & \textbf{Value of European Put option}\\ \hline\text{Value of the Underlying} & \text{Directly proportional} & \text{Inversely proportional} \\ \hline\text{Exercise price} & {\text{Inversely proportional}\\ \text{(as the exercise price increases,}\\ \text{value decreases)}} & {\text{Directly proportional}\\ \text{(as exercise price increases,}\\ \text{value increases)}}\\ \hline\text{Time to Maturity} & \text{Directly proportional} & \text{Inversely proportional}\\ \hline\text{Risk-free rate} & \text{Directly proportional} & \text{Inversely proportional}\\ \hline \text{Volatility} & \text{Directly proportional} & \text{Directly proportional}\\ \hline \text{Benefits} & \text{Inversely proportional} & \text{Directly proportional} \\ \hline\text{Costs} & \text{Directly proportional} & \text{Inversely proportional} \end{array}}$$

Question

Which of the following is most likely to have the same effect on the value of a call option?

A. High risk-free rate and negative cost of carry.

B. Low exercise price and positive cost of carry.

C. Longer time to maturity and low volatility.

Solution

The correct answer is A.

Both a high risk-free rate and low cost of carry increase the value of a call option.

The risk-free rate increases the value of the call option because a higher risk-free rate lowers the present value of the exercise price, provided the option is in the money.

Recall that cost of carry is the net of the costs and benefits associated with owning an underlying asset for a period. Therefore, the negative cost of carry implies that the cost associated with the underlying is higher than the benefits. The present value of the costs is added to the underlying price. Therefore, cost increases the value of the call option and decreases the value of the put option.

B is incorrect. A low exercise price will increase both the likelihood of exercise and settlement value if it is in the money.

A positive cost of carry implies that the present value of the benefits associated with the underlying is higher than the present value of the costs. The present value of the income or benefits is subtracted from the underlying price. As such, income or other non-cash decreases the value of a call option and increases the value of a put option.

C is incorrect. The time value of an option represents the likelihood that favorable changes to the underlying price will increase the profitability of the exercise. Therefore, a longer time to maturity for a call option increases the option’s value.

Lower volatility decreases the time value of both put and call options.

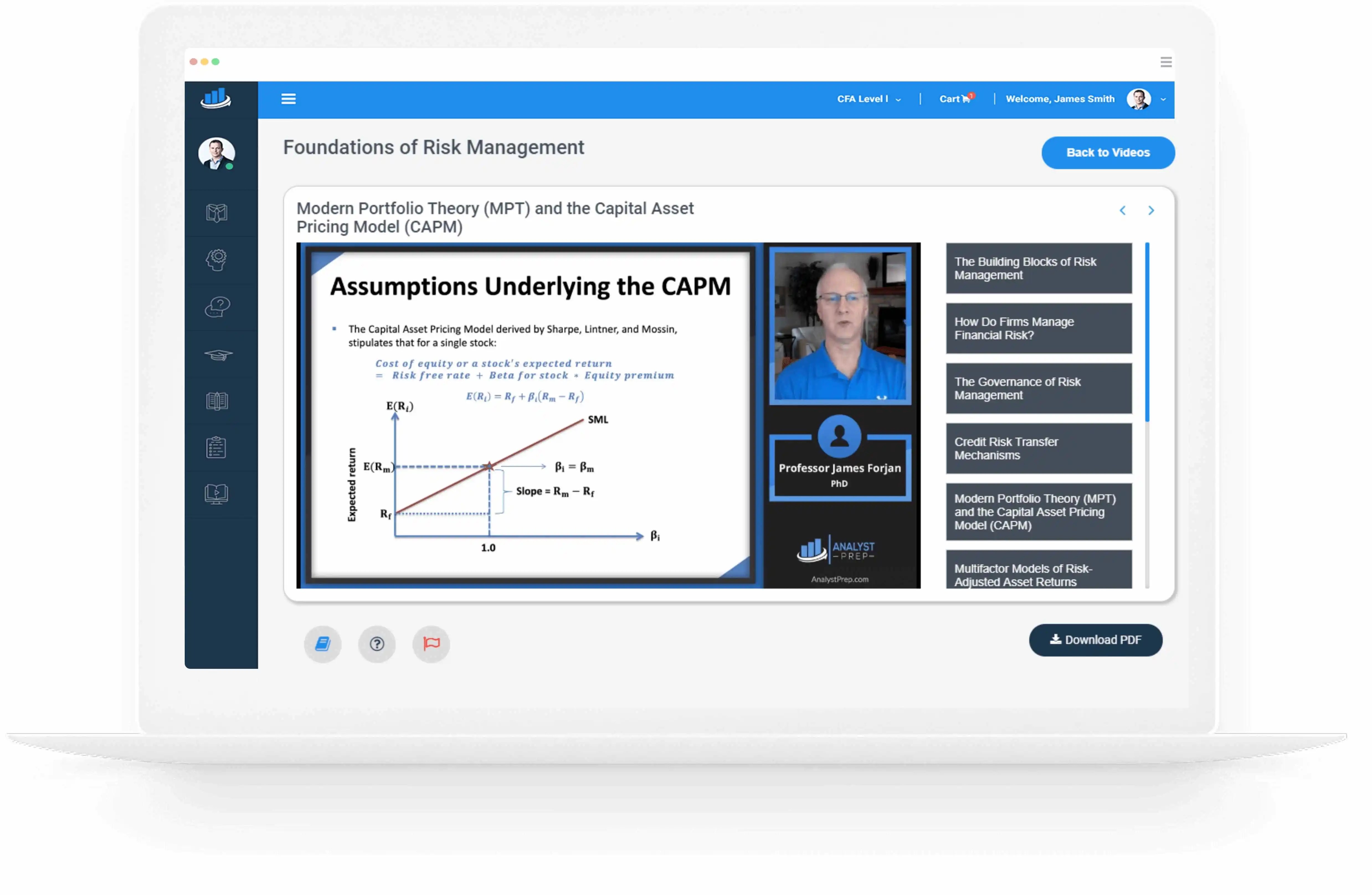

Shop CFA® Exam Prep

Offered by AnalystPrep

Featured

Shop FRM® Exam Prep

Learn with Us

Shop Actuarial Exams Prep

Shop GMAT® Exam Prep

Sergio Torrico

2021-07-23

Excelente para el FRM 2Escribo esta revisión en español para los hispanohablantes, soy de Bolivia, y utilicé AnalystPrep para dudas y consultas sobre mi preparación para el FRM nivel 2 (lo tomé una sola vez y aprobé muy bien), siempre tuve un soporte claro, directo y rápido, el material sale rápido cuando hay cambios en el temario de GARP, y los ejercicios y exámenes son muy útiles para practicar.

diana

2021-07-17

So helpful. I have been using the videos to prepare for the CFA Level II exam. The videos signpost the reading contents, explain the concepts and provide additional context for specific concepts. The fun light-hearted analogies are also a welcome break to some very dry content.I usually watch the videos before going into more in-depth reading and they are a good way to avoid being overwhelmed by the sheer volume of content when you look at the readings.

Kriti Dhawan

2021-07-16

A great curriculum provider. James sir explains the concept so well that rather than memorising it, you tend to intuitively understand and absorb them. Thank you ! Grateful I saw this at the right time for my CFA prep.

nikhil kumar

2021-06-28

Very well explained and gives a great insight about topics in a very short time. Glad to have found Professor Forjan's lectures.

Marwan

2021-06-22

Great support throughout the course by the team, did not feel neglected

Benjamin anonymous

2021-05-10

I loved using AnalystPrep for FRM. QBank is huge, videos are great. Would recommend to a friend

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Trustpilot rating score: 4.5 of 5, based on 69 reviews.

Related Posts

As an expert in finance and derivatives, I'll delve into the concepts touched upon in the provided article and coupon code details.

The article primarily revolves around options and factors influencing their value. Here's a breakdown:

-

Value of the Underlying: The underlying asset directly impacts option value. For a call option, it's valuable when the underlying asset's price rises, while for a put option, it's valuable when the price falls.

-

Exercise Price: Determines if an option is worth exercising at expiration. A lower exercise price increases the likelihood of exercise for a call option, and for a put option, a higher exercise price is more favorable.

-

Time to Maturity: The longer the time before expiration, the greater the probability of the option being profitable, affecting its value.

-

Risk-Free Rate: Impacts the present value of the exercise price. A higher rate increases the value of a call option and decreases the value of a put option.

-

Volatility: Higher volatility increases the likelihood of options finishing profitably, elevating their value.

-

Income/Cost Associated with Underlying: Income decreases the value of a call option and increases the value of a put option, whereas costs have the opposite effect.

Now, let's address the question posed in the article:

The question asks for the factor likely to affect the value of a call option similarly to a high risk-free rate and negative cost of carry. The correct choice, as explained, is A. Both a high risk-free rate and a negative cost of carry increase the value of a call option.

High risk-free rates lower the present value of the exercise price for a call option, while a negative cost of carry indicates higher costs associated with the underlying asset, increasing the value of the call option.

Furthermore, the provided coupon code pertains to AnalystPrep, an educational platform offering study materials for various exams, including CFA®, FRM®, Actuarial Exams, and MBA Admission. Their materials cover video lessons, study notes, mock exams, and practice questions for different levels of these exams, catering to individuals and partnerships. They also offer tutoring services and payment plans.

Moreover, reviews from Trustpilot highlight the effectiveness of AnalystPrep's materials, particularly praising video lectures, explanations by instructors like Professor Forjan, and the comprehensive QBank for FRM preparation, among other positive comments from users.

The article also discusses concepts related to derivatives, options valuation, forward and futures contracts, arbitrage, and risk neutrality, providing insights into these financial instruments and their valuation methodologies.

Overall, the provided content touches upon a broad spectrum of financial topics, emphasizing derivatives, options, and related exam preparation resources from AnalystPrep.