[Updated] Discounted Cash Flow (DCF) method is a better way ofintrinsic valuecalculation. The DCF model is derived from a concept called Net Present Value (NPV).

Why Intrinsic Value is required? Because based on it, one can judge if the stock is fairly priced or not.

DCF method is not an easy way of doing price valuation. It is the reason why people mostly usefinancial ratiosto check price valuations.

What are financial ratios? They compare the stock price with the underlying fundamentals of its business. Parameters used for comparison are free cash flow, earnings, dividends, book value, sales, etc.

Calculation of ratios is quick andeasy to comprehendas compared to methods like DCF. But it will not be wrong to say that ratios are only a crude way of doing price valuation of stocks.

Introduction to Discounted Cash Flow (DCF)

DCF is a financial model using which we can estimate the value of the entire company. Then, a comparison of the True Value with the share price will complete the price valuation.

For example, suppose a company stock is trading at a price of Rs.120 per share. We have estimated the value of the company, using the DCF method, as Rs.9,000 Crore. If there are 100 crore number shares outstanding, its intrinsic value will be Rs.90 per share.

Now, compare the current price (Rs.120) with its estimated intrinsic value (Rs.90). The shares of this company are currently overvalued by Rs.30 (33%).

This type of analysis is called price valuation. But the difficulty here is the estimation of the intrinsic value. There are many variables and informed assumptions required to do a DCF analysis.

Mystock analysis worksheetcan calculate the intrinsic value of stocks based on multiple financial models (including DCF).

The Concept of Discounted Cash Flow (DCF) Method

Discounted Cash Flow (DCF) analysis estimates intrinsic value based on future cash flows.

The intrinsic value of a business is the sum of the present values of all future cash it will generate during its lifetime.

The statement might not sound simple, but it is. Allow me to explain it using a simple example.

Suppose you bought the stock of a hypothetical company ABC. An assumption, the company will stay alive only for six days. In this period, it will generate the following cash flows (net profit or free cash) for itself:

- First Day: Rs.100 Crore

- Second Day: Rs.110 Crore

- Third-Day: Rs.121 Crore

- Fourth Day: Rs.133 Crore

- Fifth Day: Rs.146 Crore

- Sixth Day: Rs.450 Crore

What will be the intrinsic value of ABC? It will be the sum of all free cash flows generated during the six days.

Intrinsic Value = 100+110+121+133+146+450 = Rs. 1,060 Crore.

An analogy of the above example

The above example looks too easy, right? Yes, it is, because we are talking about a hypothetical company. In the real world, the life expectancy of a company is much longer. Hence,future free cash flowassumptions may become difficult and inaccurate. It is the main hurdle.

Moreover, adding all cash flows occurring years ahead in the future will not be correct. We will need to calculate their present value (PV). To do PV calculation, we will need a number called thediscount rate. Now, it is the second major hurdle.

The accuracy of the discount rate makes a lot of difference in the estimated intrinsic value.

So to accurately implement the DCF method, we must first learn how to estimate future free cash flows. Second, we must know what discount rate we must apply to calculate the present value.

Example

For the sake of simplicity, allow me to present another hypothetical example. But this time, the presentation will be slightly more realistic.

Suppose you bought the stock of a hypothetical company ABCD. The company will stay alive for six years. During this period, it will generate the following cash (net profit or free cash) for itself:

- First Year: Rs.100 Crore

- Second Year: Rs.110 Crore

- Third Year: Rs.121 Crore

- Fourth Year: Rs.133 Crore

- Fifth Year: Rs.146 Crore

- Sixth Year: Rs.450 Crore

We will also assume a discount rate of 9% per annum.

What will be the intrinsic value? It will be the sum of thePresent Value (PV)of all free cash flows generated during its six years of existence. In terms of a mathematical formula, the PV will be as shown below.

The intrinsic value of the company ABCD will be:

Intrinsic Value = PV(100)+PV(110)+PV(121)+PV(133)+PV(146)+PV(450)

= 100 / (1+9%)^1 + 110 / (1+9%)^2 + 121 / (1+9%)^3 + 133 / (1+9%)^4 + 146 / (1+9%)^5 + 450 / (1+9%)^6 = Rs. 735.193 Crore

A company that will generate cash flows of Rs.100 crores to Rs.450 as shown above, in six years, will yield an intrinsic value of Rs.735.2 Crore.

The first hurdle to DCF analysis is estimation of future free cash flows. So, let’s learn how to estimate it.

Future Free Cash Flow (FCF) Estimation

What is free cash flow (FCF)?

FCF isnet cash generated from operationsminus capital expenditure (CAPEX). In terms of formula, there are two alternative ways of expressing FCF:

Check Free DCF Calculator

In the DCF method, correct estimation of all future free cash flows is a number one priority. But considering that we are talking about the FUTURE, we can only estimate and guess the future FCFs.

How to guess as accurately as possible? The first step will be to calculate the FCFs of the past (5-Years). Along with FCF, we would analyze the trend of the following two metrics. Try to understand if the two variables are improving, impairing, or remaining stable in the future.

- Competitive Advantage of the sector.

- Economic Moat of the company.

Generally speaking, a company with a stableeconomic moatmay continue to grow at the same rate as it has done in the past. But to do so, it will need the support of the economy and its sector. A robust and kicking economy might boost FCFs further. Similarly, if the company is operating in an industry (sector) that is growing, it will help the company.

Discount Rates

Why we need discount rates? It is required to calculate thepresent valueof future free cash flows. Why we need the Present Values? To know this, please read about theconcept of the time value of money.

For this article, let me give you a simple example for quick understanding.

The concept is, money devalues with time. Rs.100 in our pocket today is worth more than Rs.100 received after one year. Why? Because inflation reduces the purchasing power of the currency.

Suppose your father decides to offer you a gift of Rs.5,000. But he proposes two alternatives to you. First, you can take Rs.5,000 today. Second, you can take Rs.6,050 after two years from today. Which option is better for you? To answer this question, we will use the concept of the present value of money.

But before you can apply the present value concept, you must pick a discount rate:

Two Options:

- Inflation Rate: You are aware that currently, the inflation rate is 7% per annum. Use this number to calculate the present value of Rs.6,050. The value will be Rs.5,284 (= 6050 / (1+7%)^2). It means the present value of Rs.6,050 today is Rs.5,284. Taking the gift today will get only Rs.5,000. But taking the same gift after two years is equivalent to taking Rs.5,284 today. Hence, the second alternative will be more profitable.

- Return On Investment: You know an investment option that can give you a 15% per annum return if you hold it for two years. Now consider 15% as your discount rate and do the math. Present value of Rs.6,050 will be Rs.4,575 (= 6050 / (1+15%)^2). In this case, the first alternative is profitable. [Logic: Take gift today and invest it @15% p.a. After 2 years it will become Rs.6,612 (5000 * (1+15%)^2)]

The same analogy we can use to pick discount rates for our stock analysis as well.

- The first alternative is can select theweighted average cost of capital (WACC)– the analogy of inflation.

- The second alternative is, first think internally about what investment return we desire from the investment. Suppose this value is 18% per annum. We can then use 18% as the discount rate.

But experts go with the WACC method. If you want to know more about how to calculate WACC, check the link provided above.

Use of Terminal Value (TV) in Place of FCF

In financial terms, TV is also called perpetuity value. As the name suggests, we assume that the company in consideration will continue to operate forever. But there is a problem with this theory. How to predict all FCFs of the company if it will be in operation forever?

Generally speaking, predicting FCFs for the next five years itself is a problem. So, if a company to remain in operation forever, how to preempt all its FCFs? It looks almost impossible, right?

So here comes the concept of terminal value or perpetuity value. How does it work? Forecast FCFs for the next five years. Then estimate one lump-sum value for all free cash flows happening after the fifth year. This lump-sum value is what we call TV or Perpetual value.

The formula for the terminal value is as shown below:

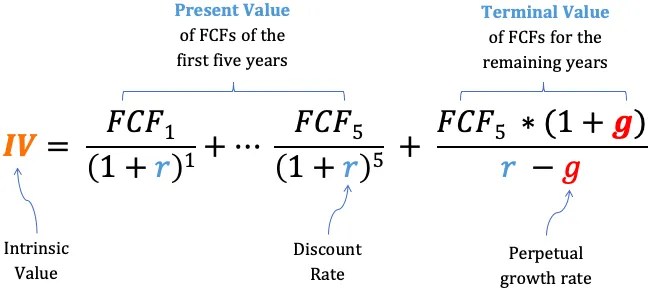

After incorporating the terminal value (TV) concept, the intrinsic value formula of a company will look like shown below:

Example of Intrinsic Value Calculation by Discounted Cash Flow (DCF) Method

Suppose you bought stocks of a hypothetical companyABCD. The company will stay alive for six years. During this period, it will generate the following cash (net profit or free cash) for itself:

- First Year: Rs.100 Crore

- Second Year: Rs.110 Crore

- Third Year: Rs.121 Crore

- Fourth Year: Rs.133 Crore

- Fifth Year: Rs.146 Crore

Assumptions

- Discount Rate (r):Here, we have two options. Either we can calculate the WACC of the company, or we can go with the theory of the expected return (see here). For simplicity, we will use the expected return number as the discount rate. Say 9% per annum.

- Perpetual Growth Rate (g): While assuming this number for a stock, we must be careful. The higher will be the number the better. But we must also understand that this is an “average growth rate” at which the company will continue to grow for life. Historically, even the best companies find it hard to beat inflation when the time horizon is forever (very long). For a country like India, long-term inflation will be 5% per annum. Hence, we will assume a growth rate of 5% and not more.

Now, apply the intrinsic value formula using the above numbers and assumptions:

The intrinsic value of the “Total company” comes out to be Rs.4,299.4 Crores. Assuming that the company has 100 crore number shares outstanding in the market, the intrinsic value per share will be Rs.42.99. If the current share price of ABCD is above Rs.42.99, it means the stock is overvalued.

Point to Note About Terminal Value

Out of the total estimated value of the company (Rs.4299.4 Crore), 89% is coming from the terminal value (Rs.3832.5 Crore). The following three factors affect the terminal value:

- FCF of the fifth year. The fifth-year FCF guess will be accurate only if our current year FCF calculation is accurate. Moreover, the FCF growth rate for the first five years is also crucial. Too high or low a number will dramatically influence the final intrinsic value.

- The higher will be thediscount rate (r), the smaller will be the Intrinsic value. Hence, being a more defensive investor, I prefer a higher discount rate for my stocks.

- A high perpetual growth rate (g), will render high intrinsic value. But I prefer a more defensive number here. Opting for a 5% or less growth rate for my stocks looks more logical (why? Read here).

Conclusion

Calculation of the intrinsic value of stocks using the DCF model is not easy for all. But it is also true that the DCF method is one of the best ways to estimate the intrinsic value of stocks.

But as you have seen, estimating intrinsic value using DCF involves several steps. Moreover, it also needs a deeper understanding of the company’s financial reports.

The procedure is fool-proof, but it has its limitations. The investor’s understanding of the numbers in the financial reports is the key.

I have developed a method for myself. I call it theStock Engine. This MS EXCEL worksheet can estimate the intrinsic value of my stocks based on DCF and other methods.

Analyze Stocks Online