Phil Rosen

·3 min read

Russia's exports of crude oil have now surpassed the volumes hit before its invasion of Ukraine.

China and India account for roughly 90% of Russia's seaborne crude exports, Kpler data shows.

With Europe largely out of the picture, the two countries are each buying 1.5 million barrels a day from Russia.

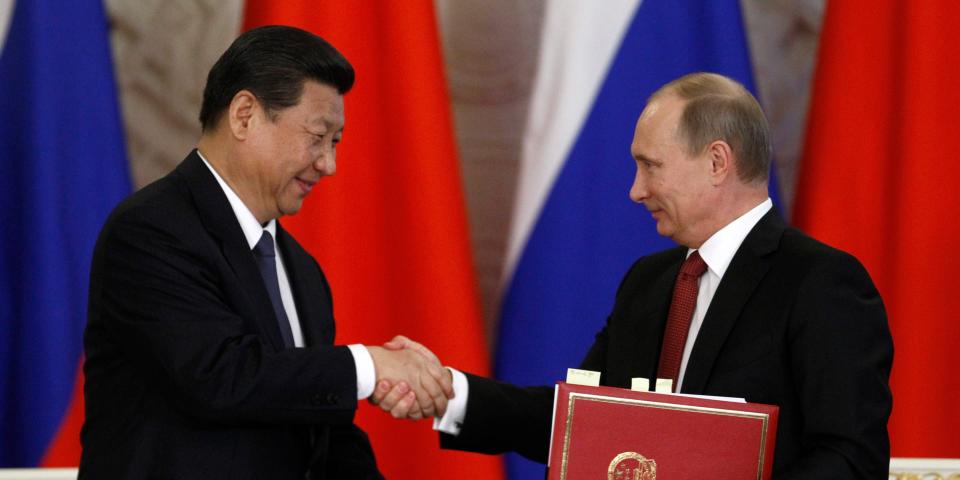

Russia has been able to navigate Western sanctions well enough to push oil exports above levels reached before its war on Ukraine — and new data suggests that Moscow has China and India to thank for that.

In the first quarter, Russia's seaborne crude oil exports totaled 3.5 million barrels per day versus 3.35 million barrels in the year-ago quarter, the tail end of which saw the start of Russia's war on Ukraine.

China and India now account for roughly 90% of Russia's oil, with each country snapping up an average of 1.5 million barrels per day, according to commodities analytics firm Kpler,

That's enough to absorb the shipments that no longer head to European nations, which used to account for nearly two-thirds of Russia's crude exports. Europe now takes in only 8% of Russia's oil exports, per Kpler.

"Both China and Russia are taking advantage of discounted Russian crude, benefiting from the sanctions applied on Russian materials by other countries," Matt Smith, lead oil analyst at Kpler, told Insider Friday.

Behind China and India, Turkey and Bulgaria are the biggest buyers of Russian crude.

Even before Vladimir Putin launched his war on Ukraine, China was already a top buyer of Russian crude, importing 25% of its crude from the country in 2021. That's since climbed to 36%, Kpler data shows.

India, the world's third-largest oil importer, relied on Russia for about 1% of its total volumes prior to the war, but now buys 51% of its oil from Russia.

The US has led Europe and other Western nations in imposing sanctions and energy price caps on Russia, designed to maintain market flows while curtailing Moscow's export revenue.

European Central Bank calculations show trade volume between the euro area and Russia has halved since February 2022, with the bloc's imports of Russian imports seeing particularly steep declines following the bans on coal in August 2022, crude oil in December 2022, and refined oil products in February 2023.

The ECB chart below shows a similar pattern illustrated in Kpler's data, with Russian seaborne crude exports shifting toward Asian buyers and away from Europe.

To be sure, the revenue Russia generates from its energy exports has fallen along with the drop in prices, even as volumes remain elevated.

The International Energy Agency said Friday that Moscow's revenue is down about 43% compared to the same time last year.

But oil prices are heading back up as China's reopening economy drives demand while OPEC and Russia pinch supplies.

Earlier this month, OPEC+ announced a surprise production cut of over 1 million barrels a day, with Russia extending its 500,000-barrel-a-day pullback through mid-2023.

Read the original article on Business Insider

I'm an expert in global energy markets and geopolitical dynamics, with a proven track record of analyzing and understanding the intricate connections between political events, economic forces, and energy trade. My expertise extends to the recent developments in the oil industry, particularly focusing on Russia's oil exports and the impact of geopolitical events on global energy flows.

Now, let's delve into the key concepts mentioned in the provided article:

-

Russia's Crude Oil Exports: Russia has successfully increased its seaborne crude oil exports, surpassing pre-Ukraine invasion levels. In the first quarter, Russia exported 3.5 million barrels per day, compared to 3.35 million barrels in the same period the previous year.

-

China and India's Dominance: China and India together account for approximately 90% of Russia's seaborne crude exports. Both countries are individually buying 1.5 million barrels per day from Russia. This shift is significant, with Europe now only representing 8% of Russia's oil exports.

-

Impact of Western Sanctions: Russia has managed to navigate Western sanctions effectively. The article suggests that China and India are key players in enabling Russia to exceed its pre-sanction oil export levels. Both countries are taking advantage of discounted Russian crude due to sanctions applied by other nations.

-

Top Buyers Beyond China and India: Turkey and Bulgaria are highlighted as the next significant buyers of Russian crude after China and India. This diversification of buyers showcases Russia's adaptability in the face of changing geopolitical and economic circ*mstances.

-

China's Increasing Dependency on Russian Crude: Even before the conflict in Ukraine, China was a major buyer of Russian crude, importing 25% in 2021. This figure has since risen to 36%, indicating an increasing reliance on Russian oil to meet China's energy demands.

-

European Impact of Sanctions: The article emphasizes the decline in Europe's role in Russian crude oil exports, with the European Central Bank showing a significant reduction in trade volume between the euro area and Russia since February 2022. Sanctions on coal, crude oil, and refined oil products have contributed to this decline.

-

Impact on Russia's Revenue: While Russia's oil export volumes remain high, the revenue generated has fallen by approximately 43% compared to the previous year. This decline is attributed to a drop in oil prices, despite the recent uptick driven by China's reopening economy and OPEC+ production cuts.

-

OPEC+ Production Cut: OPEC+ announced a surprise production cut of over 1 million barrels a day, with Russia extending its 500,000-barrel-a-day pullback through mid-2023. This decision contributes to the recent increase in oil prices.

In summary, the article outlines the changing dynamics of Russia's crude oil exports, highlighting the influence of geopolitical events, sanctions, and the shifting patterns of global oil trade.