More and more traditional institutions are coming to the realization that the [Blockchain can solve many of their inefficiencies](news/leading-clearing-houses-join-london-stock-exchange-in-exploring-the-blockchain/).

More and more traditional institutions are coming to the realization that the Blockchain can solve many of their inefficiencies. Of course, in this context we are not talking about the Bitcoin Blockchain but the technology behind it, which would allow for things like instant transactions and settlements between these institutions.

The questions that a lot of people are now asking is: What does this mean for Bitcoin’s future? It honestly depends on who you ask. According to Jamie Dimon, the CEO of JPMorgan Chase, Bitcoin will not survive, but it’s the underlying technology that’s the real innovation. If you ask the original promoters and users of Bitcoin however, the answer is quite different.

Bitcoin created an environment where something of value can now be transferred over the internet, as was famously predicted by the Nobel Prize winning economist Milton Friedman in 1999 – 7 years before his death, and 10 years before the first Bitcoin transaction. These two dynamics are very different, and Bitcoin believers should not be worried about traditional institutions taking over, or changing, the original use case of the Bitcoin Blockchain.

The success of the use cases of this underlying technology will only strengthen the confidence in the Bitcoin Blockchain and with the rise in confidence there usually comes a rise in the price.

Besides private financial institutions looking to utilize the aspects of Bitcoin’s technology for their benefit, Central Banking institutions are also looking to utilize what they deem valuable. We recently learned that the Bank of Canada views the power of Bitcoin as a possible tool to move away from physical cash.

As explained by the Deputy Governor Carolyn Wilkins, there may come a time where the bank needs to apply negative interest rates on deposits, and having physical cash presents a bit of a problem. In Regions where a negative rate has been implemented, like Sweden, there are reports of people hiding cash at home, avoiding the charge for holding funds in the bank, and negating the effect of implementing the negative rate.

Another reason for the elimination of physical cash that is mentioned in the article is that “it has the added advantage of taxing illicit activities.” This is a very important point, and not mentioned enough in financial reporting. This is perhaps the biggest reason to eliminate cash, and if Bitcoin helps Governments and the Central Banks get there, they will be all for it, for the time being.

However, a day will most likely come when the identities of Bitcoin holders will need to be known, otherwise these initiatives will not achieve their goal, as Bitcoin will become the asset people hold just like the cash hidden in Swedish homes. The fact that it is the only asset, if properly secured, that cannot be confiscated by any means, may just become the ‘killer app’ some are saying Bitcoin needs to reach the next level of adoption.

Market Outlook

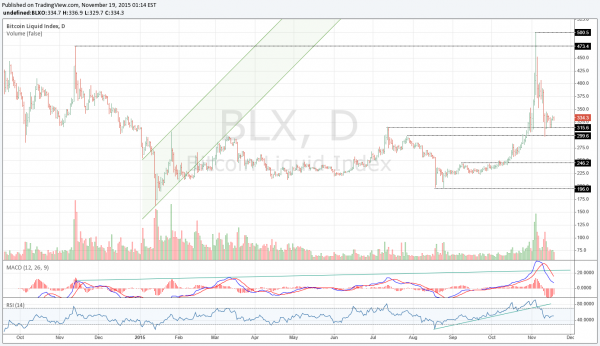

To gauge the current confidence level in a Bitcoin based digital world, we examine the price to see where it might be headed next.

This is the daily chart of the BNC Liquid Index (BLX). It shows that we have fallen from the recent exponential rise in price, and are currently still sitting above two important support levels. The Momentum indicators have fallen from their overbought conditions, and are starting to approach standard levels. Volume has also tapered off, and it is now becoming clear that the recent rise in prices was a lot more hype than real adoption.

More detailed explanations of the Short, Medium and Long-Term outlooks for technical charts are available in the BNC. Weekly Traders Report. We also break down all the relevant weekly news, it’s influence on Bitcoin’s price, and general standing within the financial ecosystem.

Final Thoughts

Without physical cash, there would no longer be a need for ATM machines. More importantly, it eliminates a potential ‘bank run‘. The lines of people stretching around the block will only be seen in historic pictures of the Great Depression, or more recently the Greek banking shutdown. In the case of Greece, the maximum amount to withdraw was 20-60 Euro’s, and that would still be the case in a digital cash society but without the visual effects of a confidence loss in a financial system. Bitcoin’s greatest asset might just be a hedge against these inevitable financial catastrophes.

This article was completed on Wednesday November 18th 11:00 pm ET, when the BNC Liquid Index (BLX) was $333

Tone Vays will be speaking at the following upcoming events:

- MIT CHIEF, Nov 21 – 22

Inside Bitcoins Seoul, South Korea Dec 9 – 11

Inside Bitcoins San Diego, CA Dec 14 – 16

BitPanel, San Francisco Dec 17

TNABC, Miami, FL Jan 24

Anarchapulco, Acapulco, MX Feb 18 – 21

Disclaimer: The price projections above are just the opinions of one trader. It is meant as a guide, or fresh look, to supplement the reader’s personal views on bitcoin. Trading in general, and especially Bitcoin, is incredibly risky and should only be done with capital one can afford to lose. The Author is a trader and does take on small position in the manner suggested in the article.

FAQs

Bitcoin, it found, is likely to hit an average peak price of $87,875 in 2024, with some experts predicting it will climb as high as $200,000. On the flip side, the average lowest price Bitcoin could hit by the end of 2024, is seen as $35,734, the report said, with some predicting it will fall as low as $20,000.

Where is Bitcoin headed? ›

Our most recent Bitcoin price forecast indicates that its value will increase by 11.21% and reach $73,974 by April 24, 2024. Our technical indicators signal about the Bullish Bullish 90% market sentiment on Bitcoin, while the Fear & Greed Index is displaying a score of 73 (Greed).

What was the starting price of Bitcoin? ›

Starting at US$0 (2009)

When the Bitcoin network was first launched in January 2009, and people mined for BTC, there was no value assigned to the cryptocurrency yet. Things would change in October of that year, however, when Finnish software developer Martti Malmi traded 5,050 BTC for US$5.02.

What is the fundamental value of Bitcoin? ›

Bitcoin Is a Convertible Currency

Bitcoin must be converted to a government-backed currency to be used, even in countries where it is recognized as legal tender. The argument here is that because Bitcoin is convertible, it doesn't have any underlying value.

How much will $1 Bitcoin be worth in 2025? ›

With the launch of potentially more Bitcoin-related financial services and the global adoption spark of Bitcoin, BTC prices will maintain a bullish trend in 2025. The cryptocurrency is expected to create a high of $140,449 with a low of $61,357.

Will Bitcoin hit 100k in 2024? ›

As bitcoin becomes more and more mainstream and integrated with traditional assets, it isn't inconceivable that it could hit US$100,000 in 2024 – an extraordinary feat for a invention that was worth nothing as recently as 2009.

What will $1000 of bitcoin be worth in 2030? ›

If Wood is correct and Bitcoin reaches $3.8 million, if you invested $1,000 in Bitcoin now, it would be worth $54,280 in 2030. This would result in a compounded annual growth rate (CAGR) of nearly 95%.

Will bitcoin go down after halving? ›

"We do not expect bitcoin price increases post-halving as it has already been priced in," analysts led by Nikolaos Panigirtzoglou wrote in a report on Wednesday, reiterating their previous similar views. "In fact, we see a downside for the bitcoin price post-halving for several reasons."

Is it still good to invest in bitcoin? ›

Unfortunately, it's also incredibly volatile. For that reason, while current market conditions are favorable for anyone considering buying Bitcoin, it is an asset you should purchase only at your own risk. Because while Bitcoin may have the potential for significant returns, you may also lose most of your investment.

Will bitcoin rise again? ›

Limited supply is one of bitcoin's key features. Only 21 million bitcoins will ever exist, and more than 19.5 million of them have already been mined, leaving fewer than 1.5 million left to pull from. So long as demand remains the same or climbs faster than supply, bitcoin prices should rise as halving limits output.

Who Owns the Most Bitcoins? Satoshi Nakamoto, the pseudonymous creator of Bitcoin, is believed to own the most bitcoins, with estimates suggesting over 1 million BTC mined in the early days of the network.

When was bitcoin worth a penny? ›

On 19 June 2011, a security breach of the Mt. Gox bitcoin exchange caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt.

What is Bitcoin backed by? ›

Backing a currency is done by the currency's issuer to ensure its value. Bitcoin, gold, and fiat currencies are not backed by any other asset. Bitcoin has value despite no backing because it has properties of sound money.

Can Bitcoin go to zero? ›

A reasonable assumption that Bitcoin could hypothetically reach the null state of it's value is worth the thought. Even-though such an event is very less likely to take place, there are some factors that could theoretically lead to Bitcoin price crashing to zero.

Is Bitcoin actual money? ›

Bitcoin (BTC) is a cryptocurrency (a virtual currency) designed to act as money and a form of payment outside the control of any one person, group, or entity. This removes the need for trusted third-party involvement (e.g., a mint or bank) in financial transactions.

How much will $100 Bitcoin be worth in 10 years? ›

A $100 investment in Bitcoin could purchase 0.00607 BTC today based on a price of $16,466.14 at the time of writing. If Bitcoin hits the $1 million price target by Wood in 2030, the $100 investment would turn into $6,070. This represents a gain of 5,970% from now until 2030.

Will BTC ever hit $1 million? ›

Known for her innovative investment approach, Cathie Wood predicts Bitcoin will surpass $1 million sooner than her previous estimate of 2030.

Which coin will reach $1 in 2024? ›

The Race to $1: Dogecoin vs Doge Uprising

If you missed the initial surge of Dogecoin, Doge Uprising might just be your ground-floor opportunity to support a project with the potential to soar to new heights—and perhaps even reach that elusive $1 mark.

Which crypto will boom in 2024? ›

1. Dogeverse – A Multi-Chain Doge Token Expected to Boom in 2024. Dogeverse ($DOGEVERSE) is a multi-chain doge-based token. With the ability to “hop” between different networks, eager investors can purchase $DOGEVERSE on six major blockchains, from Ethereum, BNB Chain, and Polygon to Solana, Avalanche, and Base.