Adria Cimino, The Motley Fool

·4 min read

One of the secrets to Warren Buffett's investing success is holding on to stocks for the long term. Though Buffett may have "missed out" on certain stocks that have soared overnight, he's also avoided the major losses of some of the market's former highfliers.

The chairman of Berkshire Hathaway has proven his strategy is one shareholders can count on to deliver excellent performance over the long term. Under his leadership, Berkshire Hathaway has generated a compounded annual gain of nearly 20% over 58 years, surpassing the S&P 500's 10% increase.

It's no wonder investors closely watch Buffett's every move. Here's one move Buffett won't be making any time soon: The billionaire investor says he doesn't plan on selling shares of two longtime holdings this year. In his recent letter to shareholders, Buffett wrote that he plans on leaving his holdings in Coca-Cola (NYSE: KO) and American Express (NYSE: AXP) untouched.

Read below to find out why Buffett plans on maintaining his positions in these two companies and whether they should be on your buy list.

A strong moat

Coca-Cola and American Express have become household names over the years. The former is the world's biggest non-alcoholic beverage maker, selling its eponymous drink along with many others. The latter is a global leader in payment services. Both of these companies have grown earnings in the double digits over the past five years and, over time, have built something else Buffett likes: a solid moat, or competitive advantage.

Coca-Cola's moat is its brand strength. It sells certain beverages (such as Coca-Cola) that people crave and generally won't replace with an alternative. American Express' moat is the rewards and security it offers card members. As they make purchases, they know they can easily receive reimbursem*nt if items don't arrive or are damaged, and American Express offers generous rewards for card users. For those reasons, card members remain loyal and are willing to pay for an American Express card every year.

Over time, "both co*ke and AMEX (American Express) became recognizable names worldwide as did their core products, and the consumption of liquids and the need for unquestioned financial trust are timeless essentials of our world," Buffett wrote in his recent letter to Berkshire Hathaway shareholders.

In recent times, even during economic struggles, both companies have managed pretty well. Coca-Cola's global unit case volume and revenue climbed last year -- even as the drink maker increased prices -- and earnings advanced in the double digits. The company also gained value share in the total nonalcoholic ready-to-drink beverages market. Coca-Cola has achieved this through maintaining the products people know and love -- and innovating to capture new customers.

American Express' double-digit revenue gains

As for American Express, the company has progressed significantly since announcing a growth plan back in January 2022. It's increased revenue by more than 40% to $61 billion, and card-member spending has climbed 37% to a record high of $1.5 trillion.

Like all credit card companies, American Express faces the risk of default or delinquencies -- when cardholders can't make payments or fall behind -- but the premium customer base means this risk may be lower.

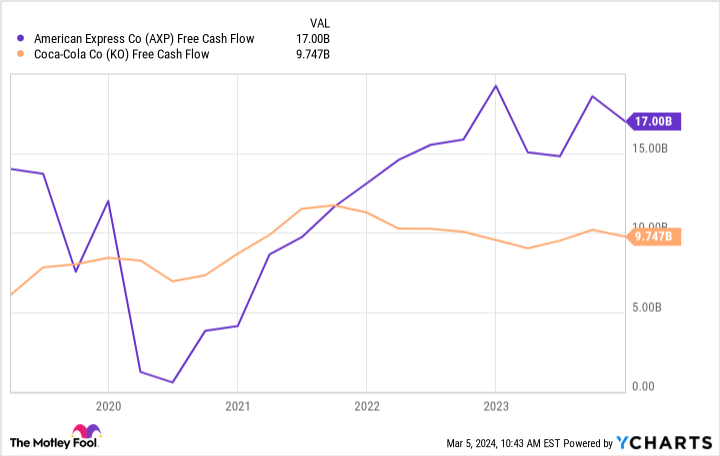

Buffett appreciates these two companies for their strong businesses and steady earnings growth -- as well as something that rewards loyal shareholders year after year: dividends. Both companies have the free cash flow to ensure ongoing passive income, and Coca-Cola has even lifted its dividend for more than 50 straight years.

Coca-Cola pays investors $1.94 per share annually, representing a dividend yield of 3.26%, while American Express' $2.40 dividend represents a yield of 1.09%. Buffett expects both companies to raise their dividends this yearand as a shareholder, he plans on benefiting.

Steady valuations over time

Let's get back to our question: Should these stocks Buffett aims to keep be on your buy list?

These stocks' valuations, relative to earnings, have remained rather steady for years and are reasonable, considering all of the points I've mentioned above. Coca-Cola and American Express trade for about 24x and 19x times trailing 12-month earnings, respectively.

For investors aiming to follow Buffett into quality businesses that also offer passive income, Coca-Cola and American Express make great buys right now.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service hasmore than tripledthe return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Adria Cimino has positions in American Express. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

2 Stocks Warren Buffett Says He's Not Selling. Should They Be Your Next Buys? was originally published by The Motley Fool