An equity swap is a financial derivative instrument where two counterparties agree to exchange a set of future cash flows, typically an equity-based return against a fixed or floating interest rate. They allow investors to gain exposure to an underlying equity asset without actually owning the asset. Below are the types of equity swaps: In a total return swap, one party receives the total return (capital appreciation/depreciation and dividend payments) of an underlying equity asset, while the other party receives a fixed or floating interest rate. In a price return swap, one party receives the price return (capital appreciation/depreciation) of an underlying equity asset, while the other party receives a fixed or floating interest rate. Dividend payments are not included in this type of swap. Below are the participants in equity swaps: Swap Dealers: Financial institutions that facilitate equity swap transactions, typically acting as intermediaries between counterparties. Institutional Investors: Large investors such as pension funds, insurance companies, and asset managers that use equity swaps for various investment strategies and risk management purposes. Hedge Funds: Investment firms that employ sophisticated strategies, including the use of equity swaps, to generate returns for their investors. Corporations: Companies that use equity swaps to manage risks, optimize their capital structure, or hedge their equity exposures. Below are components of equity swaps: Notional Principal: The hypothetical amount used to calculate the cash flows exchanged between the counterparties, which is not physically exchanged. Underlying Equity: The specific equity asset, such as a stock or equity index, that determines the cash flows for the equity leg of the swap. Fixed or Floating Interest Rate: The interest rate that determines the cash flows for the interest rate leg of the swap. Below are swap payments in equity swaps: Equity Leg: The cash flow tied to the performance of the underlying equity asset. Interest Rate Leg: The cash flow based on a fixed or floating interest rate.What Are Equity Swaps?

Types of Equity Swaps

Total Return Swaps

Price Return Swaps

Key Participants in Equity Swaps

Components of Equity Swaps

Swap Payments in Equity Swaps

Calculation of Payments in Equity Swaps

Here are some ways to calculate the payments:

Payment Frequency: The agreed-upon schedule for exchanging cash flows, typically quarterly or semi-annually.

Day Count Convention: The method used to calculate the number of days between payment dates, which impacts the interest accrued during each period.

Payment Netting: The process of offsetting the cash flows between the two counterparties, resulting in a single net payment.

Settlement Methods

Here are some settlement methods:

Physical Settlement: The delivery of the underlying equity asset by one counterparty to the other at the end of the swap agreement.

Cash Settlement: The payment of the net difference in cash flows, without the delivery of the underlying equity asset.

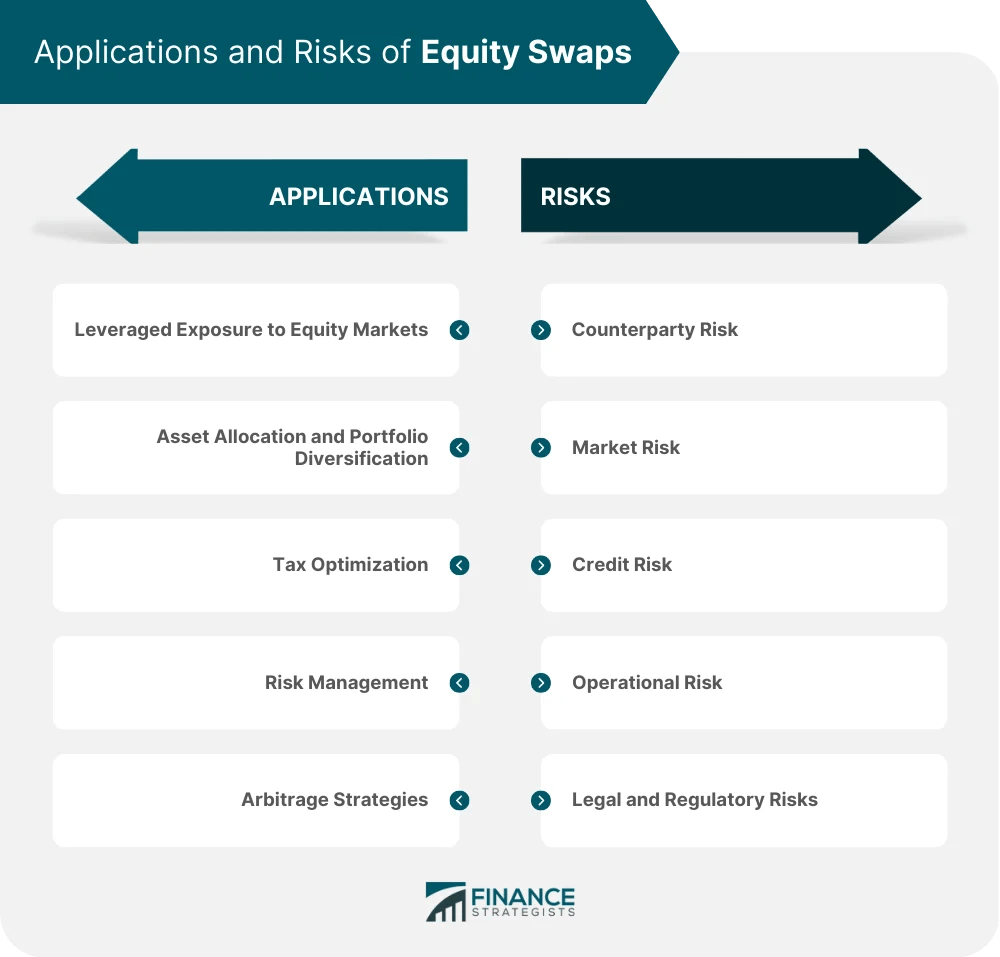

Applications and Strategies of Equity Swaps

Here are some applications and strategies of equity swaps:

Leveraged Exposure to Equity Markets

Equity swaps allow investors to gain exposure to equity assets using leverage, amplifying both potential gains and losses.

Asset Allocation and Portfolio Diversification

Investors can use equity swaps to gain exposure to specific sectors, regions, or investment styles, enhancing their portfolio diversification.

Tax Optimization

Equity swaps can help investors defer taxes on capital gains or optimize tax treatment by converting dividend income into interest income.

Risk Management

Investors can use equity swaps to hedge against market, sector, or single-stock risks.

Arbitrage Strategies

Hedge funds and other sophisticated investors may use equity swaps to exploit mispricings and arbitrage opportunities between different markets or instruments.

Risks Associated With Equity Swaps

Below are some risks associated with equity swaps:

Counterparty Risk

The risk that one party to the swap will default on its obligations, resulting in financial loss for the other party.

Market Risk

The risk that fluctuations in the underlying equity asset or interest rates will adversely impact the value of the swap.

Credit Risk

The risk that the creditworthiness of one party to the swap will deteriorate, leading to a decrease in the value of the swap.

Operational Risk

The risk of losses stemming from inadequate processes, systems, or controls in the management and settlement of equity swaps.

Legal and Regulatory Risks

The risk of changes in laws or regulations that may affect the terms, value, or enforceability of equity swaps.

Valuation and Pricing of Equity Swaps

Here are some ways in valuation and pricing of equity swaps:

Discounted Cash Flow (DCF) Method

A valuation technique that involves estimating future cash flows from the swap and discounting them back to the present value using an appropriate discount rate.

Arbitrage-Free Pricing

A pricing approach that assumes no arbitrage opportunities exist in the market, resulting in a fair value for the equity swap.

Conclusion

Equity swaps have become an essential tool for investors and financial institutions to manage risks, optimize portfolios, and implement sophisticated investment strategies.

The equity swap market is likely to continue evolving, driven by regulatory changes, market dynamics, and the development of new products and structures.

Participants in the equity swap market will need to navigate an increasingly complex regulatory landscape while capitalizing on the opportunities presented by this versatile financial instrument.

An expert in wealth management can help you navigate through the complexities of equity swaps.

Equity Swaps FAQs

Equity swaps are derivatives where two parties exchange equity-based returns and interest rates, allowing exposure to an equity asset without ownership.

The two main types are total return swaps (including capital appreciation/depreciation and dividends) and price return swaps (only capital appreciation/depreciation).

Counterparties exchange cash flows based on the underlying equity's performance and an agreed interest rate, calculated on a notional principal amount. Swaps can be settled physically or in cash.

Common uses include leveraged exposure, portfolio diversification, tax optimization, risk management, and arbitrage strategies.

Key risks include counterparty, market, credit, operational, and legal/regulatory risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.