You can transfer money seamlessly between your bank account and trading account if you have a 3-in-1 account.

Most banks provide stock brokerage services through their subsidiaries.

The flip side is, banks charge very high brokerages for intraday and delivery on a 3 -in-1 Demat account.

3-in-1 bank accounts are suitable only if you make a few transactions in stocks throughout the year.

If you are a daily trader or invest in stocks regularly, then you would end up paying a substantial amount as a brokerage. I would suggest you to open account with discount brokers like Zerodha who charge a flat brokerage fee of Rs 20 per trade.

Our 3 top picks for best Demat & trading account

Best discount broker

Zerodha

Free stock delivery

Open Account Now

Fastest growing broker

Upstox

Free account opening

Open Free Account Now

Best mobile app

5paisa

Rs 10 per trade with special plan

Open Account Now

You can go through the details on the 5 best 3-in-1 account in India 2023that helps you trade seamlessly.

Table of Contents

Best 3-in-1 Bank Account in India 2023

#1. ICICI Direct 3-in-1 Account

ICICI Direct 3-in-1 online account helps you trade on NSE and BSE in assets like equity, and derivatives (currency & commodity).

ICICI offers other value-added services like research advisory, PMS and wealth management.

The account also allows you to invest in Mutual Funds, IPOs and Life Insurance.

Brokerage Charges

ICICI Direct has 4 plans –

- i-Secure Plan

- Prepaid Brokerage Plan

- ICICI Direct Prime Plan

- ICICI Direct Neo Plan

#1. Brokerage charges for i-Secure Plan

Where a variable percentage of brokerage is charged based on quarterly turnover.

| Trading Type | Brokerage Charges |

| Equity Delivery | 0.55% (including buy and sell) |

| Equity Intraday | 0.275% (the second leg is not charged) |

| Equity Futures | 0.050% plus a flat brokerage of Rs. 50 on the second leg |

| Equity Options | Rs. 95 per lot plus a flat brokerage of Rs. 50 on the second leg |

| Currency / Commodity Futures | Rs. 20 per order |

| Currency Options | Rs. 20 per order |

The brokerage for Margin and Margin Plus under the i-Secure Plan is 0.050%

#2. Brokerage charges under Prepaid Brokerage Plan

| Prepaid value | Delivery brokerage | Intraday/ Futures | Equity Options | Currency and Commodity F&O |

| Rs. 2,500 | 0.25% | 0.025% | Rs. 35 per lot | Rs. 20 per order |

| Rs. 5,000 | 0.22% | 0.022% | Rs. 30 per lot | Rs. 20 per order |

| Rs. 12,500 | 0.18% | 0.018% | Rs. 25 per lot | Rs. 20 per order |

| Rs. 25,000 | 0.15% | 0.015% | Rs. 20 per lot | Rs. 20 per order |

| Rs. 50,000 | 0.12% | 0.012% | Rs. 15 per lot | Rs. 20 per order |

| Rs. 1,00,000 | 0.07% | 0.007% | Rs. 7 per lot | Rs. 20 per order |

#3. Brokerage charges under ICICI Direct Prime Plan

| Prime Plan | Scheme validity | Delivery brokerage | Intraday/ Futures | Equity Options | Currency & Commodity F&O |

| Rs. 299 | 365 days | 0.27% | 0.027% | Rs. 40 per lot | Rs. 20 per order |

| Rs. 999 | Lifetime | 0.22% | 0.022% | Rs. 35 per lot | Rs. 20 per order |

| Rs. 1,999 | Lifetime | 0.18% | 0.018% | Rs. 25 per lot | Rs. 20 per order |

| Rs. 2,999 | Lifetime | 0.15% | 0.015% | Rs. 20 per lot | Rs. 20 per order |

| Rs. 3,999 | Lifetime | 0.12% | 0.012% | Rs. 15 per lot | Rs. 20 per order |

| Rs. 4,999 | Lifetime | 0.10% | 0.010% | Rs. 10 per lot | Rs. 20 per order |

#4. ICICI Direct Neo Plan

| Segment | Brokerage |

| Equity Intraday | Rs. 20 per order |

| Equity Futures | Rs. 0 per order |

| Equity Options | Rs. 20 per order |

| Currency F&O | Rs. 20 per order |

| Commodity F&O | Rs. 20 per order |

You need to pay Rs. 299 as a one-time subscription fee for the Neo plan. The brokerage in F&O will be charged on both legs

Annual Fee

Charges for opening an account are as under

| Particulars | Charges |

| Trading and Demat account opening | Rs. 0 |

| Demat account annual maintenance | Rs. 700 |

Trading Platform

ICICI 3-in-1 account comes with a “Trade Racer” trading platform in the web version, desktop version and on mobile devices.

The platform combines the iClick2Gain tool, Live Scanner and Heat Maps for an enhanced trading experience.

Zerodha Demat account is the best alternative for ICICI Direct among the discount brokers. You get free stock delivery along with a flat brokerage plan for intraday trading without paying any additional fee. You can read our detailed comparison between ICICI Direct vs Zerodha.

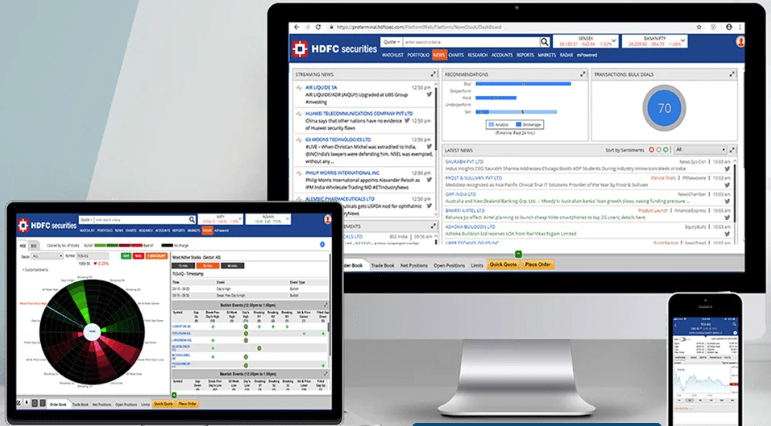

#2. HDFC Securities 3-in-1 Account

HDFC 3-in-1 account helps you trade and invest in various assets including US stocks. You also get value-added services like loans against your shares, bonds and mutual funds.

However, the drawback of the account is that you need to pay Rs. 1,999 for using the trading platform “Pro Terminal”.

Also, depending on the type of savings account you will be required to keep a certain minimum balance with HDFC Bank.

The 2-in-1 (trading + demat) and 1-in-1 (trading only) accounts are also available at HDFC Securities.

Brokerage Charges

| Segment | Brokerage Charges |

| Equity Delivery Trades | 0.50% (for both buy and sell orders) OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Intraday Trades | 0.05% (for both buy and sell orders) OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Futures | 0.025% OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Options | Higher of 1% of the premium amount or Rs.100 per lot (Both Buy & Sell) |

| Currency Futures | Rs. 12 per contract on each side |

| Currency Options | Rs. 10 per contract each side |

| Commodity Futures | 0.020% or minimum Rs.20 per order |

| Commodity Options | Rs.100 per lot |

Annual Fee

The account opening charges are under:

| Particulars | Charges |

| Trading & Demat Account Opening charges | Rs. 0 |

| Annual Maintenance Charges | Rs. 750 |

| Trading Platform Charges | Rs. 1,999 |

In case if you want to trade currency derivatives then there is a charge of Rs. 250 to activate currency trading.

If you are looking for a zero AMC Demat account, you can read our Upstox detailed review that offers free account opening with zero AMC.

Trading Platform

#1. HDFC Pro Terminal

HDFC Pro Terminal is a web-based trading platform that helps in tracking market trends and momentum.

The platform gives you access to Stock Screeners, Portfolio Tracker, Watchlists and RADAR tools.

#2. HDFC Securities App

HDFC Securities App is compatible with iOS and Android smartphones. The app helps trading by providing live market data, a few clicks trade & IPO application.

#3. Kotak Trinity 3-in-1 Account

Kotak Trinity 3-in-1 account’s USP is that it allows you to transfer any sum of money without any upper limit to your trading account on any single day.

You can place After Market Orders (AMO) that will be sent to stock exchanges when the next trading session starts.

But, Kotak Securities charges an account opening fee of Rs. 750 and you need to wait for approximately 10 days to open the Trinity 3-in-1 account.

Brokerage Charges

There are two brokerage plans, namely – Trade Free Plan and Dealer Assisted Brokerage Plan.

1. Kotak Securities – Trade Free Brokerage Plan

| Trading Segment | Brokerage Charges |

| Equity Delivery | 0.25% of transaction value or Rs. 20 whichever is higher |

| Equity Intraday | Rs. 0 |

| Equity F&O (Intraday) | Rs. 0 |

| Currency & Commodity (Intraday) | Rs. 0 |

| F&O trades (carry forward) | Flat Rs. 20 per executed order |

The brokerage charges in intraday trade are free.

You still need to pay other charges like STT, SEBI fees, Exchange charges and stamp duty on your trades.

2. Dealer Assisted Brokerage Plan

| Segment | Brokerage |

| Equity Delivery | 0.39% of transaction value |

| Equity Intraday | 0.039% |

| Equity & Commodity Futures | 0.039% |

| Equity & Commodity Options | Rs. 39 per lot |

| Currency Futures | Rs. 9 per lot |

| Currency Options | Rs. 5 per lot |

Annual Fee

| Particulars | Trade FreePlan Charges | Dealer Assisted Plan Charges |

| Demat & Trading Account opening fees | Rs. 0 (as of now) | Rs. 499 (one time) |

| AMC charges Holding value of securities <= Rs. 10,000 | Rs. 0 | Rs. 0 |

| Holding value of securities > Rs. 10,000 | Rs. 65 pm (upto 10 debits) Rs. 50 pm (11-30 debits) Rs. 35 pm (30+ debits) | Rs. 65 pm (upto 10 debits) Rs. 50 pm (11-30 debits) Rs. 35 pm (30+ debits) |

Trading Platform

#1. Kotak Website

Kotak Website is a browser-based trading platform that can be accessed directly from the Kotak Securities website.

The platform lets you trade-in equity, derivatives, IPO, ETFs and bonds.

#2. Kotak Stock Trader App

Kotak Stock Trader is compatible with Android and iOS devices. The app allows you to trade, access charts and manage your portfolio on the move.

#3. KEAT Pro X

KEAT Pro X is a downloadable EXE. application that comes with customizable watchlists, live market data, charting tools, and stock recommendations.

#4. SBICAP Securities 3-in-1 Account

SBICAP 3-in-1 account gives you access to lots of value-added services like loan products (home & auto) and research advisory.

Brokerage Charges

| Trading Segment | Delivery Trades | Intraday | Intraday |

| First Leg | Second Leg | ||

| Cash Market (Equity) | 0.50% | 0.075% | 0.075% |

| Equity Futures | 0.05% | 0.03% | 0.03% |

| Equity Options | Rs. 100 per lot | Rs. 50 per lot | Rs. 50 per lot |

| Currency Futures | 0.03% | 0.015% | 0.015% |

| Currency Options | Rs. 30 per lot | Rs. 20 per lot | Rs. 20 per lot |

| Commodity Futures | 0.05% | 0.03% | 0.03% |

| Commodity Options | Rs. 100 per lot | Rs. 50 per lot | Rs. 50 per lot |

Annual Fee

| Particulars | Fees |

| Account Opening Charges | Rs. 850 |

| Account Maintenance Charges | Rs. 750 |

Trading Platform

#1. SBISMART Trading APP

SBISmart app allows access to live market price data, news and research reports. The app is not so user-friendly and has negative reviews on the Apple and Google Play store.

#2. SBISMART Xpress

SBISmart Xpress is a desktop-based trading platform that offers live streaming, charting tools and heat maps.

#3. SBISMART Web Portal

SBISmart Web Portal is an HTML browser-based trading platform that supports trading, stock & Index analysis, provides research, company reports, and trading calls.

#5. Axis Direct 3-in-1 Account

You should pick the Axis Direct 3-in-1 account if you are new to trading and require hand-holding or you already have an Axis Bank account.

The 3-in-1 account gives access to value-added services life and general insurance, tax and will planning.

Brokerage Charges

Axis Direct has 4 brokerage plans.

| Particulars / Plans | Fixed Plan | Investment Plus Plan | Now or Never Plan | Premium Investment Plan |

| Complimentary Delivery Turnover (CDT) | NIL | Rs. 3 Lakhs (buy + sell) | Rs. 12 Lakhs (buy + sell) | Rs. 25 Lakhs (buy + sell) |

| Validity period | N.A. | 12 months | 10 years | 1 year |

| Account opening charges | Rs. 499 | NIL | NIL | NIL |

| Value-added subscription fees | Rs. 0 | Rs. 1,500 | Rs. 5,555 | Rs. 10,000 |

Brokerage Rates

| Plans | Fixed Plan | Investment Plus Plan | Now or Never Plan | Premium Investment Plan |

| Equity Delivery (each leg) | 0.50% | 0.35% | 0.20% | 0.10% |

| Equity Intraday (each leg) | 0.05% | 0.035% | 0.02% | 0.01% |

| Futures (each leg) | 0.05% | 0.035% | 0.02% | 0.01% |

| Options | Rs. 10 per order | Rs. 10 per order | Rs. 10 per order | Rs. 10 per order |

Annual Fee

| Particulars | Fees |

| 3-in-1 Account Opening Charges | Fixed Plan – Rs. 499 Investment Plus Plan – Rs. 0 Now or Never Plan – Rs. 0 |

| Annual Maintenance Charges | For Axis Bank Customer:First Year: Free Second Year Onwards: Rs. 750 For Non-Axis Bank Customer: From First Year Onwards: Rs. 2,500 |

Trading Platform

#1. Axis Direct Trade

Axis Direct Trade is a .EXE based desktop trading platform that helps create multiple customized watch lists, instant trade confirmations, live quotes and portfolio positions.

#2. Axis Web Trading Platform

Axis Web is a browser-based trading platform that provides information in “Card View”. One has access to customized filters, alerts and notifications.

#3. Axis Mobile Trading App

Axis Direct Mobile App helps you trade-in equity and derivatives only. The drawback is that you cannot invest in IPO, Mutual Funds and Bonds using the app.

Factors to Consider Before Opening 3-in-1 Account

#1. Brokerage Charges

Brokerage charges are a major cost that depends on the trading volume and the value-added services that you need.

A 3-in-1 account with a full-service broker that offers research advisory and other value-added services will have a higher percentage-based brokerage charge.

Go for a full-service broker only if you require hand-holding, stock tips, and research advisory and do not mind paying extra for other services.

On the other hand,discount brokersgive you minimal trading support and offer you flat brokerage charges.

If you do your own research and want to trade independently then a 3-in-1 account at a discount broker will be best for you.

#2. Trading Platforms

Online trading platforms are the gateways that connect you to stock exchanges for trading. You get access to a web-based, desktop-based and mobile app-based trading platform when you open a 3-in-1 account.

But, some of the stockbrokers charge a fee for providing a trading platform that you should know before you open a 3-in1 account.

#3. AMC Charges

Annual Maintenance Charge (AMC) is recurring fees related to Demat and trading accounts. The AMC fees start from Rs. 0 and goes up to Rs. 1,000 and above.

Some brokerage houses offer lifetime free AMC on a refundable interest-free deposit that needs to be paid upfront.

You should look for a 3-in-1 account that fulfills your trading needs at a low AMC cost.

#4. Account Opening Fees

The account opening fee is a one time cost.

A 3-in-1 account offered byfull-service brokerscarries processing fees for opening accounts. The fees range from a few hundred to a thousand rupees.

Whereas, discount brokers charge Rs. 0 for account opening.

Conclusion

Picking a 3-in-1 account depends on your individual trading and investing needs. So, be clear of what you want before you finalize one of the accounts.

If you want to save brokerage charges, then you can open a Zerodha account that provides free delivery of stocks.

But if you also require research advisory and do not mind paying extra money, then you can open a 3-in-1 account with your existing bank.