Stock futures are rising, as optimism is in the air over a potential breakthrough for negotiations between Ukraine and Russia on Tuesday.

Obviously not just markets would welcome a halt in the humanitarian disaster. Apart from that obvious point, other worries have focused on disruptions to farming in the global breadbasket of Ukraine.

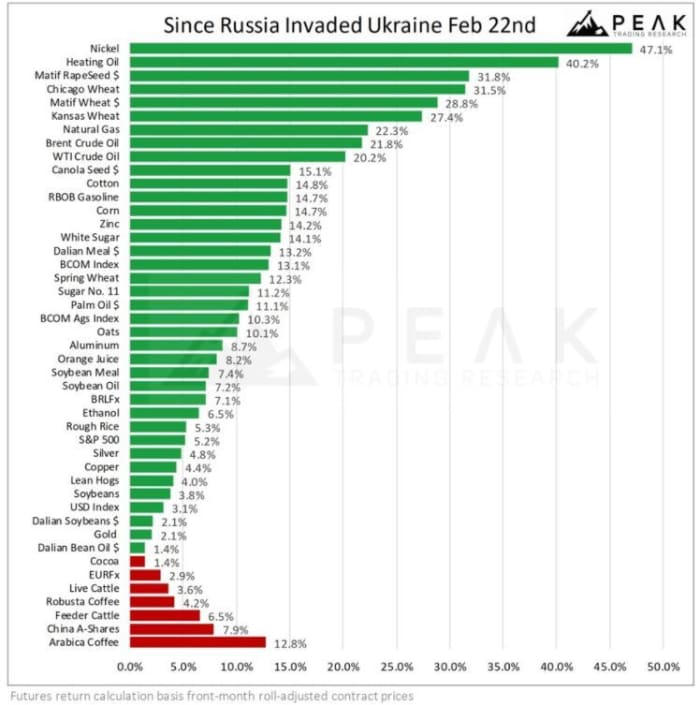

“The #1 improvement this week: Ukrainian forces are successfully defending Kyiv and there’s more optimism that Russia will focus efforts only on the Donbas region,” noted David Whitcomb, head of research at Peak Trading Research, a Geneva-based quantitative commodity trading and research group. “That means farmers could be able to get more crops in the ground with confidence over the coming weeks. We’ll see…”

That brings us to our call of the day, from Chris Rawley, CEO of Harvest Returns, a crowdfunding real estate platform that focuses on farmland. He recently spoke to MarketWatch about potentially overlooked agriculture investments.

While farm-based exchange traded funds, and grain futures are all options, Rawley views those as “more of a speculative product. Also these commodity trades are used by farmers and ag businesses as a hedge instrument,” he said.

Opinion:High fertilizer prices are creating pain for consumers and gains for investors

His sweet spot is farmland, though on its face is not cheap or easy for the average investor, said Rawley. Some of the world’s biggest billionaires are landowners, such as media mogul Ted Turner who owns 2 million acres, Amazon.com’s AMZN,

One way in is through is farmland REITS, such as Gladstone Land LAND,

How it works? Buying a 1,000 acre farm and its crops would take hefty capital that the average investor can’t manage. “If you put a bunch of those investors together, you’re able to pool those investments and go in and buy the same type of farmland or timberland or greenhouse indoor vertical farm,” he said. “That’s the way we do it.”

A minimum investment is about $5,000 to $10,000, so still not cheap. As for returns, he said over the past 10 years, farmland has returned about 11%, he noted. That’s versus an annualized return of around 14% for the S&P 500 SPX,

Farmland equipment is yet another option, with Deere & Co. DE,

Rawley also notes one newer side of farming they’ve been taking interest in — indoor agriculture, also known as vertical farming or controlled environment agriculture that cuts food waste and spoilage as crops can be grown 365 days a year.

Stock plays on that include Spring Valley Acquisition SV, AppHarvest APPH, Kalera NO:KAL and Hydrofarm Holdings HYFM,

Kalera is expected to go public on the Nasdaq this spring via a merger with Agrico Acquisition RICO, a Nasdaq publicly traded special purpose acquisition company.

The buzz

Reports suggest some progress in the latset talks between negotiators over the deadly war in Ukraine in Istanbul on Tuesday, and Russia has reportedly said it will “radically reduce” military activity outside Kyiv and Chernihivs. Ukraine earlier said it would declare its neutrality and compromise on the contested Donbas region.

The U.S. is eyeing sanctions on Russian industry, targeting sectors that keep its “war machine” running, a top official said Tuesday.

A pair of house price indexes each showed a roughly 19% annual gain in January, with consumer confidence and job openings still to come. Following that, we’ll get Fedspeak from Philadelphia President Patrick Harker and Atlanta Fed President Raphael Bostic.

UnitedHealth UNH,

Nielsen Holdings NLSN shares are soaring after Evergreen Coast Capital announced a deal to buy the information and data firm for $16 billion.

The markets

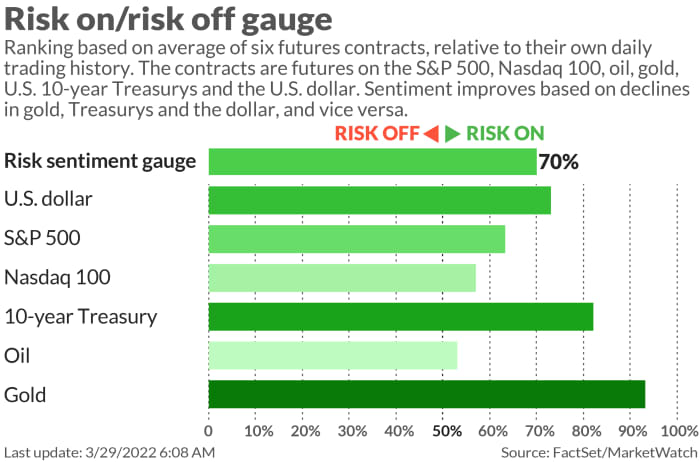

Hopes for peace in Ukraine are driving up stocks DJIA,

The Russian ruble USDRUB,

The chart

Look for semiconductors to push higher this week, says Larry Tentarelli, editor and publisher of the Blue Chip Daily Trend Report in ourchart of the day.

Last week, the VanEck Semiconductor ETF SMH,

He’s also watching Nvidia NVDA,

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

| GameStop | |

| AMC, | AMC Entertainment |

| TSLA, | Tesla |

| HYMC, | Hycroft Mining |

| NIO, | Nio |

| MULN, | Mullen Automotive |

| AAPL, | Apple |

| TLRY, | Tilray Brands |

| NVDA, | Nvidia |

| NILE | BitNile Holdings |

Random reads

The 2,000 mile journey of a so-called recyclable plastic bag.

Sales for Chris Rock’s comedy tour have suddenly surged after The Slap seen around the world.

Need to Know starts early and is updated until the opening bell, butsign up hereto get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up forThe Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

Based on the provided article, it discusses various topics, including the impact of geopolitical events on stock futures, potential breakthroughs in Ukraine-Russia negotiations, concerns about disruptions in Ukraine's farming affecting global agriculture, investment opportunities in farmland, agricultural investments, and related stock plays. Additionally, it touches on recent market movements, specific stock tickers, and expert opinions on investment prospects in different sectors. As an expert in finance and investments, here's an analysis of the concepts mentioned:

-

Geopolitical Impact on Stock Futures: The article suggests that optimism stemming from potential progress in negotiations between Ukraine and Russia is positively influencing stock futures. This showcases how geopolitical events can significantly impact financial markets, indicating the interconnectedness of global politics and economics.

-

Agricultural Investments: The piece highlights the significance of farmland as an investment option. It emphasizes that farmland REITs (Real Estate Investment Trusts) like Gladstone Land (LAND) and Farmland Partners (FPI) have shown substantial returns over the past year, providing insights into the profitability and stability of investing in agricultural real estate.

-

Alternative Investment Strategies: Chris Rawley, CEO of Harvest Returns, emphasizes alternative agricultural investment strategies beyond traditional options like farm-based ETFs and grain futures. He mentions the accessibility of farmland investments through private placements, allowing smaller investors to pool resources for farmland ownership or through farmland REITs.

-

Stock Plays in Agriculture Sector: Rawley also discusses newer agricultural sectors such as indoor agriculture or vertical farming. Companies like AppHarvest (APPH) and Hydrofarm Holdings (HYFM) operating in this domain are highlighted, showcasing the evolving nature of agricultural technologies and investment prospects in innovative farming methods.

-

Market Movements and Specific Stock Tickers: The article provides insights into recent market movements, mentioning the rise in stock prices related to hopes for peace in Ukraine. It also discusses specific stock tickers, such as semiconductor companies (Nvidia, Broadcom) and top-searched tickers (GameStop, AMC Entertainment, Tesla, Nio, Apple, Tilray, etc.), offering a glimpse into investor sentiment and interests.

-

Expert Views on Sector Performance: Larry Tentarelli's perspective on semiconductor stocks, particularly Nvidia (NVDA), Broadcom (AVGO), and Advanced Micro Devices (AMD), suggests a positive outlook for the semiconductor sector based on technical analysis indicators like moving averages and weekly trend momentum.

Overall, the article provides a comprehensive view of how geopolitical events, agricultural investments, stock market movements, specific stock tickers, and expert opinions collectively shape the current investment landscape.