ETF QQQ is an index fund that tracks the NASDAQ-100 index. The fund’s full name is Invesco QQQ Trust ETF (formerly called Powershares QQQ).

Table Of Contents

- What is a QQQ ETF

- QQQ Stock Price Target: General Information

- The Main Factors Affecting the QQQ Stock Price Chart and the Return of the Fund’s Securities

- General Market Condition

- What is the Composition of QQQ ETF Stocks

- Analog ETF QQQ

- Conclusion

What is a QQQ ETF

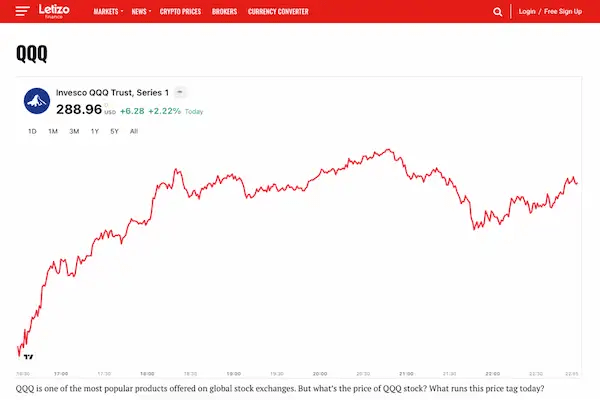

So, an ETF with the ticker symbol QQQ is one of the most popular products offered on the world’s stock exchanges. The NASDAQ-100 index consists of hundreds of large international non-financial companies and is focused on the IT sector. As this sector is intensively developing in the 21st century, when the dot-com crisis is over, the NASDAQ-100 and the QQQ ETF, which almost 100% replicates the index structure, are in demand among investors from all over the world. This makes the QQQ stock price targetan attractive instrument for a trader.

QQQ Stock Price Target: General Information

The QQQ ETF was created in 1999. The head office is located in Wheaton, Illinois, USA. The main criterion for the attractiveness of this fund is its high market capitalization (more than $530 billion) combined with a low expense ratio (0.2%). The fund’s MSCI ESG rating is about 6 out of 10.

The QQQ ETF is traded as a security, and by purchasing it, you are investing in 100 large non-financial corporations at a minimal cost. The fund is suitable for long-term passive investments in the high-tech sector. Dividends are paid four times a year.AMD stock price targetsmight not be that interesting from this point of view.

Throughout its history, the fund’s stock price has declined during periods of economic recession, after which the rate would return to normal levels and renew historic highs. Here’s how it looks on the chart: Between 2012 and 2020, QQQQETF stocks outperformed the S&P 500. One thing to consider here, however.

In 2020, the coronavirus pandemic swept the world, causing many companies to move employees to remote work. Against this backdrop, demand for computing, cloud services, and other software for telecommuting skyrocketed. Most likely, this phenomenon is temporary in nature. Also, the QQQ is more volatile than the S&P 500 because the QQQ is not as well diversified.

The Main Factors Affecting the QQQ Stock Price Chart and the Return of the Fund’s Securities

General Market Condition

The key indicators (profit, size of assets, dividends, etc.) for these companies are easy to analyze — financial reports are published quarterly, and information about the emergence of new technologies appears on the front lines of news feeds. For example, the release of a new model of Apple smartphone or a new version of Windows is quite difficult to miss. This Is immediately reflected on the QQQ stock price chart. More news onletizo.com.

What is the Composition of QQQ ETF Stocks

The predominant direction is IT technology. The economic sectors in the ETF are divided roughly in this proportion:

- IT — 48%;

- telecommunications — 21%;

- consumer staples — 15%;

- healthcare — 7%;

- consumer staples — 6%;

- industry — 3%.

The index is rebalanced on a quarterly basis, and the composition of issuers is reviewed once a year. The rate of the fund’s securities is considered an indicator of the development and investment attractiveness of the IT sector. The average annual return on shares is about 17%.

When buying securities individually, it should be considered that some shares of ETF QQQ are quite expensive. For example, the price of Alphabet-A is over $2,000 per paper. You need to have quite a lot of capital — about $100,000 to $150,000 — to balance it out.

Analog ETF QQQ

There is another leveraged ETF that also echoes the structure of the NASDAQ-100. This is the PowerShares TQQQ fund, which is an analog of the QQQ. The distinctive features of this ETF are:

- is suitable for short-term investments;

- uses derivatives;

- daily return and risk exceed QQQ’s analogs approximately threefold.

TQQQ is an instrument suitable for intraday trading, not for long-term investments. But investors should also consider the AMD after-hours stock price if they have difficulty understanding the mechanism of QQQ and TQQQ.

Conclusion

The QQQ ETF is an exchange-traded fund that includes companies with high market capitalization. It has a total capitalization of over $100 billion as of mid-2020.

Investing in Invesco QQQ is a great solution for both novice and experienced investors. This fund does not include companies with financial problems or in bankruptcy — the financial statements are reviewed quarterly by experts.