- LISTS

- Personal Credit Cards

- S'witty Kiwi Editors

- March 12, 2024

In This Article

Are you new to the US or have a limited or poor credit history, or want to improve your credit score? You have come to the right place. Do you know there are some credit cards for people like you? Know that having a good credit score can help you qualify for better interest rates, loans, mortgages, and other financial products. These cards have features and benefits that can help you establish a positive credit history and boost your credit score over time. This article tries to list some of the best credit cards to build credit, based on their fees, rewards, credit reporting, and other factors. You can also get some tips on how to use these cards wisely and avoid common pitfalls that can hurt your credit. By the end of this article, you are going to have a better idea of which credit card suits your needs and goals.

- Petal® 2 “Cash Back, No Fees” Visa® Credit Card

- Discover it® Secured Credit Card

- Capital One Platinum Secured Credit Card

- Citi® Double Cash Card

- Discover it® Student Cash Back

Overview of the Best Credit Cards to Build Credit

How to Choose the Best Credit Cards to Build Credit

Pros & Cons of the Best Credit Cards to Build Credit

What to Watch Out For

Pro Tips

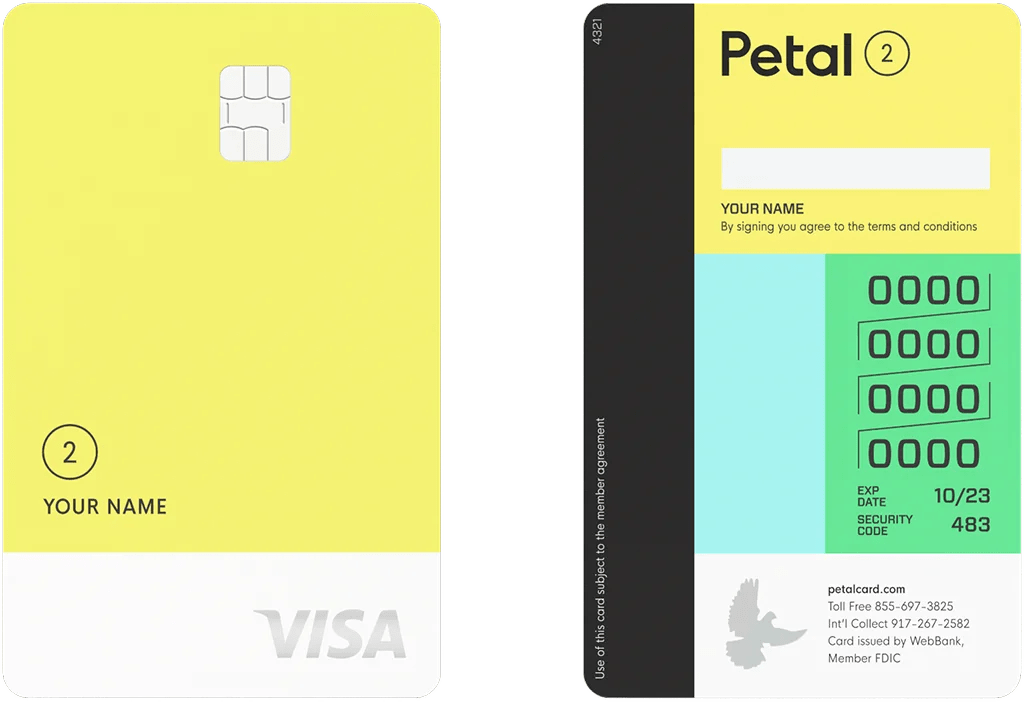

1. Petal® 2 “Cash Back, No Fees” Visa® Credit Card

Choose this card if you have no credit history or want to improve your credit score. It does not require a security deposit or charge any fees. You can get cash back on eligible purchases and at select merchants.

Pros

- Requires no credit history to apply.

- Has no fees of any kind, including annual fees, foreign transaction fees, late fees, etc.

- Earn 1% cash back on eligible purchases right away and up to 1.5% cash back after making 12 on-time monthly payments.

- Earn 2% to 10% cash back at select merchants, such as Netflix, Spotify, Amazon, etc.

- Access to higher credit limits over time with responsible use.

Cons

- Has a high variable APR of 17.99% – 31.99%.

- Lacks welcome bonus or introductory APR offer.

- Lacks generosity in cash-back rewards compared to other cards.

- Has no free credit score monitoring or other tools to help you manage your credit.

- Offers limited customer service options.

- Has a minimum credit limit of $500 and a maximum of $10,000, depending on your income and other factors.

- Allows you to use its app to track your spending, budget, and credit score.

- Permits you to pay your bill online, by phone, by mail, or through a third-party service like Plaid or Venmo.

- Gives the room for you to request a credit limit increase after six months of account opening.

- Use this card anywhere worldwide.

2. Discover it® Secured Credit Card

Choose this card to build your credit score. However, note that this is a secured card that requires a refundable security deposit of at least $200 to open an account. Enjoy cash back rewards on every purchase and match all the cash back you earn in the first year. It also has no annual fee and reports your activities to all three credit bureaus.

Pros

- Earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter, and 1% cash back on all other purchases.

- Receive an automatic dollar-for-dollar match of all the cash back you accumulate by the end of your first year.

- Lacks annual fees, foreign transaction fees, and penalty APR.

- Get free access to your FICO® Score and other credit tools on the Discover app or website.

- Enjoy automatic reviews for credit limit increases at your eight months of responsible usage of the card.

Cons

- Demands from you a security deposit of $200 or more.

- Has a high variable APR of 24.49%.

- Has no balance transfer or purchase intro APR offer.

- Limits Cash-back redemption options to statement credit, direct deposit, gift cards, or charity donations.

- Lacks wide range acceptability outside the U.S.

- Equals the security deposit is equal to your credit limit, which can range from $200 to $2,500, depending on your ability to pay.

- Allows you to use the Discover app or website to check your balance, make payments, view transactions, redeem rewards, and more.

- Allows you to pay your bill online, by phone, by mail, or at any participating bank or credit union that accepts Discover payments.

- Request a security deposit refund after you close your account or upgrade to an unsecured card, as long as you pay your balance in full and have no late payments.

- Allows worldwide usability.

3. Capital One Platinum Secured Credit Card

Do you need a card that gives you access to a higher credit limit within a short period?

Note that this card requires a security deposit of either $49, $99, or $200 before you can open an account. Note that this card has no annual fee and it reports your activities to all three credit bureaus. In fact, you can access a higher credit line when you make your first five monthly payments on time.

Pros

- Has no annual fee or foreign transaction fee.

- Offers flexible security deposit amounts.

- Access a higher credit line after making your first five monthly payments on time, with no additional deposit.

- Get free access to your TransUnion® VantageScore® and other credit tools on the Capital One app or website.

- Access to benefits such as travel accident insurance, extended warranty protection, auto rental collision damage waiver, and more.

Cons

- Has a high variable APR of 26.99%, which can be expensive if you carry a balance.

- Offers no rewards program or welcome bonus.

- Lacks balance transfer or purchase intro APR offer.

- Doesn’t refund the security deposit until you close your account or upgrade to an unsecured card, as long as you pay your balance in full and have no late payments.

- Does not have supportive customer service.

- Note that the security deposit is partially or fully refundable, depending on your creditworthiness. You can pay the deposit in full or over time before your account opens.

- Use the Capital One app or website to check your balance, make payments, view transactions, monitor your credit, and more.

- Pay your bill online, by phone, by mail, or at any Capital One branch or ATM that accepts deposits.

- Request an unsecured card upgrade after demonstrating responsible credit behavior, but it is not guaranteed.

- Use this card anywhere Mastercard is accepted worldwide.

4. Citi® Double Cash Card

Choose this card as it is a simple and rewarding option for you if you want to earn cashback on every purchase. You can get 2% cash back on every purchase.

Pros

- Lacks annual fee or category restrictions.

- Has a high and consistent cash back rate on every purchase.

- Offers flexible redemption options

- Allows 0% intro APR for 18 months on balance transfers completed within 4 months of account opening, then a variable APR of 13.99% – 23.99% applies.

- Gives you access to benefits such as Citi® Identity Theft Solutions, Citi® Entertainment, and more.

Cons

- Offers no welcome bonus or purchase intro APR offer.

- Has a foreign transaction fee of 3%.

- Lacks free credit score monitoring or other tools to help you manage your credit.

- Has a minimum credit limit of $500.

- Allows the use of Citi app or website to check your balance, make payments, view transactions, redeem rewards, and more.

- Allows you to pay your bill online, by phone, by mail, or at any Citibank branch or ATM that accepts deposits.

- Gives room to request a credit limit increase after six months of account opening.

- Gives out Mastercard, which has universal acceptability.

5. Discover it® Student Cash Back

Pick this card if you are a student who wants to earn cash back on everyday spending and build credit. Get 5% cash back on everyday purchases at different places each quarter like Amazon.com, grocery stores, restaurants, and gas stations. Plus, earn unlimited 1% cash back on all other purchases – automatically.

Pros

- Has no annual fee or foreign transaction fee.

- Gives high cash back rate on rotating categories that change every quarter (up to $1,500 in purchases per quarter, then 1%).

- Matches all your cash back yearly. No sign-up, no limit to how it can match for you.

- Get free access to your FICO® Score and other credit tools on the Discover app or website.

- Gives you benefits such as a $20 statement credit each school year if your GPA is 3.0 or higher for up to the next five years, no late fee on your first late payment, and no penalty APR.

Cons

- Requires activation every quarter to earn 5% cash back.

- Limits redemption options for cash back to statement credit, direct deposit, gift cards, or charity donations.

- Lacks wide range acceptability accepted outside the U.S.

- Has a minimum credit limit of $500.

- Allows the use of the Discover app or website to check your balance, make payments, view transactions, redeem rewards, and more.

- Allows you to pay your bill online, by phone, by mail, or at any participating bank or credit union that accepts Discover payments.

- Permits you to request a credit limit increase after six months of account opening.

- Permits usage anywhere in the world that accepts Discover.

Overview of the Best Credit Cards to Build Credit

Bear in mind that the best credit cards to build credit are those that have low or no fees, offer rewards or cash back, and report to all three credit bureaus. You can use these cards to establish a positive credit history and boost your credit score over time, as long as you use them responsibly and pay your bills on time. Some examples of the best credit cards to build credit are:

Petal® 2 “Cash Back, No Fees” Visa® Credit Card, Discover it® Secured Credit Card, and Capital One Platinum Secured Credit Card.

However, there are many credit cards to build credit that are available in the U.S. According to Forbes Advisor, there are hundreds of credit cards to build credit in the U.S., but not all of them you may find easy to get or offer the best terms and benefits.

How to Choose the Best Credit Cards to Build Credit

- Check your credit score and credit report.

- Compare fees and interest rates.

- Look for rewards and benefits.

- Consider security deposit requirements.

- Choose cards that report to all three credit bureaus.

Pros & Cons of the Best Credit Cards to Build Credit

- Pros

- Help you establish a positive credit history and boost your credit score over time, as long as you use them responsibly and pay your bills on time.

- Help you qualify for better interest rates, loans, mortgages, and other financial products in the future.

- Offer rewards or cash back on your purchases.

- Offer other benefits, such as free credit tools, fraud protection, travel insurance, etc.

- Cons

- Have high fees or interest rates that can outweigh the benefits of using them, especially if you carry a balance or miss a payment.

- May require a security deposit to open an account.

- May have low credit limits that can limit your spending power and affect your credit utilization ratio.

- May have limited rewards or benefits compared to other types of credit cards, such as travel cards, cash-back cards, or premium cards.

- May not have a wide range of acceptability outside the U.S.

What to Watch Out For

- Avoid carrying a balance month-to-month.

- Don’t always make minimum payments.

- Avoid missing a payment.

- Don’t apply for too many cards.

- Watch out for how you close a card.

Pro Tips

- Pay your bill on time and in full every month.

- Keep your credit utilization low.

- Monitor your credit score and report regularly.

- Choose a credit card that suits your needs and goals.

- Use your credit card wisely and sparingly.

Recap

To find the best credit cards to build credit, you need to consider several factors, such as fees, interest rates, rewards, security deposit requirements, and credit reporting. When choosing credit cards to build credit, you need to watch out for some common pitfalls that can hurt your credit score, cost you money, or limit your options.

Note that there are different types of credit cards you can use to build credit, such as secured cards, student cards, store cards, and unsecured cards. Secured cards require a refundable security deposit to open an account, while unsecured cards do not. Student cards and store cards are tailored credit cards for specific groups of consumers.

Finally, Remember that building credit takes time and patience, but it can also be rewarding and beneficial for your financial future.

Related Articles

How to Get a USAA Credit Card

S'witty Kiwi Editors

Bank of America Credit Cards Review

S'witty Kiwi Editors

Best First Citizens Credit Cards

S'witty Kiwi Editors

Best Credit Cards for Home Improvement

S'witty Kiwi Editors

Become a

S'witty Kiwi Credit Insider!

Get the latest credit tips and hacks in your inbox!